Bitcoin at a Crossroads: BTC Holds Steady as Technicals Flash Correction Warnings

Bitcoin's price action hits the snooze button—but the charts are screaming 'caution.'

The consolidation conundrum: BTC's tight range has traders split between 'buy the dip' and 'brace for impact.' RSI and MACD aren't bullish anymore—just politely coughing into their hands.

Institutional déjà vu: Wall Street's latest 'blockchain revolution' fund (with 2% actual crypto exposure) launches right on schedule. How convenient.

One thing's certain: when Bitcoin zigzags, weak hands get liquidated. Whether this is a pitstop before new highs or the start of a deeper pullback depends who's holding the leverage.

Corporate companies' demand for BTC persists

Strategy, formally known as MicroStrategy, announced on Monday that the firm has acquired 6,220 BTC for $739.8 million, bringing its total holdings to 607,770 BTC. Moreover, the company also announced its intention to conduct an initial public offering (IPO) of 5,000,000 shares of Strategy’s Variable Rate Series A Perpetual Stretch Preferred Stock (STRC). The firm intends to use the net proceeds from the offering for general corporate purposes, including the acquisition of Bitcoin, as well as working capital.

Also on Monday, the US President Donald Trump-backed Trump Media & Technology Group (DJT) announced that it had purchased $2 billion worth of Bitcoin (BTC) and Bitcoin-related securities.

Similarly, Sequans Communications (SQNS), a leading provider of cellular IoT semiconductor solutions, announced the acquisition of an additional 1,264 BTC, bringing its total holdings to 2,317 BTC.

Volcon (VLCN) announced that it has closed its previously announced private placement, exceeding $500 million, and that it has launched its bitcoin treasury strategy, allocating more than 95% of the gross proceeds from the Private Placement to the acquisition of BTC. The firm currently holds 280.14 BTC on its balance sheet and intends to use the net proceeds from this financing to rapidly increase its BTC holdings.

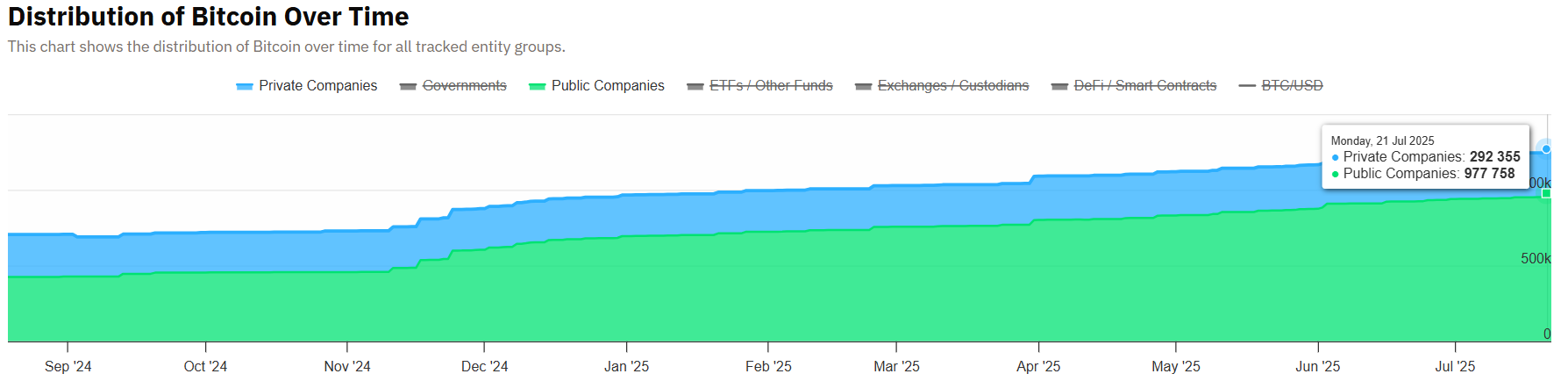

These announcements by companies are bullish for BTC in the longer term, and according to data from BitcoinTreasuries.net, both public and private companies are accumulating BTC as reserves have been constantly rising.

Distribution of Bitcoin over time chart. Source: BitcoinTreasuries.Net

JPMorgan explores lending against clients’ cryptocurrency

JPMorgan could start lending directly against crypto assets, such as Bitcoin and Ethereum, as early as next year, according to a report in The Financial Times on Tuesday.

