PI Network Price Surge Ahead? Channel Breakout Looms as Altseason Hype Intensifies

PI Network’s price is teetering on the edge of a bullish breakout—just as whispers of an altseason crescendo. Here’s why traders are suddenly paying attention.

### The Setup: A Textbook Channel Breakout

PI’s price action has been coiling in a tight trading range for weeks. Now, it’s testing the upper boundary of its channel. A clean breakout could trigger algorithmic buys and FOMO inflows.

### Altseason Winds Blowing?

With Bitcoin dominance wobbling and mid-cap alts waking up, PI isn’t the only coin eyeing a run. But its mobile-mining narrative gives it retail appeal—for better or worse.

### The Cynic’s Corner

Let’s be real: half the ‘altseason’ chatter comes from bagholders desperate for exit liquidity. But hey, even broken clocks are right twice a day.

### What’s Next?

Watch the channel resistance. If PI flips it to support, things get interesting. If not? Back to the grind—until the next hype cycle kicks in.

Optimism sparks among crypto investors

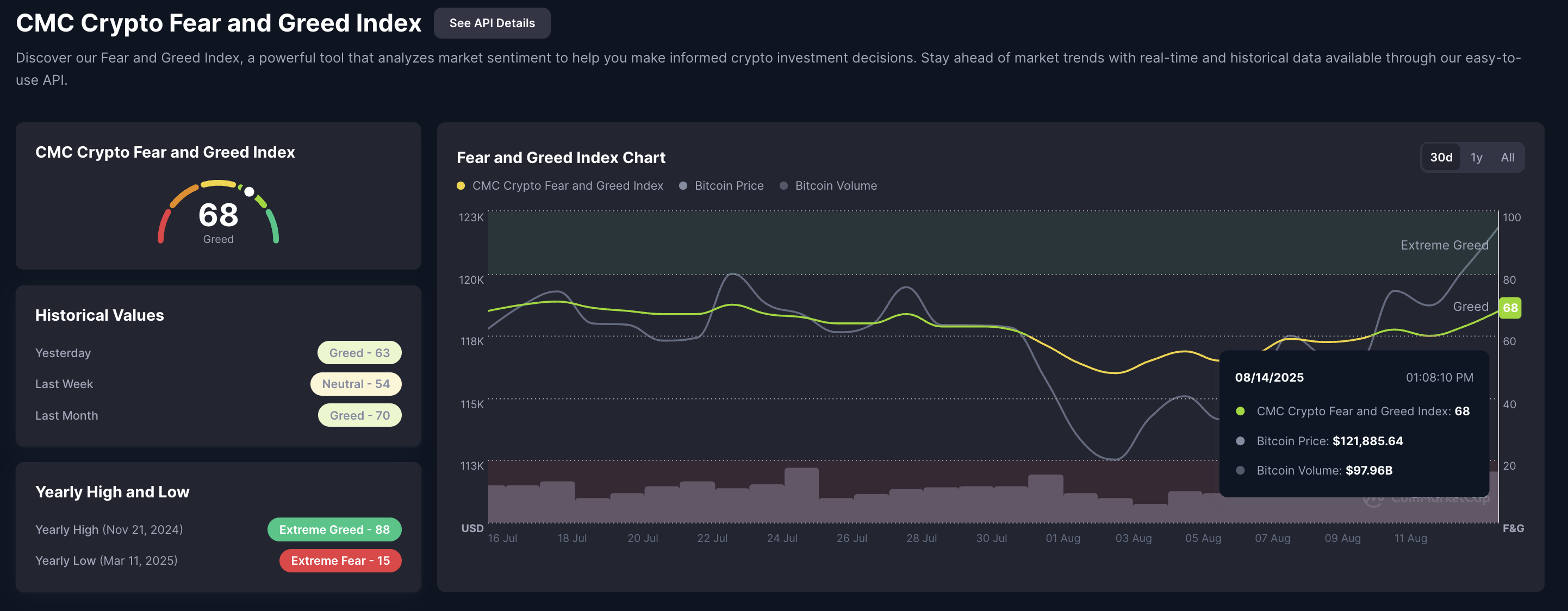

CoinMarketCap data shows that investor greed, on a scale of 0 to 100, is at 68, up from 63 on Wednesday. This heightened greed correlates with the return of risk-on sentiment among investors, fueling capital inflows and driving Bitcoin (BTC) and other top altcoins to reach all-time highs.

