Bitcoin’s Rally Isn’t Just Hype—It’s a Hedge Against US Deficit Chaos

Forget memecoins and celebrity tweets—Bitcoin's latest surge has roots in cold, hard fiscal reality. The US deficit is ballooning like a DeFi ponzi scheme, and smart money's fleeing to crypto's hard cap.

Digital gold for a dollar dumpster fire

While Wall Street analysts were busy downgrading Treasury bonds, BTC quietly ate their lunch. The OG cryptocurrency just notched its third straight green weekly candle as deficit hawks sound alarms.

Institutions vs. the printing press

BlackRock's ETF inflows tell the story: $12B last quarter alone. That's not retail FOMO—that's hedge funds realizing 31 trillion in debt might actually matter. Who needs yield curves when you've got 21 million coins?

Of course, the Fed will probably 'fix' this with more money printers. Good luck explaining negative real yields to your grandkids.

US’s $7 trillion deficit swing

US President Donald Trump’s “One Big Beautiful Bill Act” (OBBBA) was passed in July, raising the debt ceiling by $5 trillion, the largest single increase in US history.

Instead of the promised $2 trillion deficit reduction, the bill could add $2.3 trillion and $5 trillion to federal deficits over the next decade. This creates a potential $7 trillion swing from initial expectations, said Thielen.

With deficit spending showing no signs of slowing and monetary policy turning more accommodative through projected rate cuts, bitcoin is positioned as the “ultimate beneficiary” of this macro environment, he said.

This isn’t just another crypto rally, “it’s a direct response to a US fiscal landscape unraveling far quicker than expected,” he said.

“Alongside gold, Bitcoin is now positioned as the primary defense against a looming fiscal crisis — and that crisis is rapidly intensifying.”

Bitcoin price catalysts

The analyst identified other market catalysts with a number of upcoming events.

Key legislation will be reviewed in what has been dubbed “Crypto Week” in Washington D.C.

Lawmakers are expected to debate and potentially vote on three high-profile bills: the CLARITY Act, for regulatory oversight of crypto markets; the GENIUS Act, which creates a stablecoin framework; and the Anti-CBDC Surveillance State Act.

Trump’s Digital Asset Task Force will also release a crypto policy report, potentially including a Strategic Bitcoin Reserve proposal on July 22.

There is also a Federal Reserve meeting on July 30 where rate cuts are expected. However, CME futures markets still predict a 93% probability that rates will remain unchanged.

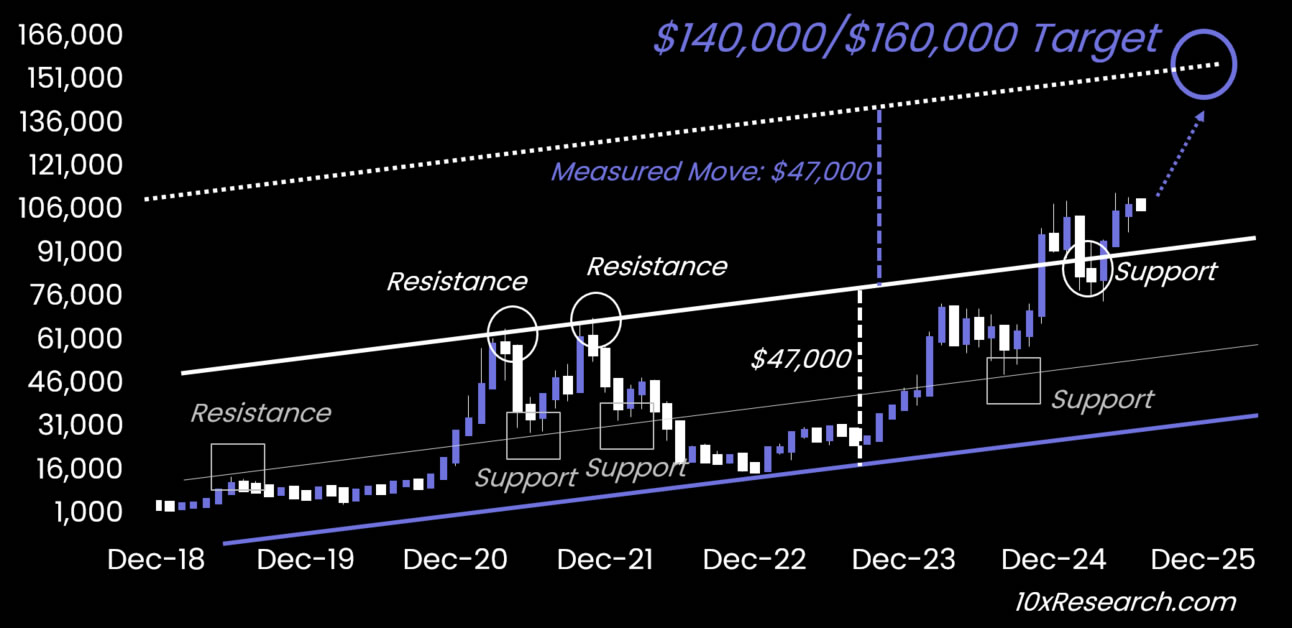

10x Research has targeted $140,000 to $160,000 BTC for 2025. Source: 10x Research

Analysts react to Bitcoin’s new all-time high

“As the US gears up for Crypto Week to discuss key legislation, crypto remains resilient despite stock market volatility from geopolitical tensions and tariff concerns,” Eugene Cheung, chief commercial officer of crypto platform OSL, told Cointelegraph.

He predicts that the asset has the potential to reach $130,000 to $150,000 by year-end.

“Bitcoin breaching $120,000 is more than a milestone, it is a marker of how deeply embedded digital assets have become in institutional portfolios,” added Rachael Lucas, an analyst at Australian crypto exchange BTC Markets.

Meanwhile, LVRG research director Nick Ruck told Cointelegraph that “We expect altcoins to continue following Bitcoin's trend as traders diversify their portfolios and take on more risk.”