Mantle (MNT) Defies Market Caution with Explosive Rally as Stablecoin Sector Booms

Mantle's native token MNT is punching through resistance while traditional investors nibble on index funds. The Layer-2 project rides a wave of stablecoin adoption—proving once again that crypto moves faster than your average hedge fund's risk committee.

Stablecoins Fuel the Fire

As USD-pegged assets balloon to record market caps, MNT capitalizes on the liquidity surge. No fancy financial instruments here—just pure, unfiltered blockchain velocity.

Defying Gravity (and Skeptics)

While macro traders fret about yield curves, Mantle's ecosystem keeps stacking partnerships. The token's outperformance smells like 2021-era altcoin mania—minus the rug pulls (so far).

One protocol's rally won't fix Wall Street's Excel addiction. But watching MNT outpace 'professional' portfolios? Priceless.

Mantle steadies recovery amid capital influx

Capital has been flowing into the Mantle ecosystem, as evidenced by the growth in the network’s stablecoin market capitalisation. DefiLlama data shows that over the last 24 hours, the stablecoin market share on Mantle increased 23% to approximately $654 million.

Tether’s USDT is the largest stablecoin in the ecosystem, accounting for around 66% of the total market capitalisation.

The chart below highlights a slight increase in the DeFi Total Value Locked (TVL) to $234 million. TVL refers to the sum of the value of all the coins locked in all the smart contracts across the protocol. If this uptrend steadies as adoption paces up in the ecosystem, the tailwind on Mantle could accelerate the recovery above the $1.00 milestone.

Mantle DeFi stats | Source: DefiLlama

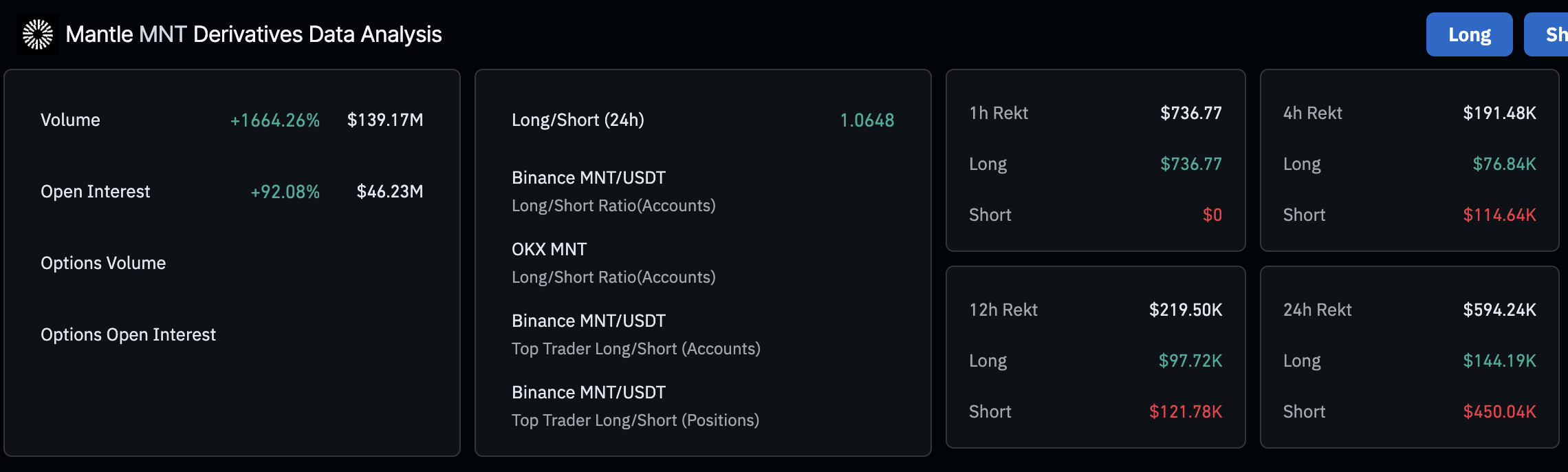

The derivatives market sheds light on a significant 92% increase in Open Interest (OI) to $46 million over the last 24 hours. Moreover, volume grew more than 16 times to $139 million in the same time frame, underscoring the spike in trading activity. A long-to-short ratio of 1.0648 indicates that traders are increasingly betting on the MNT price rising in the short term.

