Whales Gobble $110M in Ethereum, $60M in XRP as Institutional Money Floods Crypto

Crypto's big players just made their move—and it's a tidal wave. Ethereum and XRP are back on the menu for institutional investors, with nine-figure bets signaling renewed confidence (or maybe just FOMO).

The whale watch is on

When deep-pocketed traders start stacking ETH and XRP like this, markets take notice. $110 million into Ethereum? $60 million into XRP? That's not 'dabbling'—that's conviction buying. Or hedgies chasing yield after traditional finance bored them to tears.

Follow the smart money (or the desperate money)

Institutional inflows don't lie—though their motives might. Are these bets on blockchain fundamentals? Or just parking liquidity before the next Fed pivot? Either way, when this much capital moves this fast, retail traders better pay attention... or get left holding bags again.

Whales' confidence grows for Ethereum and XRP

Whales' rising interest in cryptocurrency often foreshadows a bullish run, as the massive purchases ignite market demand and boost traders’ confidence. According to Whale Alert, a large investor acquired 20 million XRP tokens from Upbit exchange on Tuesday, a transaction worth over $60 million.

Similarly, two investors acquired 14,575 ETH and 15,000 ETH on Tuesday from FalconX exchange, worth over $54 million and $55 million, respectively.

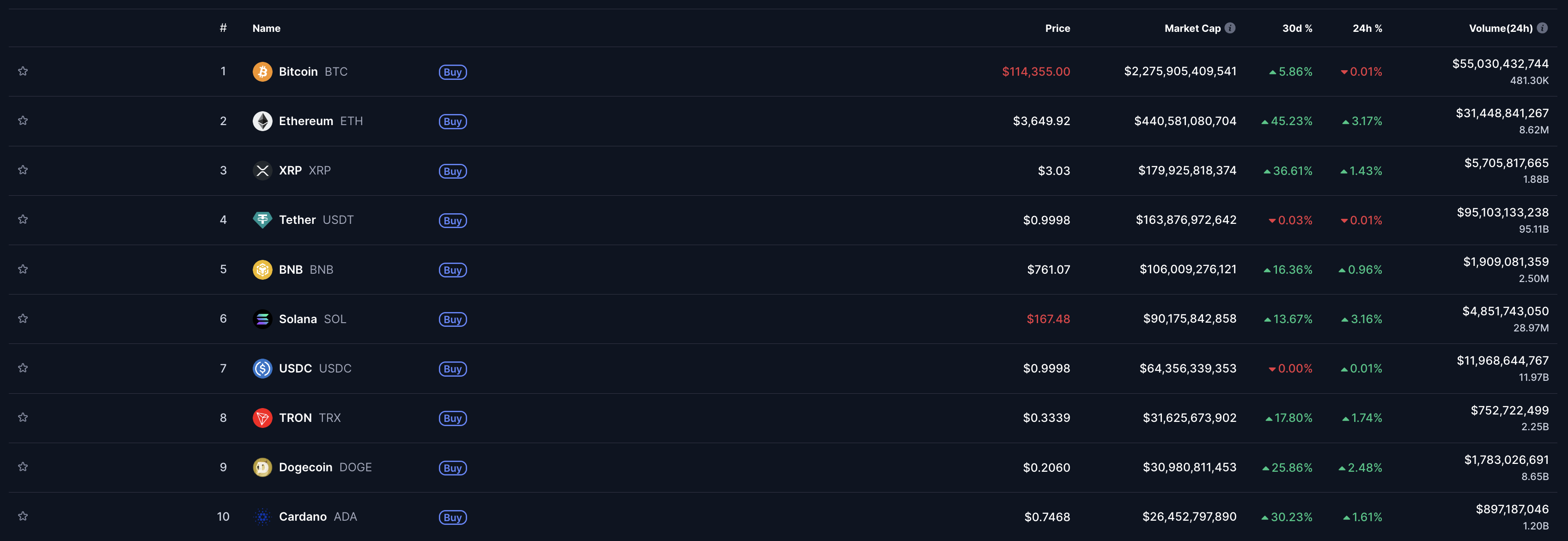

These big transactions involving Ethereum and Ripple come after a solid performance in the past 30 days, with both emerging as front-runners among the top crypto assets by experiencing price surges of 45% and 36%, respectively. In the last 24 hours, Ethereum has increased by over 3% and XRP holds over 1% in gains.

Cryptocurrency market data. Source: CoinMarketCap

Ethereum and XRP Digital Asset Funds grow amid renewed market confidence

Coinshare’s report, released on Monday, highlights that Ethereum-related products posted a 15th consecutive week of capital inflows. Ethereum digital asset investments registered $134 million in inflows in the past week, reaching $27,488 million in Assets Under Management (AUM).

On the other hand, XRP flows were at $31.26 million, with an AUM of $2,275 million. Such increased inflows reflect heightened institutional support, which could further drive the prices of Ethereum and XRP higher.