The policy WOULD mark a big shift for JPMorgan chief executive Jamie Dimon, who eight years ago branded Bitcoin a “fraud” that would “eventually blow up” and was only useful for drug dealers and murderers.

However, Dimon’s stance softened at the bank’s annual investor day in June. While clients can purchase Bitcoin, JPMorgan will not hold the asset in custody; instead, the bank will reflect the holdings in client statements.

Earlier in June, the bank allowed its clients to offer cryptocurrency-backed assets, such as Bitcoin (BTC) exchange-traded funds (ETFs), as collateral for loans, starting with BlackRock's iShares Bitcoin Trust (IBIT).

The move to start lending directly against crypto assets reflects a growing interest by large banks to update traditional lending practices to include digital assets. The recent developments and regulation clarity under the TRUMP administration could also boost wider crypto adoption in the long term.

Some signs of concern for BTC price

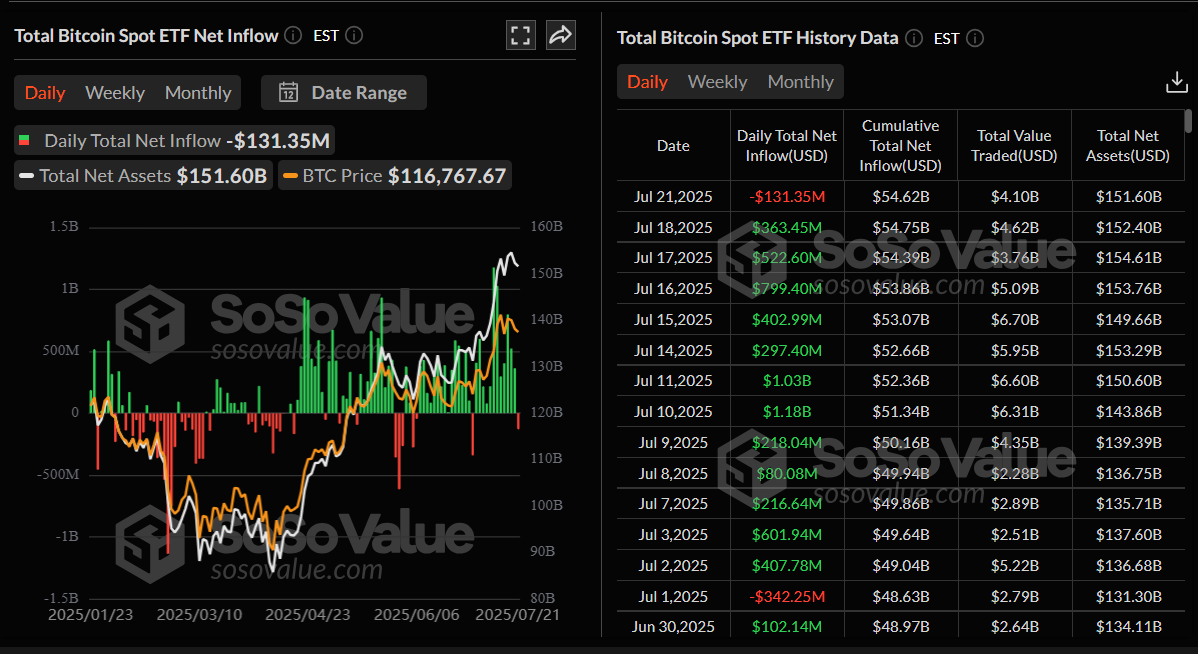

Despite public and private companies, as well as large banks, showing interest in BTC, there are some signs of concern to watch for in the short term. According to SoSoValue data, US spot Bitcoin Exchange Traded Funds (ETFs) recorded an outflow of $131.35 million on Monday, breaking the daily streak of inflows seen since July 2. If this trend continues and intensifies, Bitcoin price could face a correction.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