Mantle derivatives market data | Source: CoinGlass

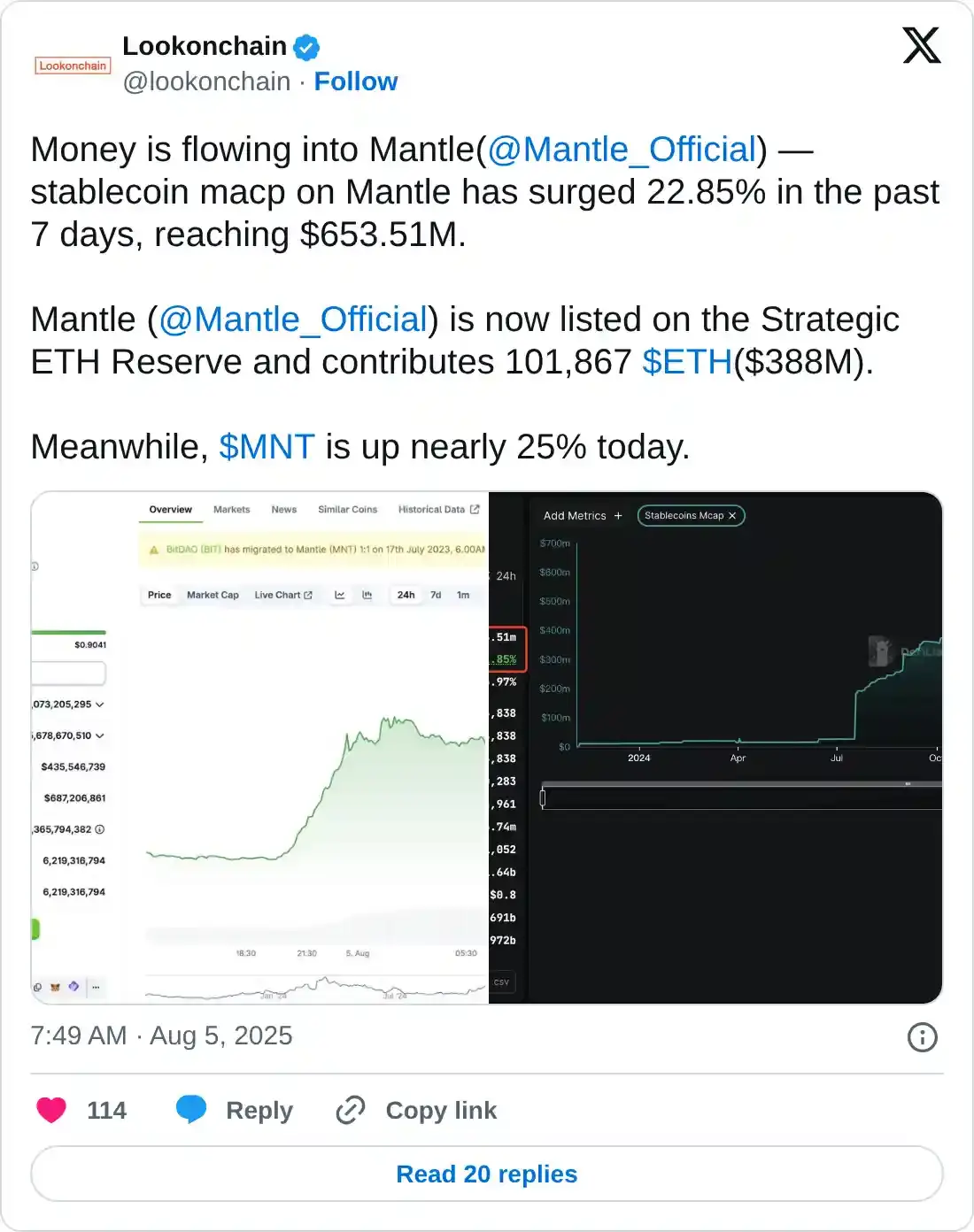

Lookonchain reported that, other than the capital inflow into assets on the Mantle network, the blockchain organisation is now part of Strategic ethereum Reserves, after contributing 101,867 ETH, valued at approximately $388 million. With this allocation, Mantle could sustain the correlation with Ethereum.