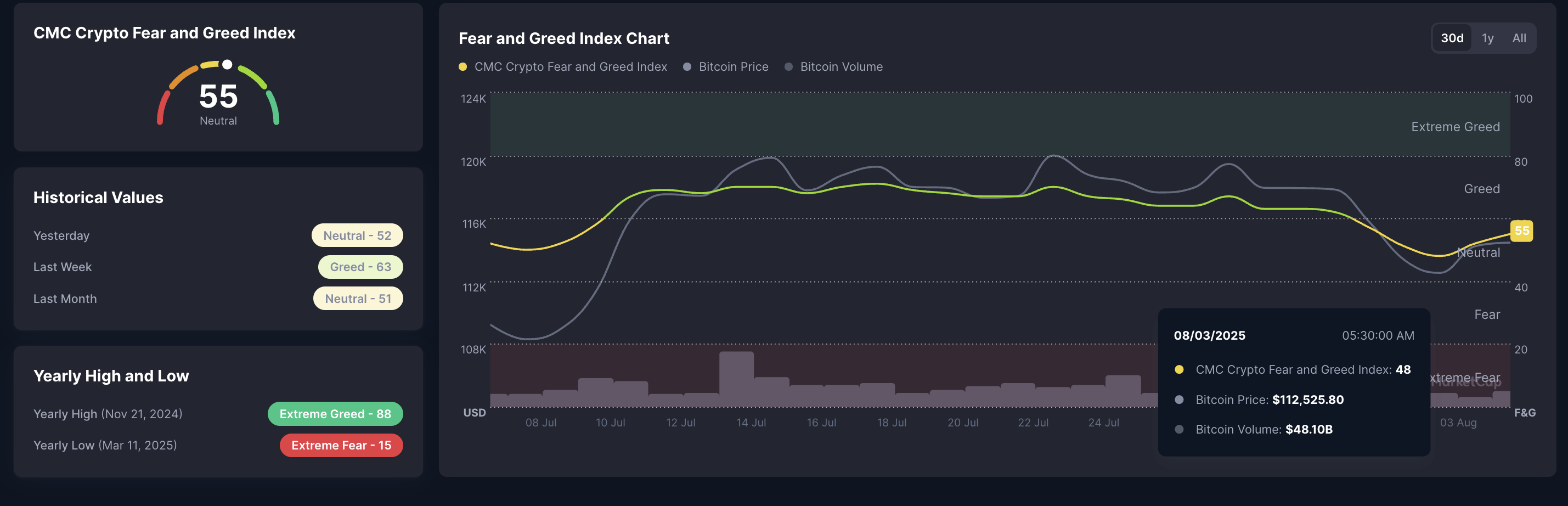

The institutional support remains as the crypto market sentiment reclaims a neutral level, following a correction at the end of last week. CoinMarketCap data shows Fear and Greed Index at 52, up from the previous week’s low at 48, signaling slightly improving market sentiment.

Fear and Greed Index. Source: CoinMarketCap

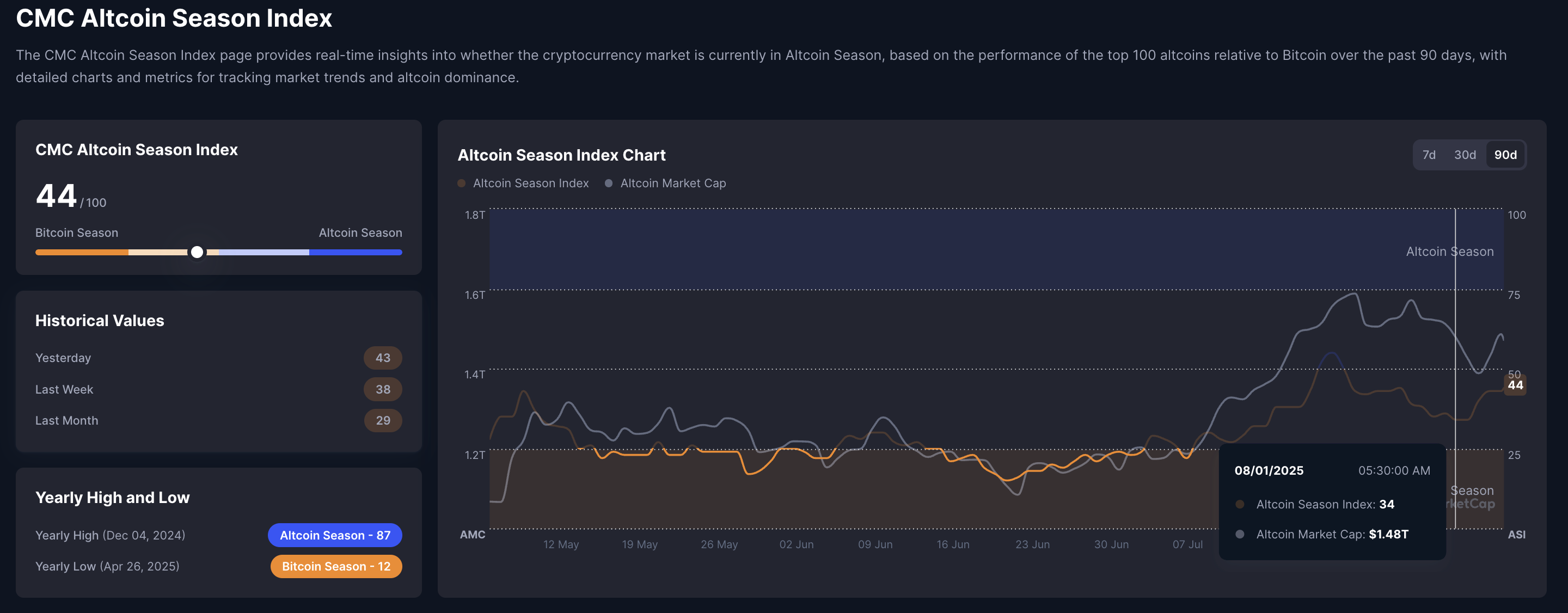

Altcoin Season Index. Source: CoinMarketCap

Furthermore, the upcoming altcoin season could increase the demand for top tokens such as ETH and XRP. The CoinMarketCap Altcoin Season Index remains at 44, after dropping to 34 last week, suggesting improved chances of a potential altseason.