Arthur Hayes Goes All-In: Doubles Down on Hyperliquid, Ethena, and Lido Amid Market Dip

Crypto heavyweight Arthur Hayes isn't just buying the dip—he's bulldozing it. The ex-BitMEX CEO just doubled his bets on Hyperliquid, Ethena, and Lido, signaling a brutal vote of confidence in DeFi's bleeding edge.

Why the reckless abandon? Hayes has never met a fire sale he didn't like. While retail investors panic-sell, he's loading up on protocols that even seasoned degens whisper about in Telegram backchannels.

The targets: Hyperliquid's perpetual swaps, Ethena's synthetic dollar magic, and Lido's stake-and-chill empire. No half-measures—just pure, uncut conviction. (And let's be real—when a guy who built a derivatives empire zigzags, Wall Street 'analysts' suddenly remember they left their crystal balls at the office.)

One thing's clear: in crypto's casino, Hayes plays with the house's money—and the house always wins. Until it doesn't.

Arthur Hayes expands his DeFi holdings

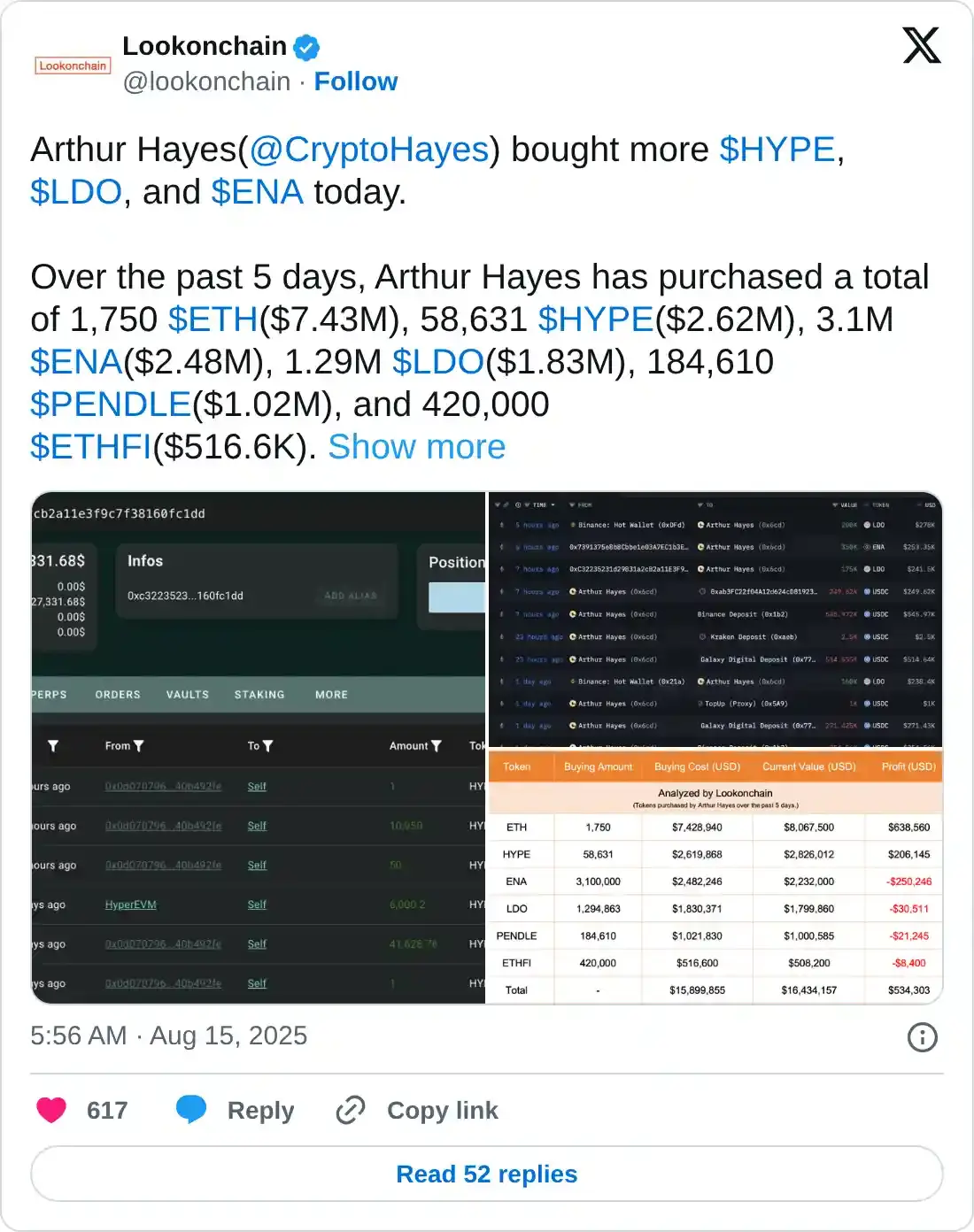

An X post from Lookonchain indicates that Arthur Hayes holds multiple Decentralized Finance (DeFi) tokens. Over the last 24 hours, 375,000 LDO and 350,000 ENA tokens, worth approximately $519,500 and $253,350, respectively, have been added to the wallet.

