Pi Network Price Forecast: RSI Divergence Hints at Double-Bottom Pattern Reversal - Bullish Signals Ahead

Pi Network's price action flashes a classic reversal signal as RSI divergence sets the stage for a potential double-bottom breakout.

Technical traders are circling—this could be the momentum shift that finally shakes loose some real movement.

The Setup: RSI Divergence in Play

While price languished near recent lows, the Relative Strength Index started climbing. That hidden strength often foreshadows a bounce—and this time, it's lining up with a double-bottom pattern, one of technical analysis' most reliable reversal formations.

Double-Bottom Dynamics

Two distinct troughs at similar levels suggest selling pressure is exhausting. A break above the pattern’s neckline could confirm the reversal and trigger a wave of buying. No guarantees, of course—this is crypto, where 'reliable' is a relative term.

Market Psychology at a Turning Point

Traders love these patterns because they reflect shifting sentiment. Fear fades, cautious optimism returns, and suddenly everyone's a genius again—until the next dip, anyway.

Timing the Move

Watch for volume confirmation on any breakout attempt. Thin volume rallies in crypto are like Wall Street promises—loud, flashy, and often empty.

Potential upside targets loom if buyers seize control, but in a market this volatile, even the prettiest chart can turn ugly fast. Always trade with a stop—unless you enjoy donating to the crypto casino.

PI demand surges ahead of Hackathon 2025

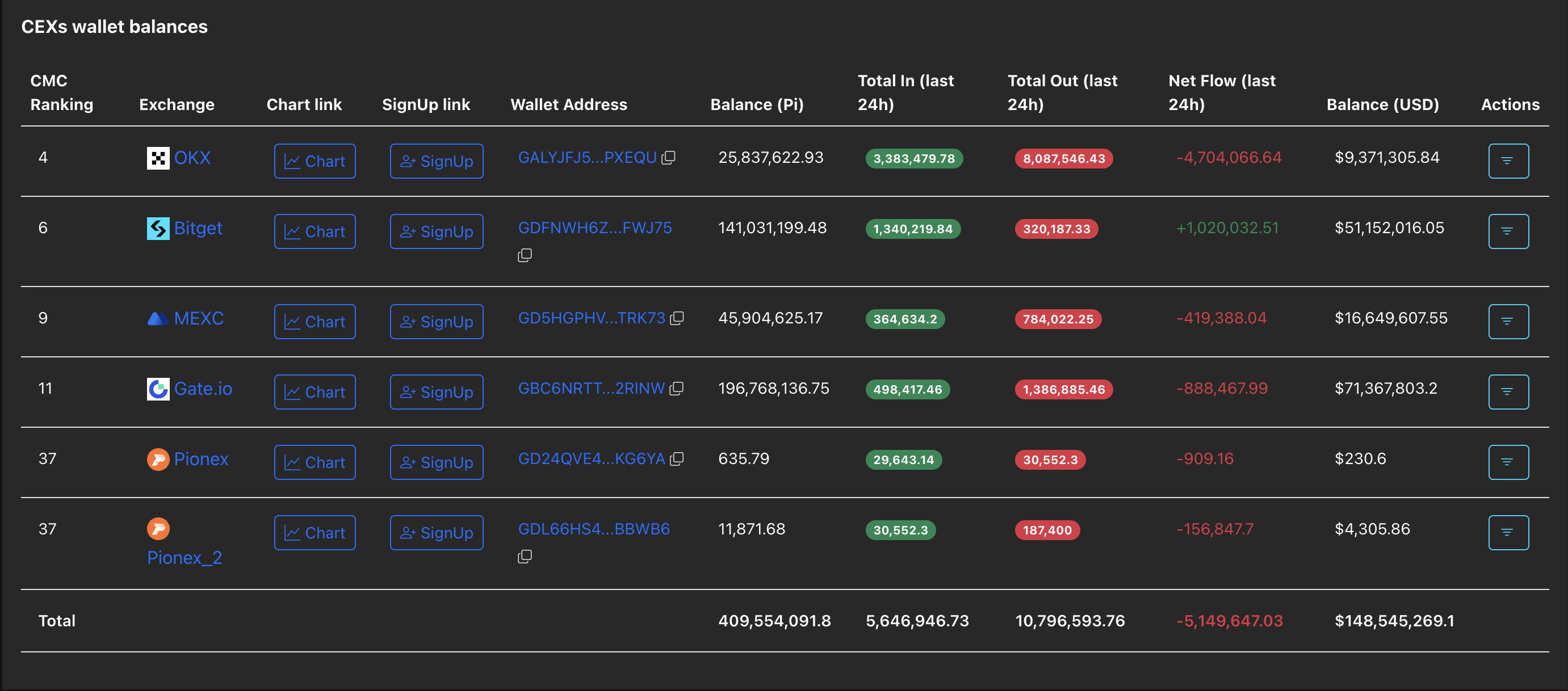

PiScan data shows the CEXs’ wallet balances recording an outflow of 5.14 million Pi tokens in the last 24 hours, dropping the reserve to 409.55 million tokens. This massive withdrawal accounts for a 1.24% decrease in CEX's balances, indicating a surge in demand among investors, is likely driven by the start of the Pi Hackathon 2025, the ecosystem's first hackathon after the launch of Open Network.

CEXs' wallet balances. Source: Coinglass

Pi Network eyes breaking out of a rising channel

Pi Network’s PI token edges higher by nearly 1.50% at press time on Thursday, extending the 4.92% rise from Wednesday. The reversal from the $0.3442 support level hints at a double bottom pattern reversal, previously tested on August 6, targeting the 50-day Exponential Moving Average (EMA) at $0.4319.

The declining average line aligns with the resistance trendline of a falling channel pattern, as marked on the daily chart (shared below). A decisive close above this level could reinforce a potential bullish trend, targeting the $0.5000 psychological level.

The Relative Strength Index (RSI) reads 42 on the daily chart, inching closer to the halfway line as buying pressure recovers. Additionally, the RSI has significantly recovered compared to the previous dip at $0.3442 level, indicating a bullish divergence.

Still, the Moving Average Convergence Divergence (MACD) and its signal line have merged and moved sideways, signaling a loss in decisive trend momentum.

PI/USDT daily price chart.

On the contrary, a reversal below the $0.3442 support level WOULD invalidate the double bottom reversal pattern, increasing the risk of the $0.3220 support level, which aligns with the all-time low.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.