Bull Market Brakes? September Rate Cut Odds Plummet to 40%

Wall Street's rate-cut hopium takes a hit as Fed odds drop below coin-flip territory. The 'patient' bull might need to graze longer than expected.

Market pulse check: Traders now pricing in a 60% chance Powell & Co. hold firm—because nothing says 'transitory inflation' like 18 months of stubborn price growth.

Pro tip: When the Fed whispers 'data-dependent,' grab your risk-off helmet. Crypto's next leg up? Probably waiting on those magical 2% inflation unicorns.

No decisions about September

Powell said increased tariffs are beginning to show up in consumer prices for some categories of goods. He did not rule out maintaining rates again at the next Federal Open Market Committee (FOMC) meeting in September, adding that it WOULD depend on economic data over the next two months.

“We have made no decisions about September, we don’t do that in advance,” he said.

“If the unemployment rate holds steady and tariffs push up inflation, it will be hard to justify a rate cut in the next few months,” Bill Adams, chief economist at Comerica Bank, told Reuters.

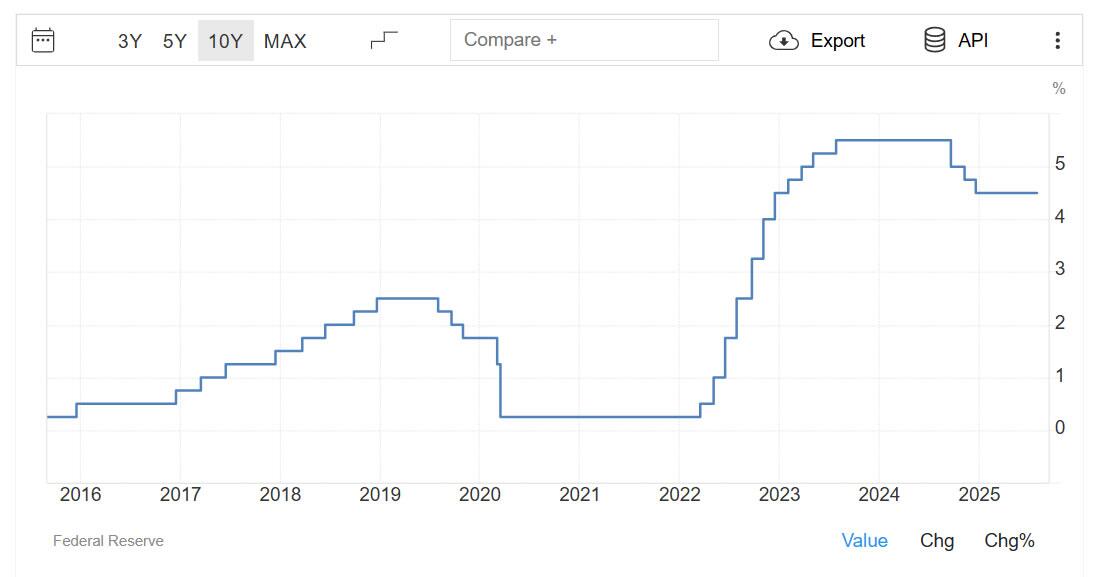

US interest rates remain close to their highest levels in over a decade. Source: Trading Economics

Powell defied US President Donald Trump, who has called for lower rates, maintaining his wait-and-see approach amid growing concerns that the ongoing trade war could reverse progress toward the central bank’s 2% inflation target.

US inflation is currently 2.7% and has increased for the past four months.

Rate cut probability declines

Powell’s comments dashed the probability of a rate cut in September to 40% after the meeting. It was at a 63% chance before the FOMC statement.

“If the Fed maintains its cautious stance, the bull market’s pace may slow, but the underlying liquidity surge could keep the floor intact for an eventual rebound,” Nick Ruck, director at LVRG Research, told Cointelegraph.

“The market had priced in that there would be no rate cut this week, so this is no surprise,” Apollo Capital’s chief investment officer, Henrik Andersson, told Cointelegraph.

However, the market still expects one to two rate cuts before year-end.

We don’t think this will have a material effect on the crypto market; it’s been clear for a while that the uncertainty regarding tariffs will delay US rate cuts.

He added that it was interesting that two commissioners dissented, the first time in 30 years that this has happened. Christopher Waller, a governor, and Michelle Bowman, vice chair for supervision, supported the Fed lowering interest rates by a quarter of a percentage point.

Crypto markets dipped slightly following the announcement but have rebounded again during the Thursday morning trading session in Asia.

Total capitalization was around $3.94 trillion, and well within a range-bound channel that has been trading sideways for the past fortnight.

US rate cuts typically boost crypto markets because lower interest rates make traditional savings accounts less attractive, pushing investors toward higher-risk, higher-reward assets such as crypto.