🚀 Ether-Staking Giant BitMine Smashes $3B Barrier Amid ETH’s 6% Surge

Ethereum's staking ecosystem just flexed its muscles—hard. BitMine, the heavyweight of ETH staking platforms, roared past $3 billion in locked value as the second-largest cryptocurrency rallied 6% in a single day. Wall Street's bond traders are suddenly looking very underpaid.

The staking gold rush accelerates

While traditional finance struggles with 5% yields (before the taxman cometh), Ethereum validators are quietly stacking digital assets like armored trucks at a bullion depository. The $3B milestone proves institutional money's finally waking up to crypto's passive income potential—about three years late, as usual.

ETH price action fuels the fire

That 6% ETH pump didn't just pad portfolios—it supercharged staking APYs across the board. More value staked means more transactions securing the network, which means... well, more fees for everyone involved except the poor saps still using savings accounts.

As the merge fades into history, Ethereum's real economy emerges—one where your crypto works harder than your average hedge fund manager. The only question now: How long until BlackRock launches an 'Innovative Yield Staking ETF' at a 2% management fee?

Several competitors in the race

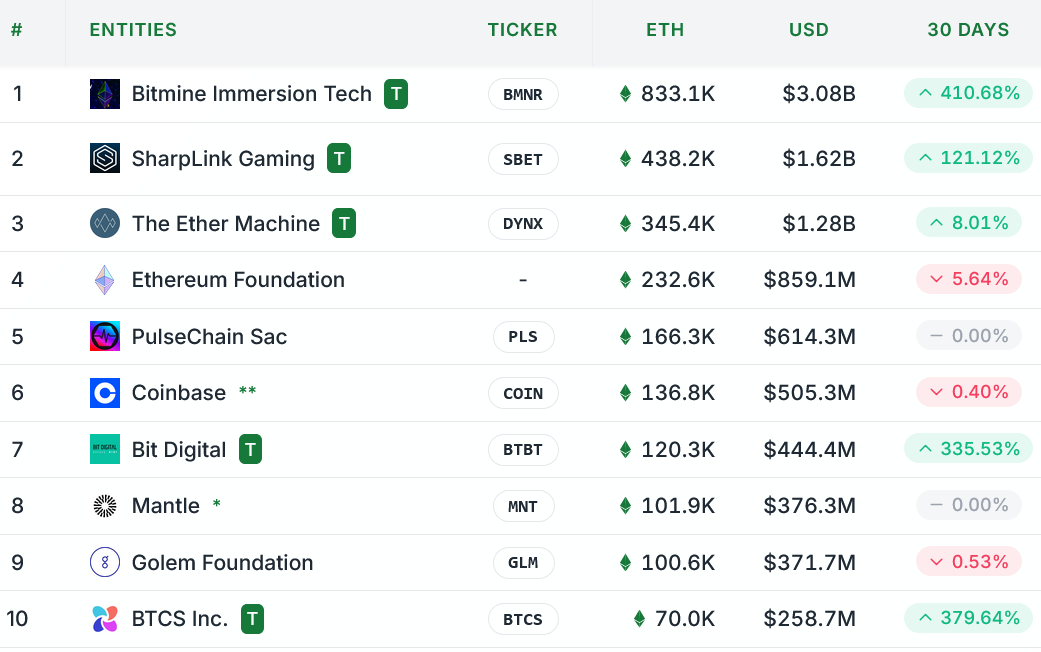

SharpLink holds the second-largest ETH stack with more than 438,200 coins, worth $1.61 billion, while The Ether Machine is third with 345,400 ETH to its name after making a $40 million purchase on Monday.

The Ethereum Foundation and PulseChain SAC round out the top five at 232,600 ETH and 166,300 ETH each, StrategicETHReserve data shows.

Largest Ethereum treasury firms by ETH holdings. Source: StrategicETHReserve.xyz

Lee shares rare bullish market sentiment for August

Lee told CNBC that he expects market prices to rise in August due to recent labor data signaling a softening job market, encouraging the Federal Reserve to pivot from tightening to a more accommodative easing policy and stimulate housing.

“I think we’re going to rally pretty strongly in August,” Lee said, adding the Standard and Poor’s 500 could return to all-time highs in the next couple of weeks, and given the crypto market’s strong correlation to the broader market, such an outcome would likely push Ether and the crypto market higher as well.