🚀 Ethereum Whales Go Shopping: ETH Price Pumps as Exchange Reserves Plummet to 9-Year Lows

Whales are circling Ethereum—and they're not waiting for a discount. As exchange reserves hit their lowest point since 2016, ETH's price gets a bullish jolt. Here's why the smart money's betting big.

The Great Ethereum Drain

Exchanges are bleeding ETH. With reserves now at a near-decade low, the market's sending a clear signal: hodl season is here. No one's selling—they're too busy loading up.

Whale Watch 2025

Big players aren't just dipping toes—they're diving in headfirst. While retail investors panic over 'regulation FUD,' these deep-pocketed traders see blood in the water. Their play? Buy now, laugh later when Wall Street finally 'discovers' crypto (again).

Bottom Line

When supply shrinks and demand spikes, even your traditional finance MBA knows what comes next. Too bad most bankers are still trying to short Bitcoin at $200K. Ethereum's not waiting for permission to rally—it's rewriting the rules.

The Ether Machine adds 15,000 ETH

The Ether Machine, the ether generation company, announced on Wednesday that on Ethereum's 10-year anniversary, its subsidiary, The Ether Reserve LLC, purchased nearly 15,000 ETH at an average price of $3,809.9, totaling $56 million.

This purchase is a part of The Ether Machine's long-term accumulation strategy, bringing the total to 334,757 ETH. The firm said it still has up to $407 million available for additional ETH purchases.

"We couldn't imagine a better way to commemorate Ethereum's 10th birthday than by deepening our commitment to ether," said Andrew Keys, Chairman and Co-Founder of The Ether Machine, in a press release.

"We are just getting started. Our mandate is to accumulate, compound, and support ETH for the long term – not just as a financial asset, but as the backbone of a new internet economy," he added.

