Monero (XMR) Price Forecast 2025: Bears Tighten Grip as Privacy Coin Stumbles

Monero's price action turns ugly as sellers dominate—privacy features no match for market forces.

Blood in the water: XMR's chart paints a classic bearish breakdown, with support levels crumbling like a regulator's patience during bull runs.

Privacy premium evaporates: Even bulletproof cryptography can't hide the asset's 30-day downward trajectory, proving anonymity fetches no favors in a risk-off climate.

Silver lining for degens? Every crypto winter eventually thaws—though bagholders might need Swiss bank-level secrecy to hide their entry prices. Meanwhile, TradFi quants sip champagne over their 'predictable' short positions.

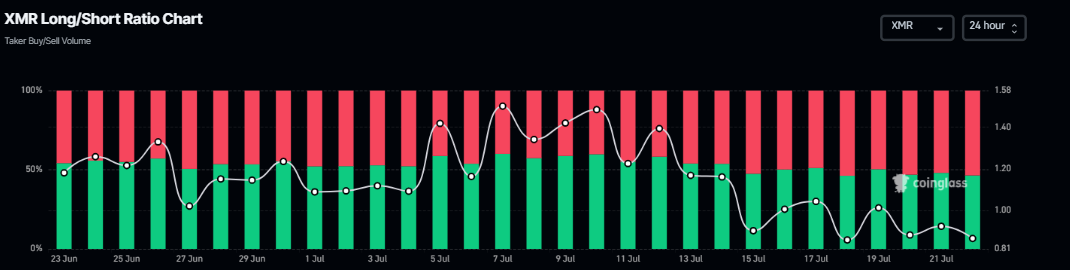

Monero’s bearish bets are rising

Coinglass's data shows that the long-to-short ratio of Monero reads 0.82 on Tuesday, the lowest level in more than a month. This ratio, below one, indicates bearish sentiment in the markets, as more traders are betting on Monero's price to fall.

Monero long-to-short ratio chart. Source: Coinglass

Monero Price Forecast: XMR momentum indicators show bearish signs

Monero price broke and closed below its ascending trendline (drawn by connecting multiple lows since mid-June) on Friday. XMR found support around the 50-day Exponential Moving Average at $320.01 during the weekend, but failed to close above this broken trendline.

Similarly, on Monday, it again faced rejection from the trendline and closed below its 50-day EMA at $320.01. At the time of writing on Tuesday, it trades at around $321.21.

Sidelined investors looking to short XMR can do so around the current trading levels with the stop-loss set slightly above its Monday high of $332.43.

If XMR faces correction from the level mentioned above, it could extend the decline to retest its July 1 low of $301.71, which roughly coincides with the 100-day EMA at $305.14. A successful close below this WOULD extend the losses to retest the June 22 low of $288.83.

The Relative Strength Index (RSI) indicator on the daily chart reads 46, pointing downward and below its neutral level of 50, which suggests mild bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) also showed a bearish crossover on Monday, giving a sell signal.

XMR/USDT daily chart

However, if the Monero price closes above Monday's high of $332.4 on a daily basis, the bearish thesis would be invalidated. Such a scenario could extend the rally toward the July 14 high of $357.66.