Ethereum’s Surge Threatens Bitcoin Dominance: 99% Chance BTC’s Reign Has Peaked

Bitcoin's throne is wobbling. As Ethereum rockets upward, analysts now see a 99% probability that BTC's market dominance has hit its ceiling—unless the OG crypto pulls a rabbit out of its decentralized hat.

The flippening whispers grow louder. ETH's relentless rally isn't just altseason noise—it's a direct challenge to Bitcoin's supremacy. Smart contract adoption, institutional DeFi plays, and that sweet, sweet staking yield are stealing BTC's spotlight.

Meanwhile, Bitcoin maximalists are coping harder than a Wall Street banker explaining why their 'low-risk' crypto fund just got rekt. The numbers don't lie: when ETH moves, the whole market trembles. Game on.

“Impossible” for BTC dominance to spike if ETH pattern holds

“It is basically impossible for Dominance to push higher if ETH continues higher against BTC,” Hyland added.

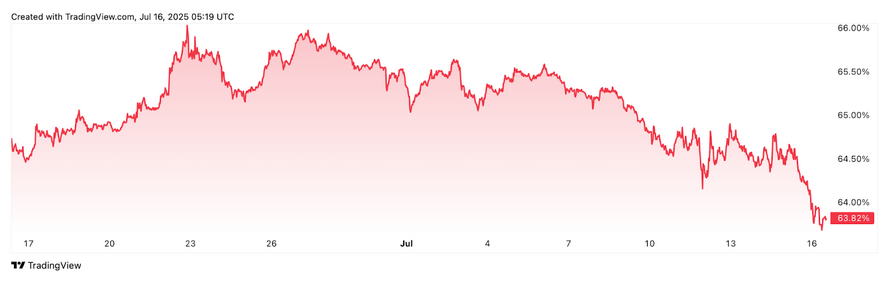

Bitcoin (BTC $118,272) dominance — a measure of Bitcoin's share of the market — is at 63.82% at the time of publication, up 9.89% since Jan. 1, according to TradingView.

Bitcoin dominance is down 1.35% over the past 30 days. Source: TradingView

Over the past seven days, it is down 1.85%, which crypto trader Ash Crypto said is because “money flowing into ETH & altcoins.”

Bitcoin’s rising market dominance typically suggests that investors favor Bitcoin over altcoins, while a decline may signal growing confidence in the broader altcoin market.

Meanwhile, Ether (ETH $3,162) is up 19.87% over the past seven days, trading at $3,117, according to CoinMarketCap data. Crypto trader Cas Abbe said the asset is at a stage of one of the most obvious bull flag formations, “and it’s getting closer to a breakout.”

Bitcoin may consolidate short term

Ether’s relative strength against bitcoin has spiked almost 10% over the past 30 days.

Capriole Investments founder Charles Edwards told Cointelegraph that he expects Bitcoin’s market to cool off following its recent high of $122,884 on Monday, but believes the uptrend will pick back up toward the end of the year.

“I see some consolidation here after the big move, but ultimately higher into year end,” Edwards said.

While TradingView’s Bitcoin Moving Average Indicator signals the asset is a “Strong Sell,” many crypto analysts predict much higher for the asset before the year-end.

21Shares crypto research strategist Matt Mena told Cointelegraph that Bitcoin isn’t likely to enter a downtrend anytime soon, with strong fundamentals supporting its trajectory.