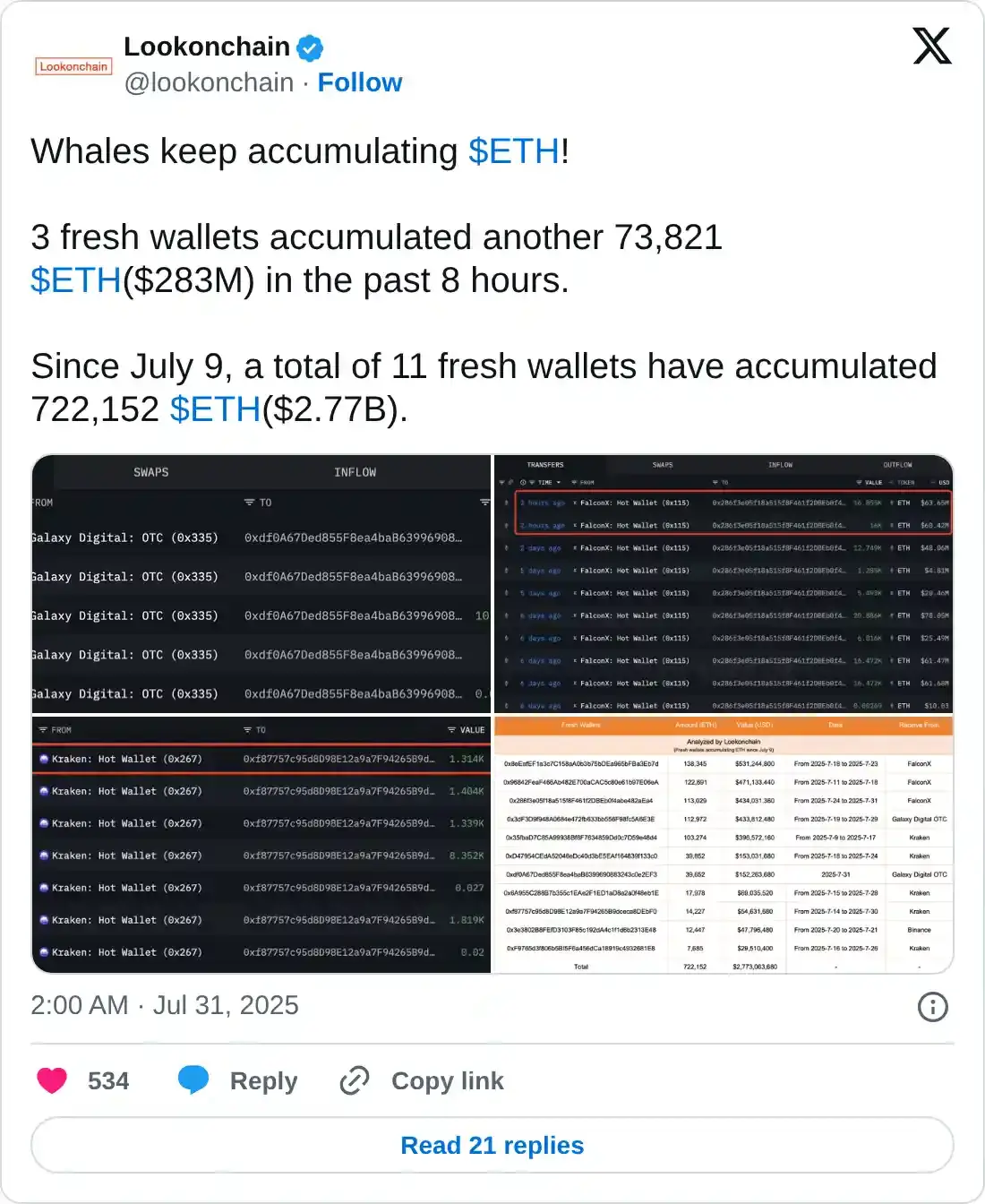

Whales are accumulating ETH tokens

Lookonchain data shows that whale wallets are accumulating ETH tokens. The data shows that three fresh wallets have added another 73,821 ETH worth $283 million in the past 8 hours. Since July 9, a total of 11 new wallets have accumulated 722,152 ETH worth $2.77 billion.

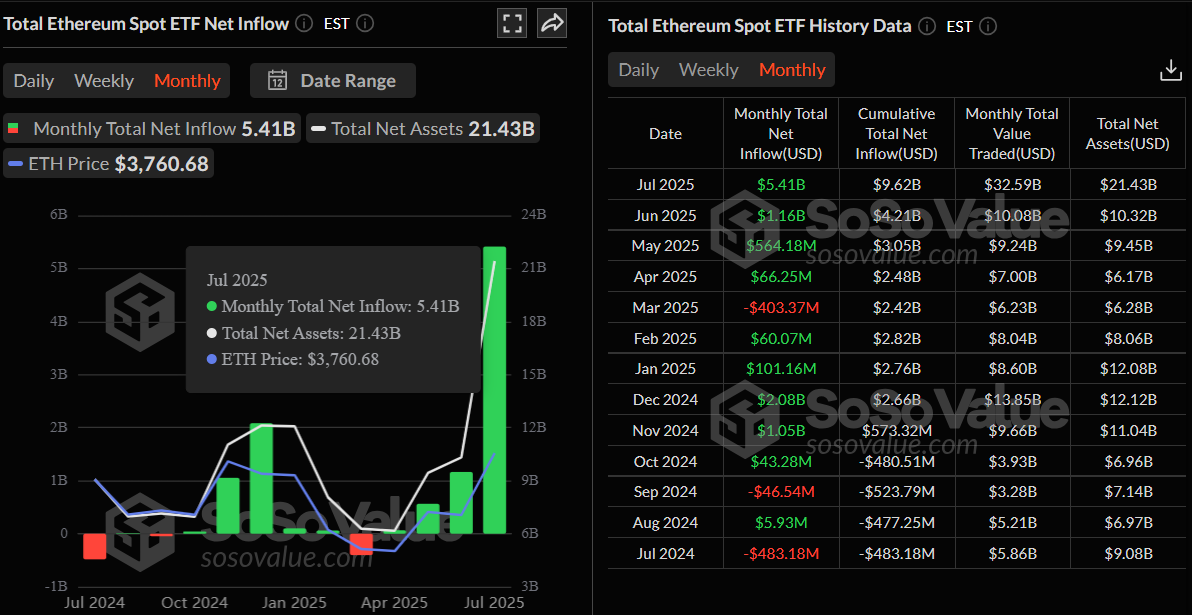

Institutional demand is also rising, albeit by less than earlier in July. According to the SoSoValue data, US spot ethereum Exchange Traded Funds (ETFs) recorded a mild inflow of $5.79 million on Wednesday, continuing its streak of positive flows since July 3. So far in July, the monthly flows have reached $5.14 billion, the highest level since their launch.

