XRP Soars to New All-Time High as Crypto Fund Inflows Surge to $4.4B

XRP rockets past previous records—fueled by a tidal wave of institutional cash flooding crypto markets.

Wall Street’s latest love affair with digital assets isn’t slowing down. The $4.4 billion plowed into crypto funds this year just proved traditional finance will FOMO into anything with a chart that goes ↗️.

Meanwhile, XRP’s rally leaves skeptics scrambling. The 'banker’s crypto' keeps defying expectations while regulators play whack-a-mole with the rest of the sector. Stay tuned—this bull run’s got teeth.

Demand propels XRP price toward all-time high

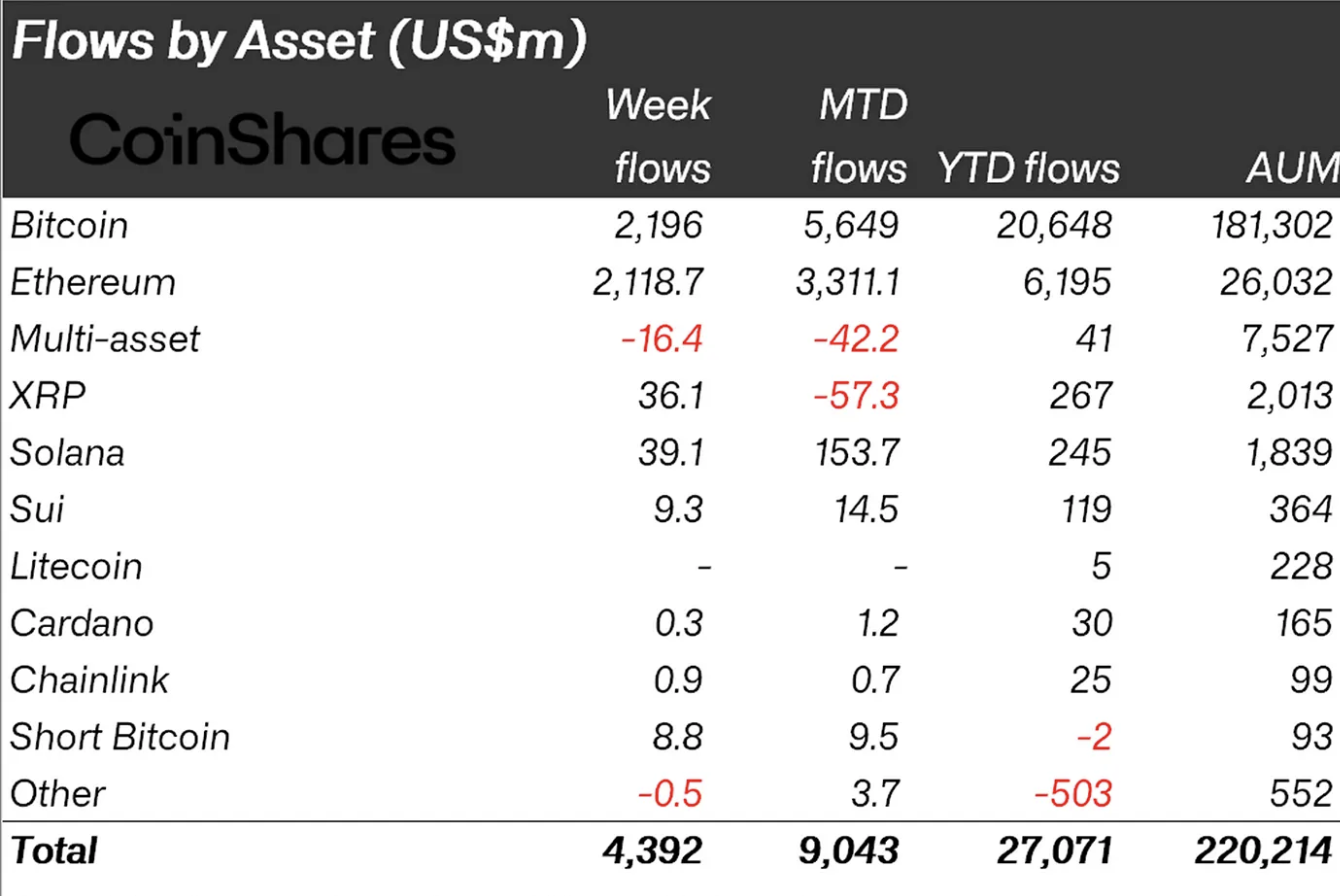

Digital investment products saw a significant increase in demand with inflows reaching $4.39 billion last week, according to a weekly CoinShares report released on Monday.

