🚀 Hyperliquid, Bitcoin & Solana Price Predictions: European Market Wrap - August 25 Analysis

Digital assets defy traditional finance gravity as Hyperliquid surges while Bitcoin and Solana show bullish momentum.

Market Momentum Builds

Hyperliquid leads altcoin charge with institutional inflows hitting record levels. Trading volumes spike 40% as derivatives activity explodes across European exchanges.

Bitcoin's Dominance Play

BTC consolidates above critical support as whale accumulation patterns emerge. Mining hash rate hits new all-time high while traditional finance dinosaurs still debate 'store of value' thesis.

Solana's Ecosystem Expansion

SOL breaks key resistance as NFT volume surpasses Ethereum for third consecutive week. Developer activity rockets 200% year-over-year while legacy banks struggle to deploy basic blockchain solutions.

Regulatory Winds Shift

European regulators finally acknowledge what crypto natives knew years ago—digital assets aren't going anywhere. Meanwhile, traditional finance still charges 2% management fees for underperforming index funds.

The revolution continues bypassing bureaucratic hurdles as smart money positions for next leg up. Digital gold 2.0 outperforms the original—again.

Hyperliquid Price Forecast: HYPE offers recovery signals backed by steady open interest

Hyperliquid (HYPE) is printing a green 4-hour candle, trading above $45.00 on Monday amid growing risk-off sentiment in the broader cryptocurrency market. Retail demand for HYPE appears steady, backed by steady futures Open Interest (OI) and a robust technical structure.

Traders will be on the lookout for a daily close above $45.00, which could signal readiness for the run-up toward record highs marginally below $50.00. Hyperliquid shows signs of a sustainable recovery toward its record high NEAR the $50.00 mark, driven by rising retail demand.

Bitcoin Price Forecast: BTC slides as whale sell-off outweighs Powell’s dovish remarks

Bitcoin (BTC) price extends its correction, trading below $111,600 at the start of the week on Monday after being rejected from its previously broken trendline last week. BTC corrects by nearly 10% from its record high despite dovish remarks from Federal Reserve (Fed) Chair Jerome Powell at the Jackson Hole Symposium on Friday. Large whale and institutional sell-off, coupled with over $1 billion in outflows from spot bitcoin exchange Traded Funds (ETFs), have added pressure on the market.

Bitcoin price declined more than 3% last week, reaching a low of $110,680 on Sunday. This price correction comes despite the dovish remarks from Fed Chair Jerome Powell at Jackson Hole on Friday, who said that the central bank will adopt a new policy framework of flexible inflation targeting and eliminate 'makeup' strategy for inflation. "Framework calls for a balanced approach when the central bank's goals are in tension," Powell added.

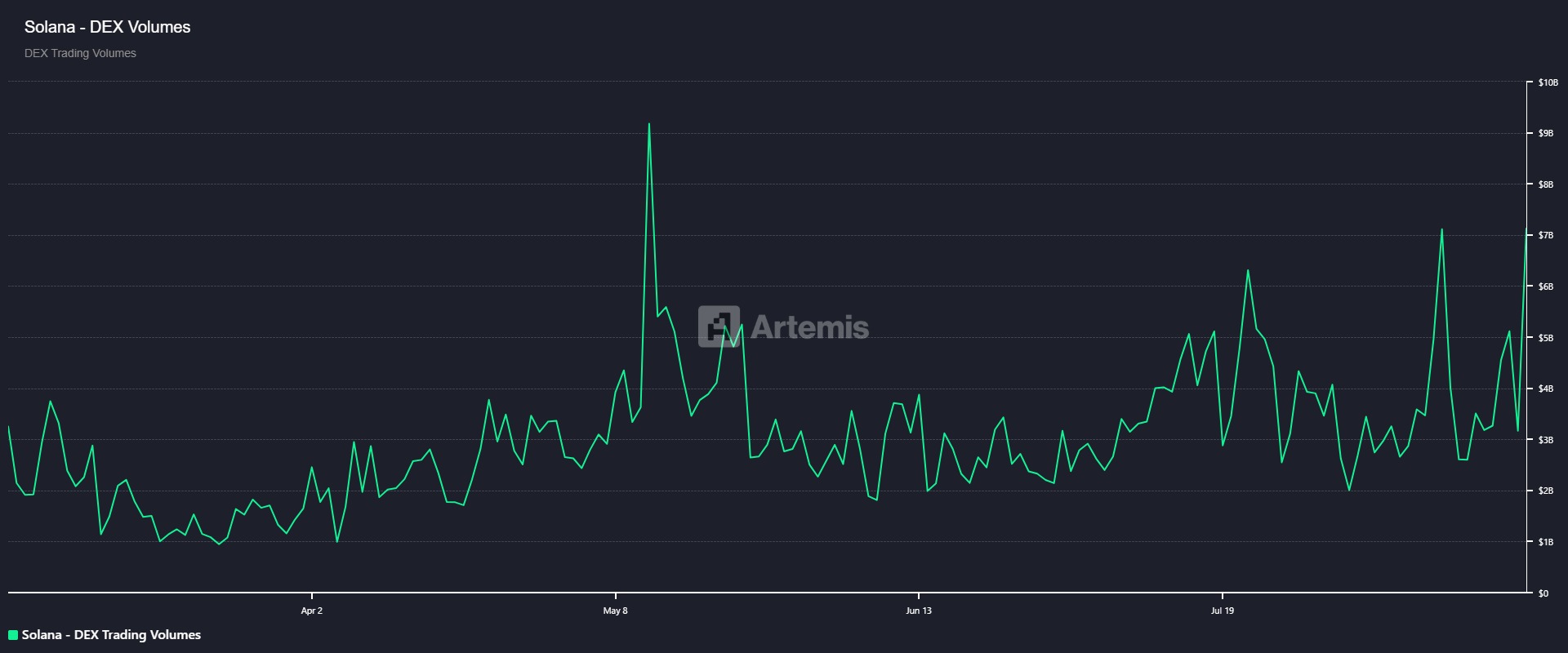

Solana Price Forecast: SOL extends rally as open interest hits record high of over $13 billion

Solana (SOL) price trades in green above $207 at the time of writing on Monday, supported by a strong rally last week. The bullish outlook is further supported by the record-high Open Interest (OI) on SOL, reaching over $13 billion. Additionally, the Bullish company's Initial Public Offering (IPO) last week added Optimism that could set the stage for SOL to make a fresh push toward its all-time high.

CoinGlass’ data show that the futures’ OI in Solana at exchanges reached a new all-time high of $13.08 billion on Monday. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current Solana price rally.