🚀 Crypto Bulls Charge: PI, Cardano & Bitcoin Price Predictions – Europe’s July 31 Market Pulse

Crypto markets refuse to sit still as PI, Cardano, and Bitcoin make their moves. Here’s where the smart money’s betting—and where the bag-holders are sweating.

PI’s Quiet Ascent: The dark horse of decentralized projects keeps climbing while Wall Street still doesn’t get it.

Cardano’s Make-or-Break Moment: ADA’s tech promises keep colliding with trader impatience. Will this week’s action finally settle the debate?

Bitcoin: The Macro Weathervane: Traders treat BTC like a bond market proxy—until it moons and wrecks their hedges.

One thing’s certain: these charts move faster than a hedge fund manager’s ethics. Buckle up.

Pi Network price forecast: PI struggles near $0.40 amid token unlock fears

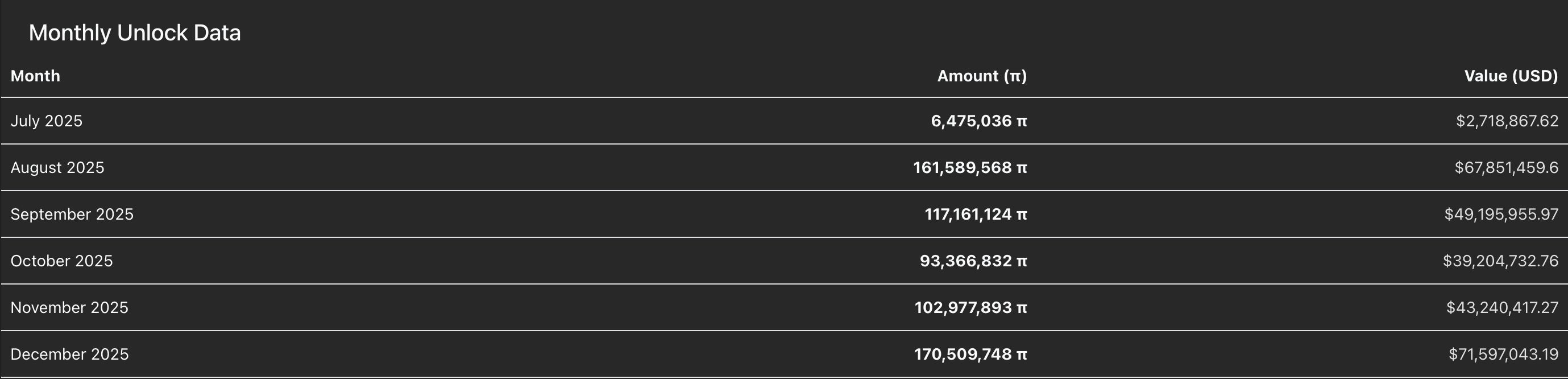

Pi Network (PI) loses steam on Thursday, trading below $0.4200 at the time of writing, falling from a daily high of $0.4364 earlier in the day. The bearish grip on PI, which has been on a clear downtrend since mid-May, tightens ahead of the 160 million token unlock in August and the delay in Pi integration by Onramp Money, tilting the technical outlook bearish.

Cardano Price Forecast: ADA targets wedge breakout as bullish bets rise, $8.57 million in shorts at risk

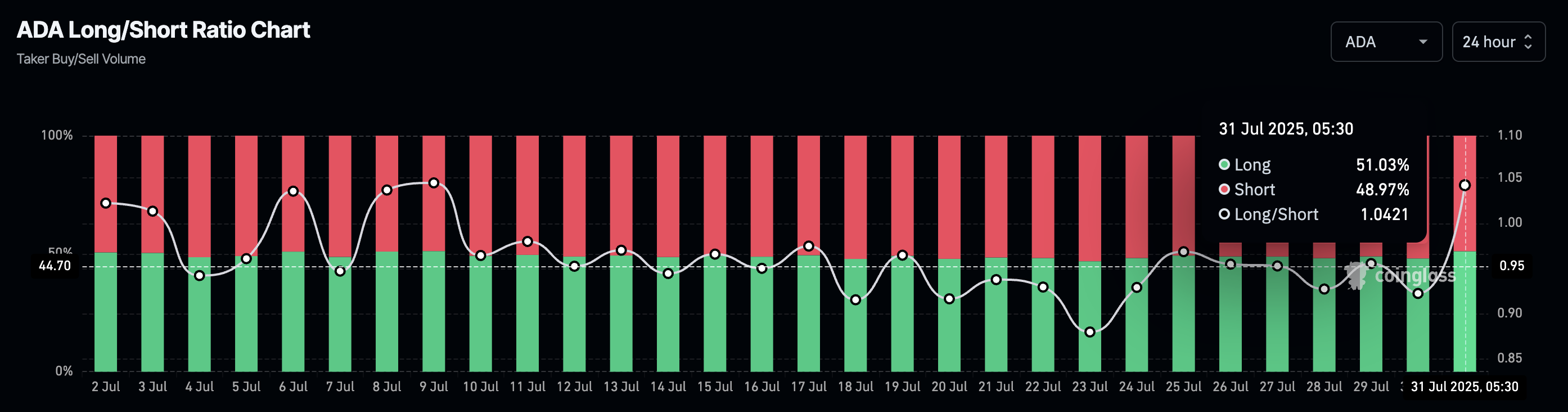

Cardano (ADA) edges higher by nearly 3% at press time on Thursday, inching closer to the $0.8000 level. The derivatives data indicate an increase in long positions, putting $8.57 million of short positions at risk, while the technical outlook suggests ADA could continue to rise within a wedge pattern.

Bitcoin Price Forecast: BTC extends consolidation as whale buying, regulatory clarity boost sentiment

Bitcoin (BTC) price is trading above $118,500 at the time of writing on Thursday, continuing a consolidation phase that has been underway for the past 16 days. Despite the lack of a clear price direction, on-chain data shows some signs of optimism for the largest cryptocurrency as large-wallet holders' accumulation increases and Over-The-Counter (OTC) balance has reached record lows.