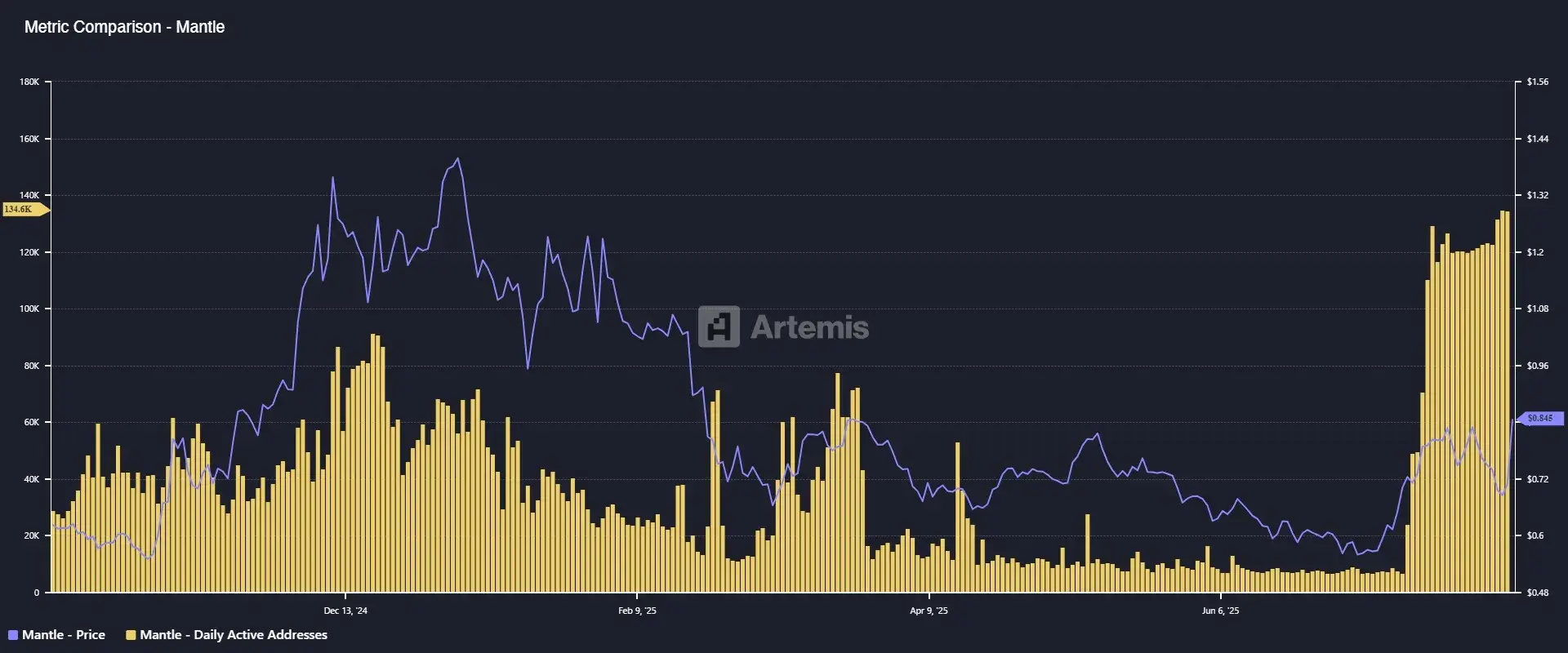

Active Addresses on the Mantle Network have also experienced a major boost, growing by more than 1,600%, from 7,000 to around 120,000 in less than a month, according to Artemis Analytics. This surge aligns with the positive reaction in the price of MNT, which is up approximately 28% in August.

Mantle Active Addresses | Source: CoinGlass

Technical outlook: Mantle bulls eye breakout past $1

Mantle price consolidates gains slightly below the $0.90 key level after surging to an intraday high of $0.92. The path of least resistance appears upward, backed by an up-trending Relative Strength Index (RSI), which is approaching overbought territory after falling below the middle line on Saturday.

A buy signal from the SuperTrend indicator reinforces the bullish grip. This indicator also serves as dynamic support or resistance. As long as the price remains above the SuperTrend line, bulls are likely to be in control.

MNT/USDT daily chart

Traders will look for Mantle’s reaction to two key levels: the immediate support at $0.85 and the resistance at $0.90. A daily close on either side of this range could provide insight into the direction the Mantle Price would take, especially with bulls eyeing a breakout beyond the $1.00 mark.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.