The post also highlights the purchase of 11,000 HYPE tokens worth over $530,000. Hayes’s doubling down on these tokens highlights his increased confidence in a potential bull market after the recent ethereum (ETH) sell-off and buyback.

Hyperliquid eyes an all-time high

Hyperliquid edges higher by 6% at press time on Friday, eyeing the $50 psychological milestone, which WOULD mark a new all-time high. The uptrend faces opposition at the $48.56 level, marked by the July 13 close.

A decisive push above this level could extend the uptrend to the R2 pivot level at $55.58.

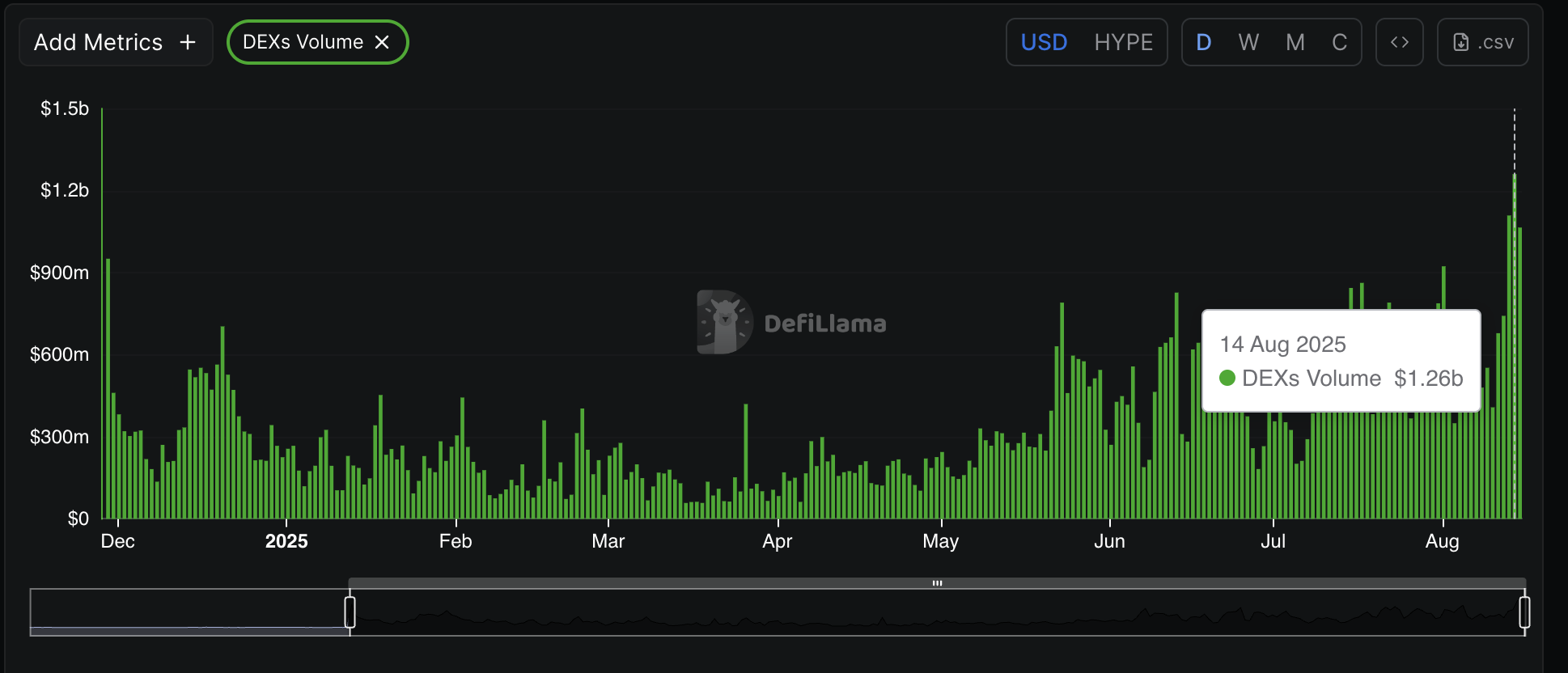

DeFiLlama data shows the Decentralized Exchange (DEX) volume is at $1.07 billion, down from the all-time high of $1.26 billion on Thursday. The recent surge in DEX volume highlights rising activity, leading to increased revenue and HYPE demand.

