🚀 Ethereum Price Surge: SharpLink’s $200M Treasury Gamble as ETH Dominates Crypto Markets

Ethereum isn't just outperforming—it's rewriting the playbook. While legacy finance scrambles to keep up, SharpLink just placed a $200 million bet on ETH's bull run. Here's why it matters.

The Treasury Play: SharpLink's massive capital injection screams institutional confidence—even your hedge fund manager's whiskey tumbler is shaking.

ETH's Relentless March: No pullbacks, no apologies. The smart contract king keeps defying 'overbought' warnings like a Wall Street analyst defying sobriety.

Bottom Line: When crypto-native firms start deploying nine-figure reserves, it's either the smartest trade of 2025... or the most extravagant way to light money on fire since the last SPAC boom.

SharpLink launches $200 million offering as ETH outperforms Solana

Ethereum treasury firm SharpLink Gaming revealed it entered into a purchase agreement with estimated gross proceeds of $200 million to increase its ETH acquisition.

The company stated it struck a deal with four institutional investors to purchase its shares in an at-the-market (ATM) offering priced at $19.50 per share.

"The net proceeds of the offering will be directed toward expanding SharpLink's ETH treasury, which upon deployment is expected to exceed $2.0 billion in value," SharpLink said in a statement on Thursday.

The offering follows SharpLink's $1 billion shelf registration with the Securities and Exchange Commission (SEC), which it later increased to $6 billion in July.

The Nasdaq-listed firm, which also doubles as an esports gaming company, began accumulating ETH in June after raising $450 million from a stock sale led by ethereum infrastructure provider Consensys, whose CEO Joseph Lubin currently chairs SharpLink's board.

The company ranks second among corporate entities with Ethereum-focused treasuries after declaring holdings of 521,900 ETH in a statement on Tuesday. It trails Peter Thiel's backed BitMine Immersion (BMNR), which holds over 833,000 ETH.

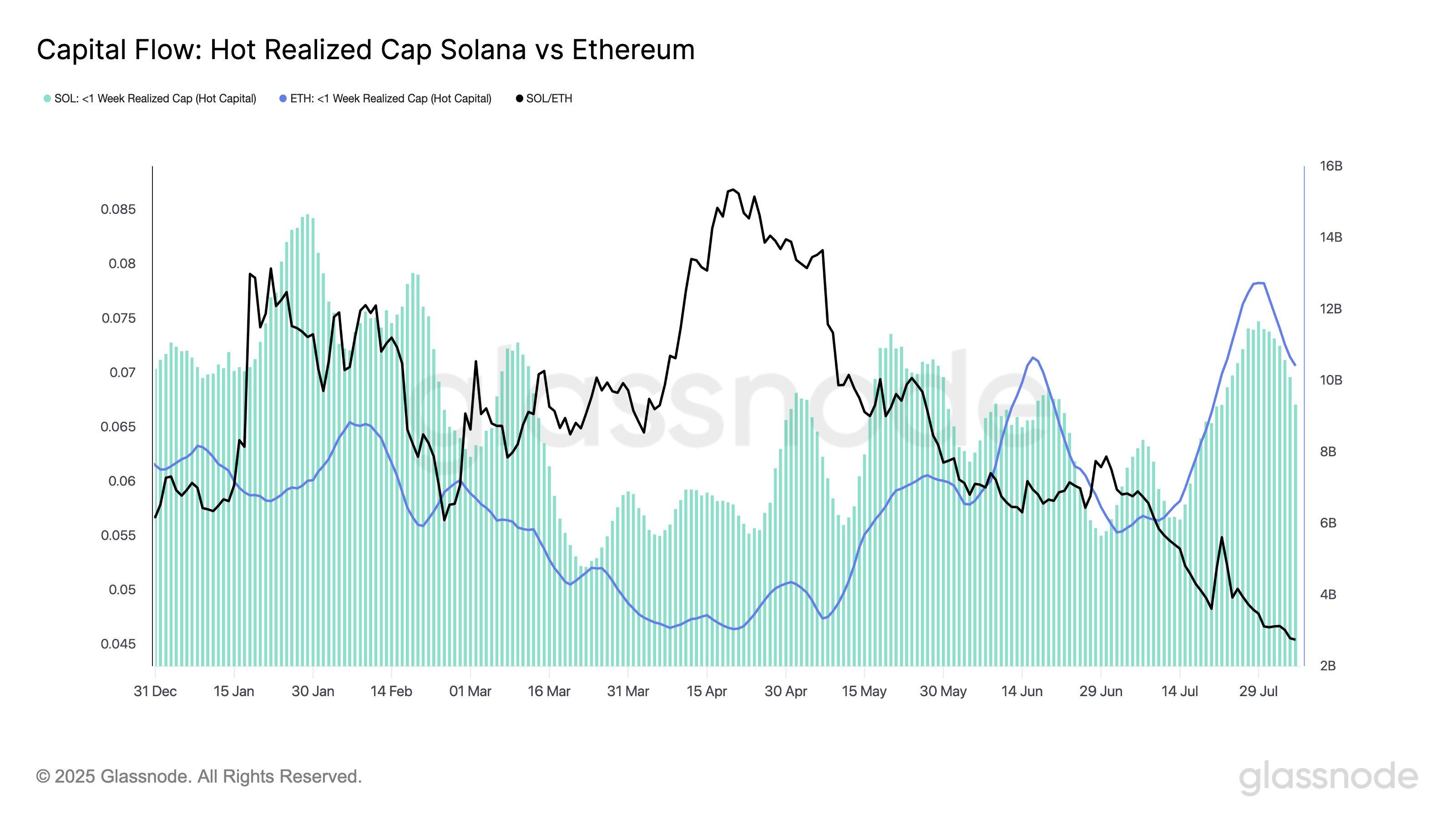

Since these treasury companies gained mainstream attention in June, ETH has outperformed most top cryptocurrencies. Notably, the SOL/ETH ratio, which hit an all-time high above 0.085 in April, has plunged to a year-to-date low of 0.045, signaling a preference for ETH among investors, according to Glassnode data.