Crypto Fear and Greed Index. Source: CoinMarketCap

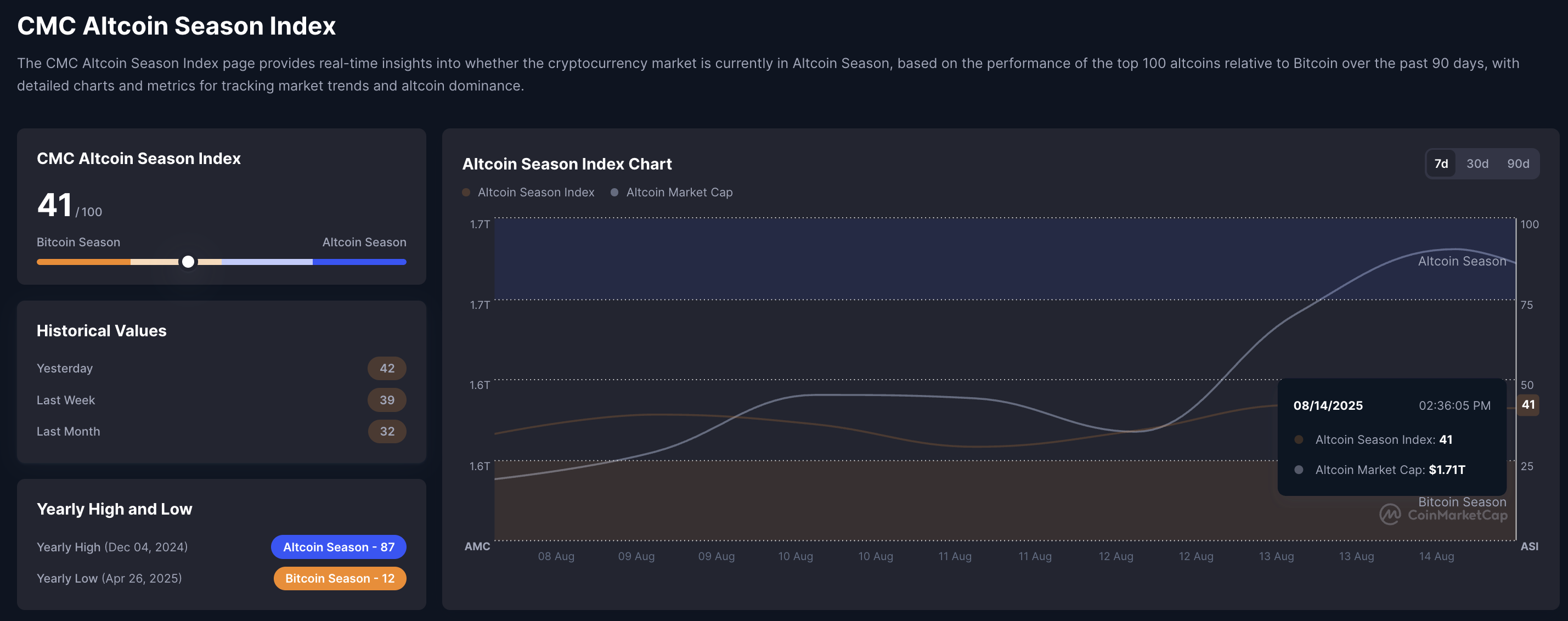

Additionally, the Altcoin Season Index is at 41, up from last week’s 39 and last month’s 32, indicating increasing chances of a potential altcoin season. In the next potential altseason, Pi Network could experience increased capital inflow as the capital rotates from bitcoin and other top altcoins toward riskier and more volatile cryptocurrencies such as PI.

Altcoin Season Index. Source: CoinMarketCap

Pi Network looks out for a channel breakout rally

The PI token holds steady NEAR the $0.40 level, extending the muted sideways price action after the sharp 9.32% drop on Sunday. PI token’s reversal marks a negative cycle within a falling channel as it fell from the overhead trendline formed by connecting the highs of May 21 and June 25.

A trendline connected by the lows of May 17 and June 22 forms the lower boundary of the falling channel pattern. To reinforce a trend reversal, PI should surpass the overhead trendline, which is near the declining 50-day Exponential Moving Average (EMA) at $0.45.

The Moving Average Convergence Divergence (MACD) trend is upward, indicating rising bullish momentum. Still, the Relative Strength Index (RSI) reads 47 on the daily chart, as it moves flat below the halfway line. This indicates the fading selling pressure near the neutral level, but also a lack of buying pressure.

PI/USDT daily price chart.

Looking down, an extended correction in Pi Network could test the $0.37 support zone, followed by the $0.33 level marked by the low from August 6.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.