🚀 Dogecoin, Pi & Bitcoin: July 24 Price Predictions & Market Movers You Can’t Ignore

Crypto markets never sleep—and neither do the memecoins. As Bitcoin flirts with key resistance levels, Dogecoin's retail army reloads while Pi Network's 'mine-from-phone' dream faces a reality check. Here's what's shaking the digital asset space today.

### Bitcoin: The Macro Whale

BTC's consolidation pattern hints at a make-or-break moment—institutional inflows creep up, but that Mt. Gox overhang still looms like a bad NFT investment.

### Dogecoin: Meme Magic or Tragic?

Elon's favorite joke currency keeps defying gravity (and common sense). Watch the 50-day MA—retail traders treat it like a religion.

### Pi Network: Mainstream Mirage?

The 'next Bitcoin' narrative faces its toughest critic yet: actual liquidity. Closed mainnet trading sparks more exit scams than adoption.

---

Bullish signals clash with regulatory headwinds—because nothing says 'financial revolution' like waiting for the SEC's permission slip. Trade accordingly.

Dogecoin Price Forecast: DOGE could drop 13% amid suppressed network activity

Dogecoin (DOGE) price is attempting recovery on Thursday after dropping nearly 23% from its recent high of $0.2873 and testing $0.2219 as support. The leading meme coin by market capitalization exchanges hands at around $0.2372 at the time of writing, marking a decline of more than 1.5% on the day.

%20%5B14-1753359292908.08.58,%2024%20Jul,%202025%5D-638889587495341740.png)

%20%5B14-1753359292908.08.58,%2024%20Jul,%202025%5D-638889587574893053.png)

Pi Network Price Forecast: CEXs' balances surge as traders book profit ahead of 10M token unlock

Pi Network (PI) edges lower by 2% at press time on Thursday, extending the declining trend to a crucial support floor. An inflow surge of the Centralized Exchanges (CEXs) wallet balances ahead of the 10.8 million Pi token unlock signals a rise in selling pressure as traders book profit ahead of the incoming supply spike.

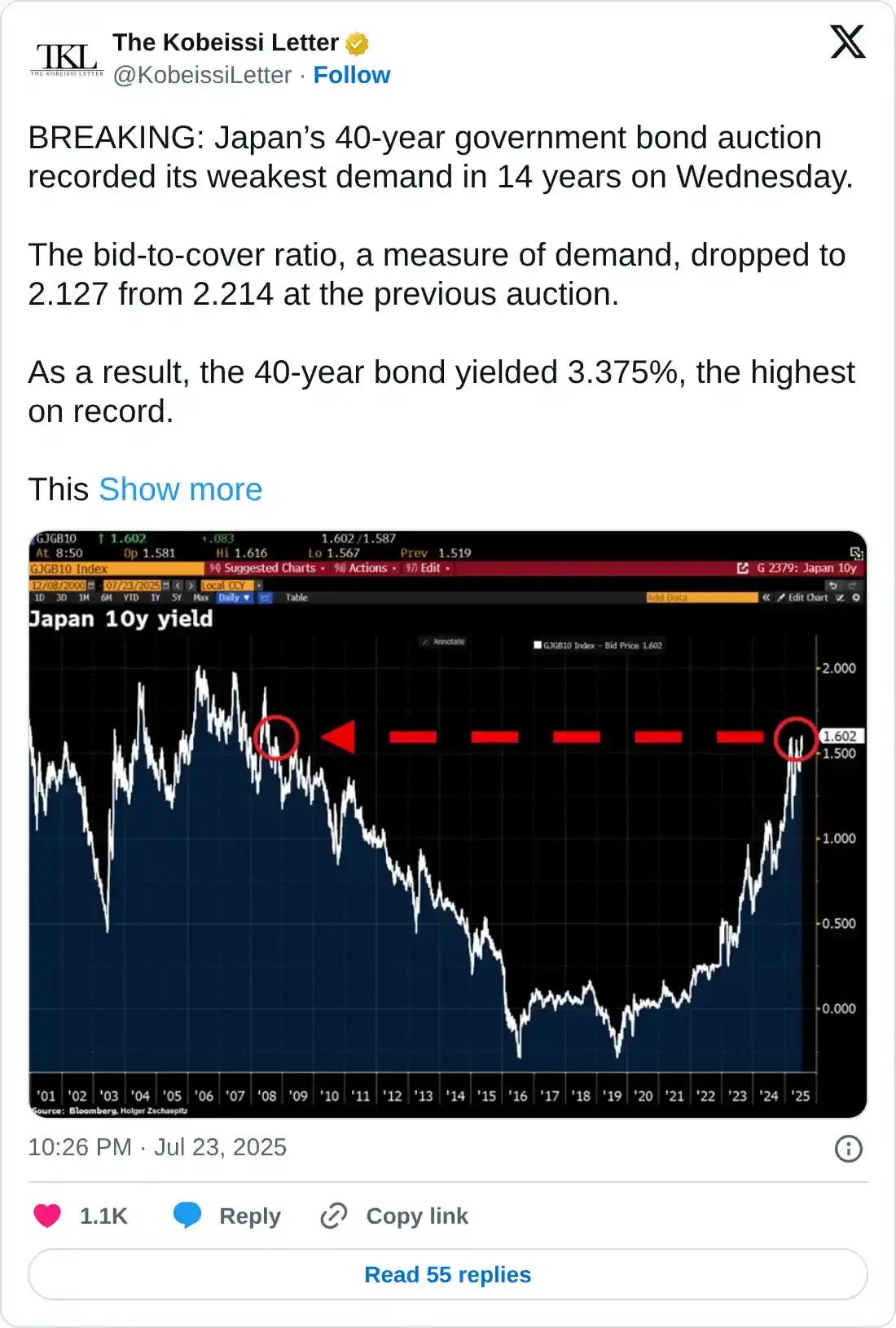

Japan’s AI company Quantum to acquire 3,000 BTC amid US-Japan trade deal, rising treasury yield

Quantum Solutions, a publicly listed AI company on the Tokyo Stock Exchange, announced its aim to acquire 3,000 Bitcoin (BTC) amid Japan’s recent trade deal with the United States (US) and the rising Bond yields in the country.