XRP-related financial products recorded a remarkable increase in the capital inflow, reaching $36 million, from posting outflows of $104 million the previous week. Their total year-to-date inflow currently stands at $267 million net with assets under management (AUM) averaging slightly above $2 billion.

Ethereum (ETH) was the best-performing cryptocurrency last week with inflows of $2.1 billion, slightly below Bitcoin's (BTC) $2.2 billion.

"Digital asset investment products recorded their largest weekly inflows on record, totalling $4.39 billion, surpassing the previous peak of $4.27 billion set post-US election in December 2024," the CoinShares report states.

Digital fund flows data | Source: CoinShares

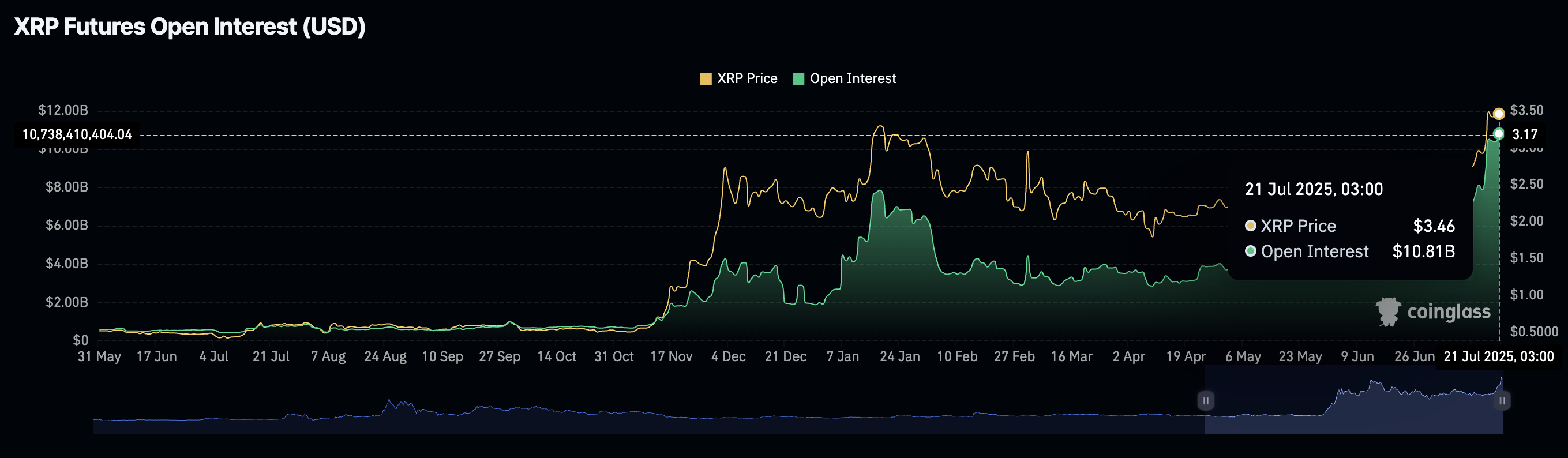

The surge in the XRP futures market's Open Interest (OI) underscores the soaring interest among traders. CoinGlass data shows that Open Interest, which represents the value of all futures and options contracts that have not been settled or closed, has expanded to $10.81 billion from a low of $3.54 billion in June. If traders continue to bet on XRP's price increasing to new record highs, OI could remain elevated in the upcoming weeks.

XRP Futures Open Interest data | Source: CoinGlass

Technical outlook: XRP bulls take control

XRP price is inching closer to establishing new record highs above $3.66, supported by a strong technical structure and positive market sentiment. The Moving Average Convergence Divergence (MACD) indicator reinforces the bullish outlook, flaunting a buy signal triggered on June 28.

In addition to XRP trading significantly above key moving averages, a recently confirmed Gold Cross pattern, formed when the 50-day Exponential Moving Average (EMA) crossed above the 100-day EMA, predisposes the token for the price discovery phase.