This is also visible in the SOL/ETH Hot Realized Cap, which compares demand for both assets based on recently moved coins. Demand for ETH has continued to outpace that of SOL since mid-July.

Capital Flow: Hot Realized Cap SOL vs ETH. Source: Glassnode

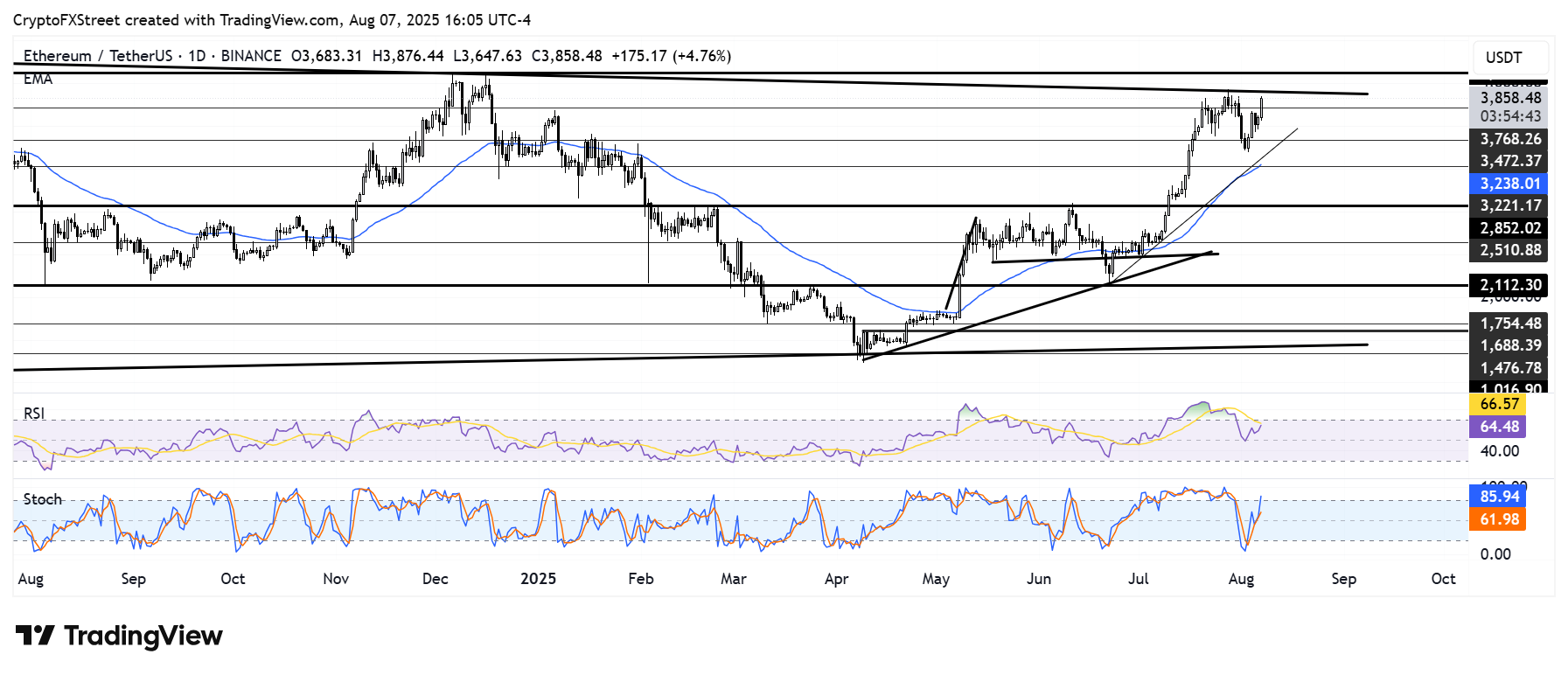

Ethereum Price Forecast: ETH faces multi-year trendline resistance

Ethereum saw $135.37 million in futures liquidations over the past 24 hours, with liquidated long and short positions reaching $22.68 million and $112.69 million, respectively, per Coinglass data.

After crossing above the $3,770 hurdle, ETH is attempting to test a multi-year descending trendline resistance extending from November 2021. A rejection could strengthen the sell pressure NEAR $3,900 and push ETH toward the support level at $3,470.

ETH/USDT daily chart

However, a MOVE above the descending trendline resistance could see ETH tackle the historical selling pressure near $4,100 — a level that bulls failed to overcome on three occasions in the past year.

A firm close above $4,100 could see ETH rally toward the next key resistance near $4,500.

The Relative Strength Index (RSI) is trending upward above its neutral level and is testing its moving average yellow line. A cross above the yellow line could accelerate the bullish momentum.

A daily candlestick close below $2,850 will invalidate the thesis and send ETH toward $2,500.