Hyperliquid DEX Volume. Source: DeFiLlama

The Relative Strength Index (RSI) is currently at 62, maintaining a steady uptrend as buying pressure gradually increases. Additionally, the Moving Average Convergence Divergence (MACD) indicator suggests increasing bullish momentum as both the MACD and signal lines maintain an uptrend.

HYPE/USDT daily price chart.

Looking down, a reversal from the $48.56 resistance could test the 50-day Exponential Moving Average (EMA) at $41.57.

Ethena eyes $1 as TVL hits record high

Ethena holds above the $0.7000 round figure, rising by nearly 1% at the time of writing on Friday. The Golden Cross, formed by the intersection of the 100-day and 200-day EMAs, indicates that the outlook is turning bullish.

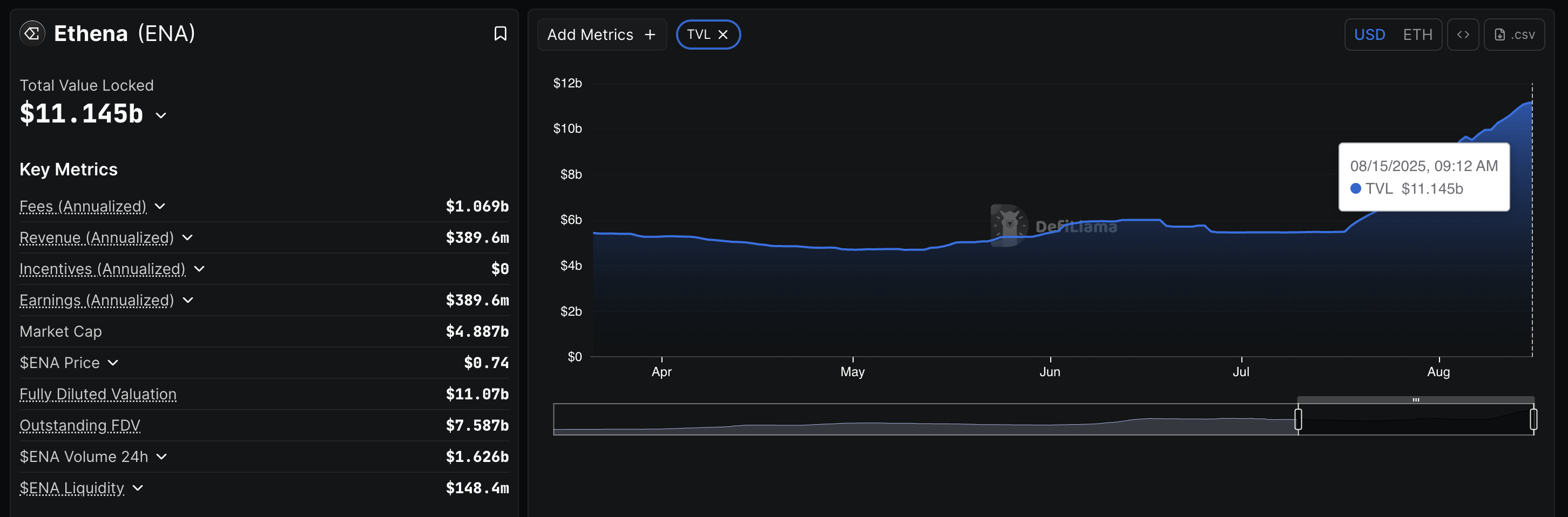

DeFiLlama data shows that the Total Value Locked (TVL) on Ethena has reached an all-time high of $11.145 billion from $11.066 billion the previous day. An increase in TVL points to heightened activity on the network based on digital asset deposits.

Ethena TVL. Source: DeFiLlama

Still, the declining MACD line risks crossing below its signal line, which would flash a sell signal. Additionally, the RSI is at 61, dropping from the overbought zone, which suggests lower buying pressure.

To reinforce an upward trend, ENA should mark a decisive close above the $0.7982 resistance, potentially targeting the $1.0000 psychological level.

ENA/USDT daily price chart.

On the contrary, a slip below $0.6576 could extend the decline to the 50-day EMA at $0.5364.

Downside risk escalates for Lido

LDO trades at $1.383 at the time of writing on Friday, retracing from the high of $1.444. The intraday loss of ground risks extending the recent declining trend below the $1.374 support level, marked by the March 2 close.

A decisive push below this support could test the $1.179 level, marked by the high of May 10.

Similar to Ethena, the momentum indicators suggest a decline in bullish momentum. On the daily chart, the RSI drops to 64 from the overbought zone, while the MACD and its signal line MOVE closer to each other, risking a trend reversal.

LDO/USDT daily price chart.

Looking up, a bounce from the $1.374 support could reach the weekly high of $1.628.