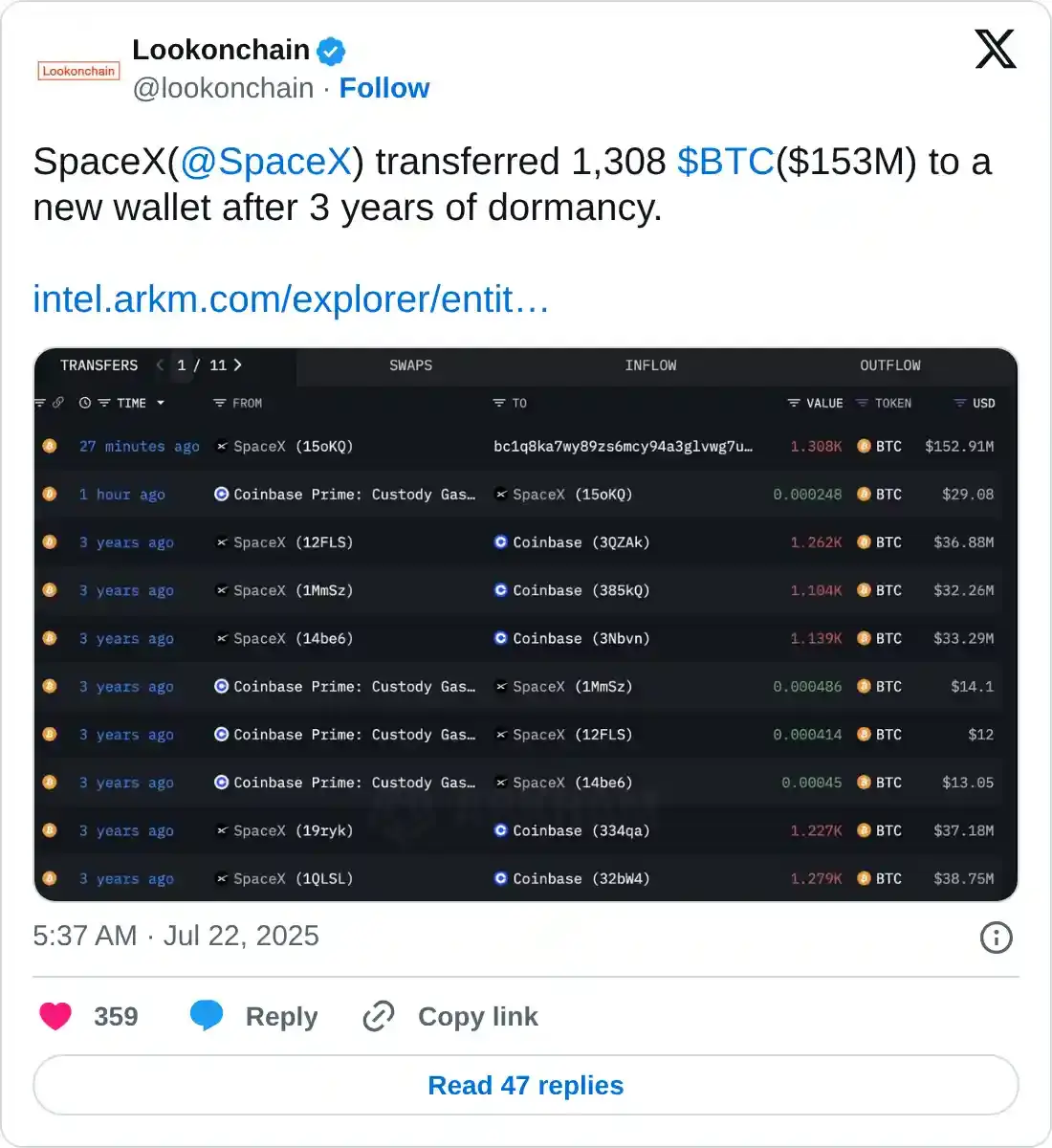

Meanwhile, Lookonchain data shows that SpaceX transferred 1,308 BTC, worth $153 million, to a new wallet after three years of dormancy. If the holdings from the new wallet are transferred to exchanges, it would trigger short-term selling pressure that could weigh on the BTC price. The firm currently holds a total of 6,977 BTC worth $825.88 million.

Bitcoin Price Forecast: BTC shows early signs of weakness

Bitcoin price reached a new all-time high of $123,218 on July 14 and has been trading broadly sideways between $116,000 and $120,000 since then. At the time of writing on Tuesday, it trades slightly above at around $118,300.

If BTC falls below the lower consolidation boundary at $116,000 on a daily basis, it could extend the decline to retest the 50-day Exponential Moving Average (EMA) at $110,589.

The Relative Strength Index (RSI) on the daily chart reads 65 and points upward, indicating bullish momentum. However, traders should be cautious, as the Moving Average Convergence Divergence (MACD) indicator generated a bearish crossover on Monday, providing a sell signal and indicating the start of a downward trend.

BTC/USDT daily chart

If BTC closes above the upper boundary of the consolidation range at $120,000 on a daily basis, it could extend the recovery toward the fresh all-time high at $123,218.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.