From Vapes to BNB Vaults: Canadian Firm Skyrockets 550% in Crypto Pivot Play

A Canadian vape company just pulled off the ultimate pivot—ditching e-cigarettes for BNB treasury management and watching its valuation explode by 550%. Talk about switching addictions.

### The Crypto Cash Grab

When traditional markets flatline, desperate firms turn to digital assets faster than a DeFi rug pull. This one bet the farm on Binance’s ecosystem—and won (for now).

### Numbers Don’t Lie (Until They Do)

That triple-digit surge smells like 2021-era meme stock mania—except this time, the hype’s backed by blockchain buzzwords instead of Robinhood traders. Genius or gambit? The chart tells the story… until the next quarterly report.

### The Icarus Warning

Every crypto Cinderella story has a midnight timestamp. Will this be the rare pivot that sticks—or another case of ‘narrative inflation’ meeting cold, hard reality? Grab your popcorn (and maybe some downside protection).

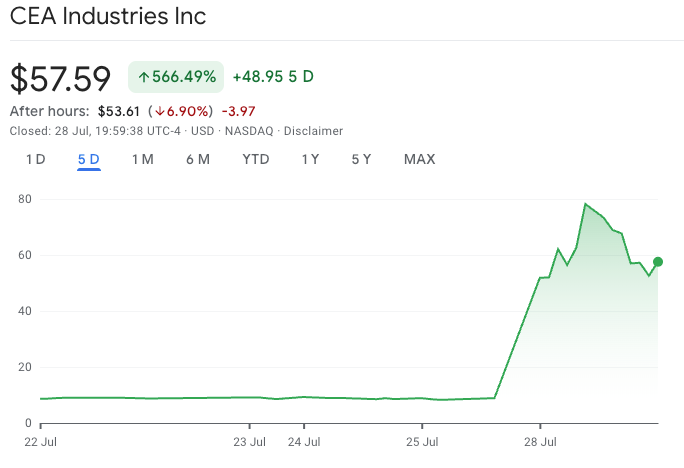

VAPE shares closed trading on Monday up nearly 550% to their highest close in nearly three and a half years. Source: Google Finance

Up to $1.25 billion could be used to buy BNB

The deal could potentially unlock $1.25 billion for CEA Industries after the deal’s expected close on Thursday, which it intends to use “to acquire BNB, creating a gateway for institutional and retail investors to participate in the BNB Chain ecosystem.”

“By creating a U.S.-listed treasury vehicle, we are opening the door for traditional investors to participate in a transparent way,” said CEA Industries’ incoming CEO, David Namdar, a senior partner at 10X Capital and a co-founder and former co-head of trading at Galaxy Digital.

“BNB Chain is one of the most widely used blockchain ecosystems globally, yet institutional access has been limited until now,” he added.

The company plans to bolster its BNB holdings over the next two years through at-the-market offerings and “other proven strategies.” It will also look to make revenue from its holdings through staking and lending.

Several public companies have pivoted to stockpiling crypto this year. In some cases, the announcements have boosted the value of the company and the crypto token it’s buying.

BNB mostly held by Zhao, Binance

Zhao revealed in February that 98.5% of his crypto portfolio was BNB, without specifying the total value of his holdings. Forbes reported in June 2024 that Zhao and Binance together controlled what was then 71% of the BNB tokens in circulation.

Binance is deeply tied to BNB, as it launched the token and the BNB Chain in 2017, and still offers perks to BNB holders on its platform.

While the exchange is not involved in developing the token or the blockchain, some investors could see BNB as a way to indirectly gain exposure to the Binance ecosystem.

Zhao is banned from managing Binance as part of a deal with the US to plead guilty to money laundering violations, but he is still the exchange’s biggest shareholder.

BNB has fallen 1.8% over the past 24 hours to trade below $830 after hitting an all-time high just above $858 earlier on Monday, according to CoinGecko.

10X Capital stacks CEA top brass

CEA Industries said that many of 10X Capital’s executives WOULD take over the top roles at the vape company.

Along with Namdar taking over as CEO, 10X Capital’s chief investment officer, Russell Read, will take on the same role at CEA Industries, while former Kraken product management director Saad Naja will also FORM part of CEA Industries’ management team.

CEA Industries entered Canada’s nicotine vape market after it bought vape retailer and manufacturer Fat Panda in early June.