Total Ethereum spot ETF net inflow daily chart. Source: SoSoValue

Total Ethereum spot ETF net inflow monthly chart. Source: SoSoValue

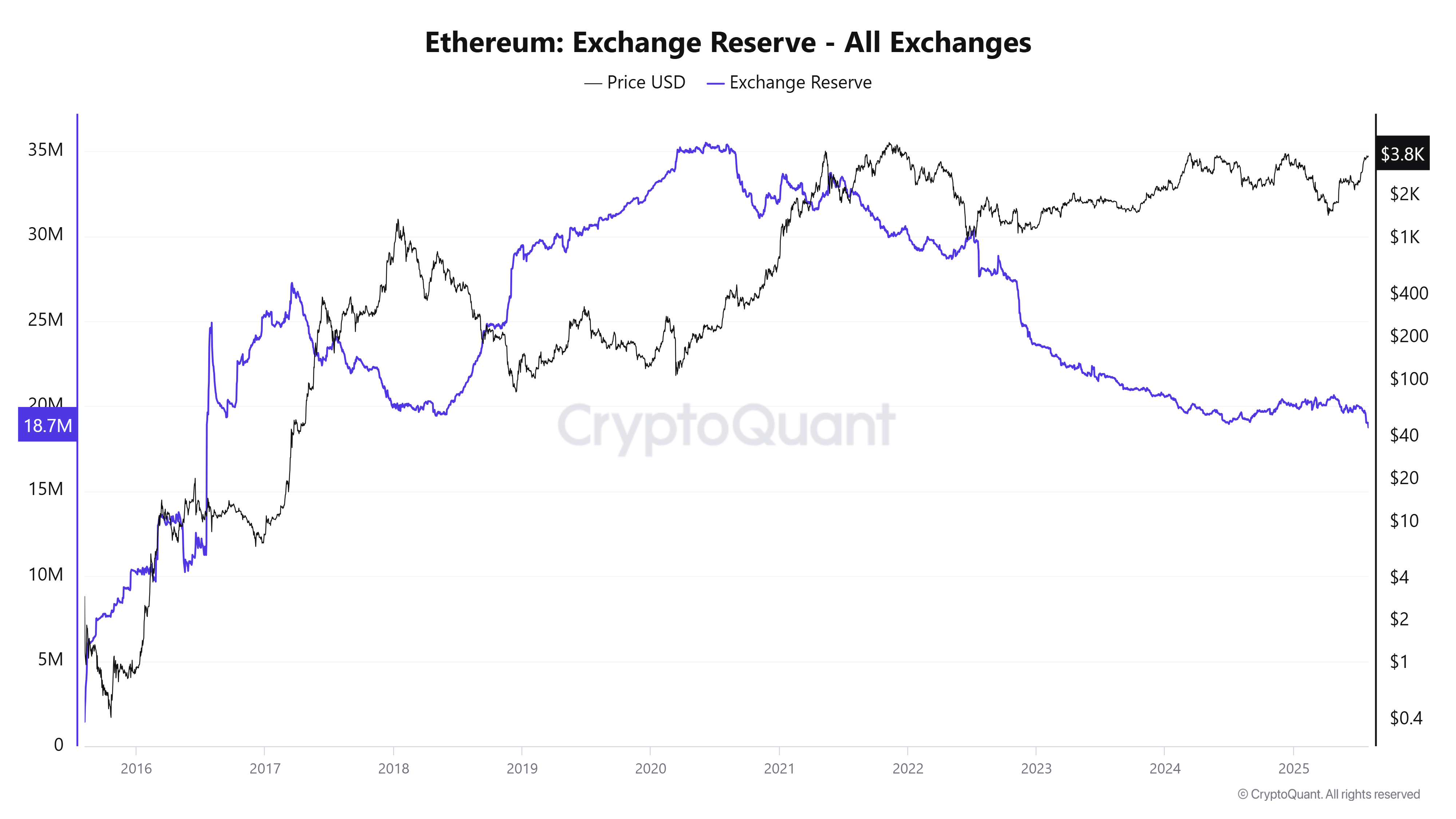

Ethereum exchange reserve drops to a 9-year low

CryptoQuant data indicate that the ETH reserves in exchanges have dropped to 18.7 million as of Thursday, extending the decline seen since early July 2024. Reserves have reached its lowest level since 2016, indicating lower selling pressure from investors and a reduced supply available for trading.

A drop in reserve also signals an increasing scarcity of coins, an occurrence typically associated with bullish market movements.

