Bitcoin Shatters ATH: Is the Altcoin Season Finally Here?

Bitcoin just bulldozed through its all-time high—again. The crypto king's relentless rally has traders scrambling, but the real question isn't about BTC anymore. It's about the sleeping giants in its shadow.

Altcoins: Primed for takeoff or doomed to lag?

History says when BTC stalls, alts catch fire. But this cycle's different—institutional money's playing by new rules (or pretending to). Ethereum's flirting with scalability, Solana's dodging outages like Neo in the Matrix, and meme coins... well, they're still betting on Elon's next tweet.

The trigger? Could be ETF approvals, could be Fed pivots, or just good old-fashioned FOMO. Meanwhile, TradFi dinosaurs are still explaining why 'this time it's different' for their 0.5% yield products.

One thing's certain: When the altseason dam breaks, it won't ask for permission. Buckle up.

Weekly thoughts

There’s a certain order of business in crypto markets.

Bitcoin moves first and the rest follow - and Bitcoin just set a record high.

We talked about the opportunity in bitcoin just prior to the breakout in week 26’s analysis. Now we’re looking for the next opportunities in other tokens.

When Bitcoin moves (especially to new highs) it tends to pull the rest of the market with it. If crypto sentiment is strong enough in this bullish phase for Bitcoin, investor confidence spills over into altcoins.

Smaller coins occasionally front-run Bitcoin on short-term narratives (e.g., HYPE cycles around specific projects), but these are exceptions rather than the rule. In terms of setting the tone for broader market cycles, Bitcoin leads.

For crypto traders it’s a signal.

When Bitcoin breaks out, liquidity starts flowing back into the market. Institutional interest picks up, media coverage intensifies, and retail investors begin to return. Soon after, what CAN happen (but doesn’t always) is “alt season” when smaller cryptocurrencies begin to surge, some with massive upside volatility.

To be clear: We are not crypto specialists looking for the next 1000X MOVE from obscurity. That requires a much deeper understanding of the projects involved and possibly some inside information.

We’re looking to the alternative crypto ‘blue chips’ already accessible as CFDs to see what’s possible.

One thing to think about is that usually the big winners of the last cycle aren’t the winners of the next one. But even the most down-beaten coins pick up interest when there’s a bull market.

So there’s THREE conceptual ways to play this alt season (if it comes). And these happen to be pretty much the entire universe of trading strategies at their core!

Buy current momentum.

Buy the dip.

Buy off the lows.

We explore these through our 3 chart setups below.

was a big winner in the recent risk-on move since the 90-day tariff pause.

was a big winner in the prior up-move in November following Trump’s election win.

was a standout gainer during the 2021 meme coin era thanks largely to Elon Musk.

Setups and signals

We look at hundreds of charts each week and present you with three of our favourite setups and signals.

Monero $XMR

The price has pulled back to a formerly significant price pivot at 300 after hitting a 4-year high over 400 in April. The price is well above its up-sloping 30-week moving average.

The daily chart shows a potential breakout from a base formed above 300 with RSI also confirming the bullish turn with a break over the 50 level.