XRP/USDT daily chart

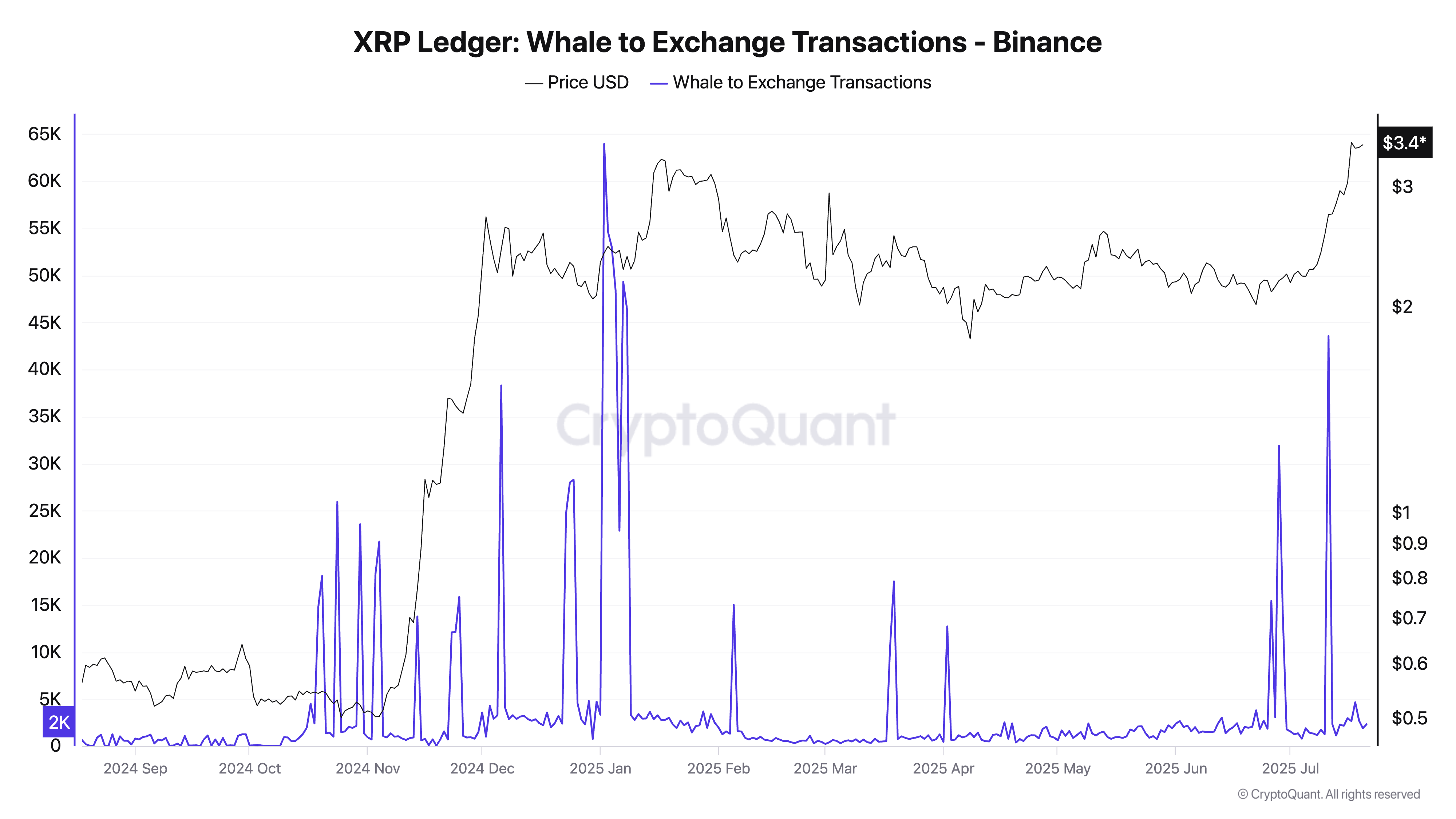

On the other hand, traders should be aware of the sudden increase in whale-to-exchange transactions, which exceeded 43,000 on July 11, according to data from CryptoQuant. There was another smaller increase in similar transactions, reaching 4,672 on Friday, followed by a subsequent decline to 2,339.

XRP whale-to-exchange transactions (Binance) | Source: CryptoQuant

Sharp increases in this metric can have a negative impact on the price of XRP, particularly if whales sell for profit as the token trades near its all-time high.

A reversal from the current price level could result from profit-taking activities, sudden changes in market dynamics and sentiment, particularly with the implementation of United States (US) President Donald Trump's higher tariffs on August 1.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.