Ethereum Exchange Reserve– All Exchanges chart. Source: CryptoQuant

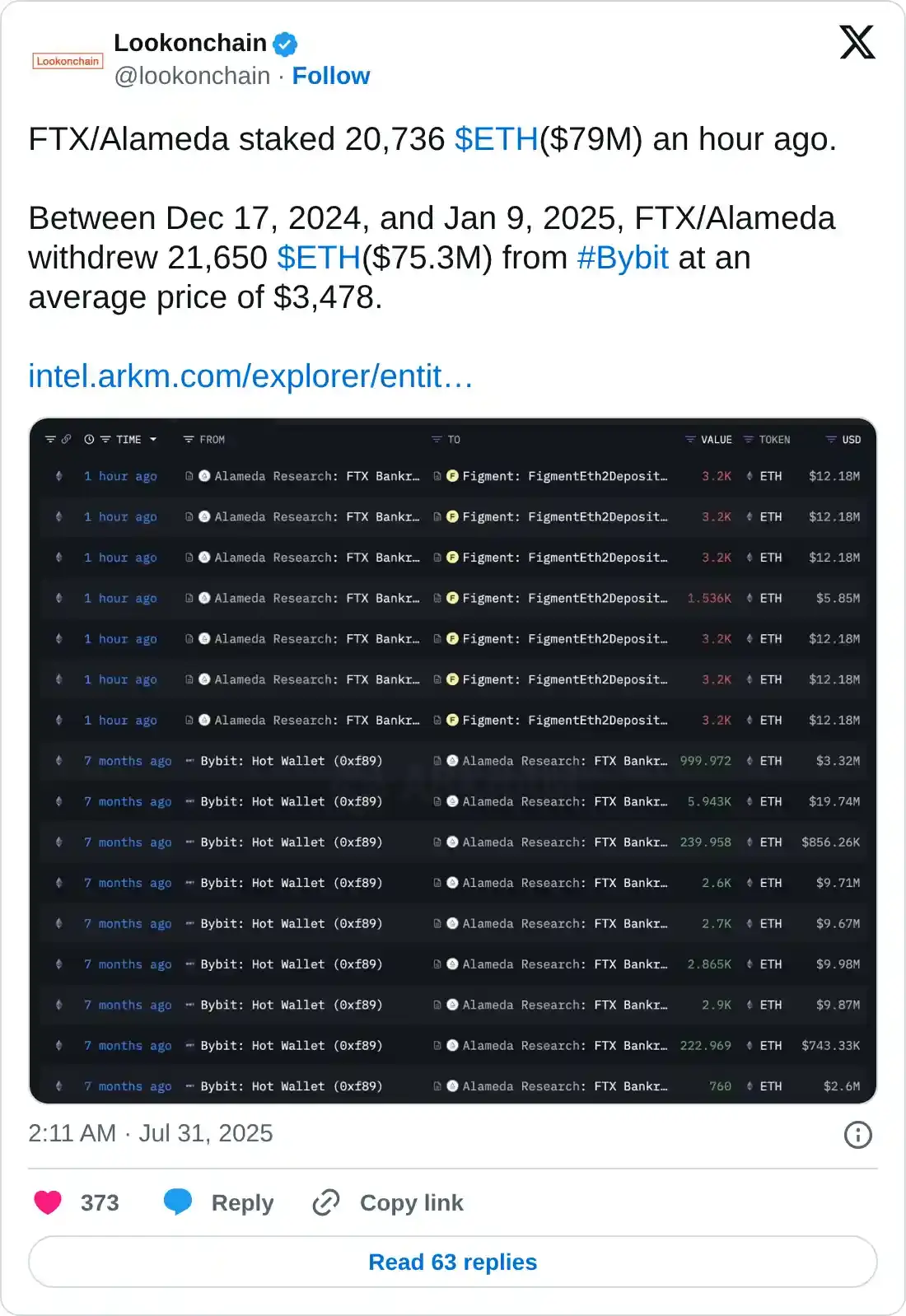

Apart from the falling exchange reserve, Lookonchain data shows that FTX/Alameda has staked 20,736 ETH worth $79 million on Thursday. From mid-December to early January, FTX/Alameda withdrew 21,650 ETH from the Bybit exchange, thereby reducing selling pressure and increasing the scarcity of coins.

Ethereum Price Forecast: ETH bulls aiming for levels above $4,000

Ethereum price faced rejection just below its $4,000 psychological level on Monday and declined slightly to find support around the daily level at $3,730 the next day. On Wednesday, ETH rebounded after retesting this support level. At the time of writing on Thursday, it continues to recover, trading above $3,800.

If the daily support at $3,730 holds, ETH could continue its upward momentum targeting its key psychological level of $4,000. A close above this level could extend additional gains toward the December 9, 2021, high of $4,488.

The Relative Strength Index (RSI) indicator on the daily chart reads 77, above its overbought level of 70. Traders should keep a watch as the Moving Average Convergence Divergence (MACD) showed a bearish crossover on Wednesday, suggesting early signs of bearish momentum and a potential downward trend ahead.

ETH/USDT daily chart

If ETH faces a correction and closes below the daily support at $3,730, it could extend the decline to the next support at $3,500.

Ethereum FAQs

What is Ethereum?

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

What type of blockchain does Ethereum fall under?

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum VIRTUAL machine which helps developers create and launch applications with smart contract functionality.

What are smart contracts?

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

What is staking and why did Ethereum shift from Proof-of-Work to Proof-of-Stake?

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

What is gas in the context of Ethereum?

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.