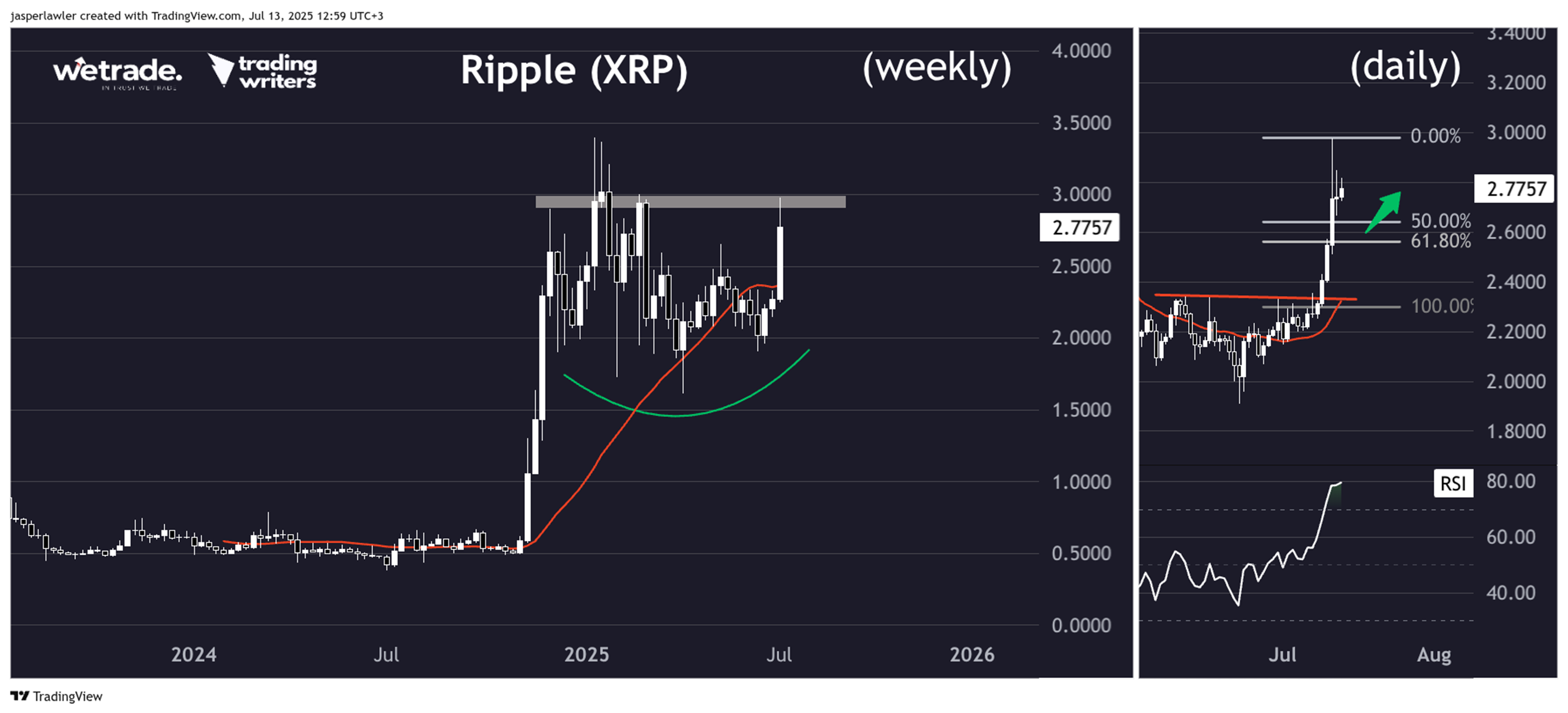

Ripple $XRP

The price has been consolidating since the explosive move from ~50c to $3 last year. There has been a wide $1 price range between $2 and $3. A failed breakdown below a still rising 30-week moving average and new 4-month high suggest underlying bullishness.

Should there be any follow-through to last week's big up-move, then any pullback to thebetween the 50% and 61.8% Fibonacci retracement levels could trigger a rebound.

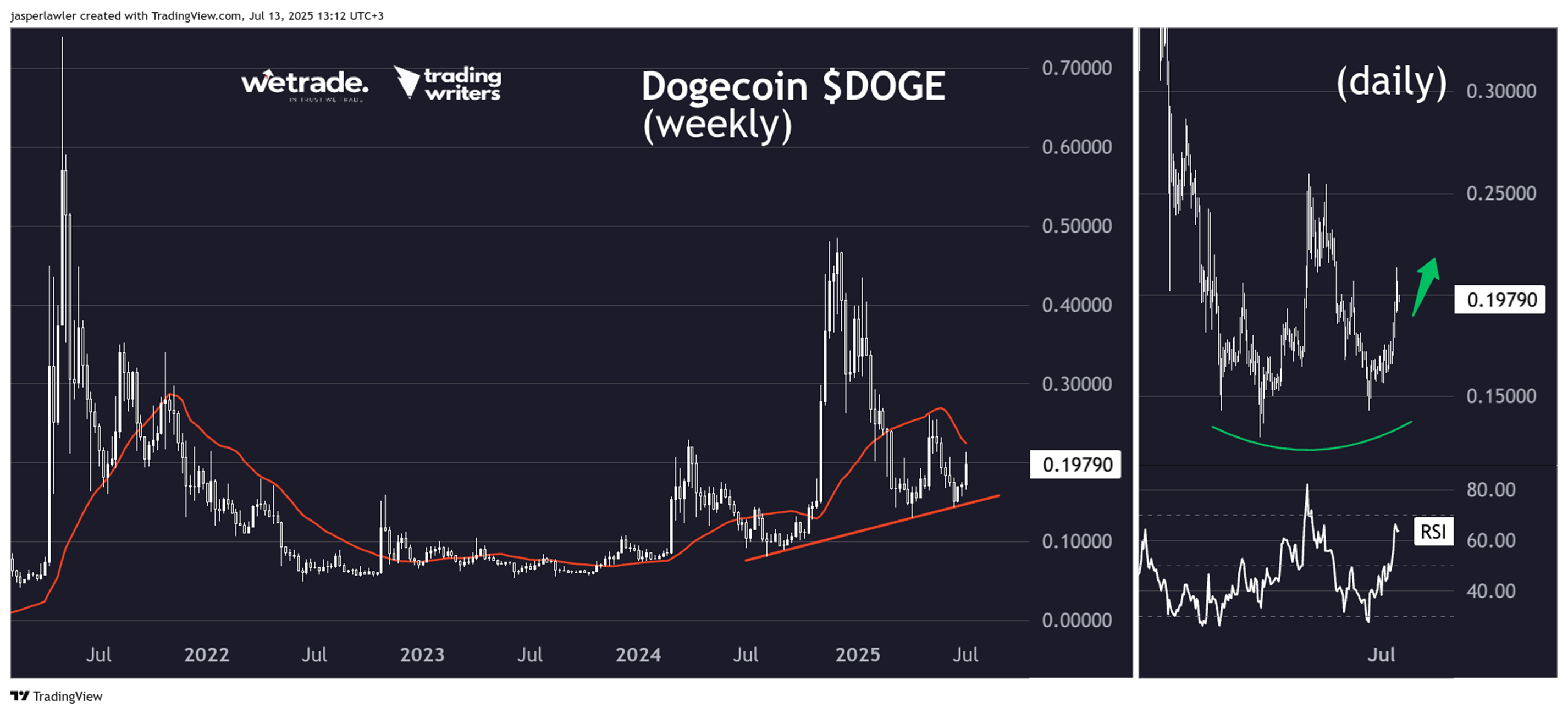

Dogecoin $DOGE

The price is still under its 30 week SMA following a long drawdown that erased 100% of its November 2024 surge. A break back over the 30-week MA and ideally a completed double bottom WOULD be needed to signal a bullish trend reversal.

There are signs of a breakout off a bullish base above 15c where 25c is the next major resistance.