🚀 Bitcoin’s On-Chain Boom: 3 Bullish Signals That Could Propel BTC Past Its New ATH

Bitcoin just smashed through its all-time high—again. But the rally might be far from over. Here's what the on-chain data reveals.

1. Whale Accumulation Goes Parabolic

Big money isn't just dipping toes—it's diving headfirst. Addresses holding 1,000+ BTC hit a 12-month peak this week.

2. Miner Capitulation? Not This Time

Unlike previous cycles, miners are HODLing through price surges. Their outflows just hit a 3-year low—a classic bullish divergence.

3. The 'Diamond Hands' Metric Flashes Green

Long-term holder supply hasn't budged since the breakout. Retail FOMO hasn't even started yet (though your Uber driver will probably start giving crypto tips soon).

Will this finally be the cycle where Wall Street bankers admit they were wrong about Bitcoin? Don't hold your breath—those guys still think the earth is flat when it comes to decentralized finance.

1. Bitcoin selling pressure remains subdued

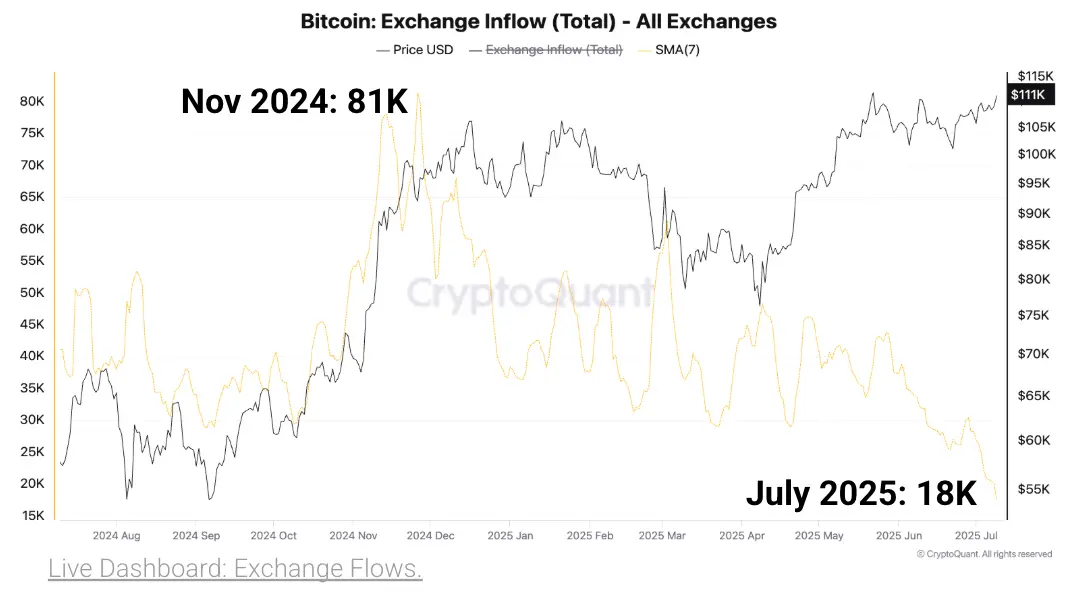

Bitcoin is trading in peculiar conditions, with selling pressure remaining significantly subdued despite the price rallying to a new all-time high on Thursday. According to CryptoQuant, the total daily bitcoin exchange inflow has fallen to 18,000 BTC, the lowest level since April 2015.

A persistent drop in the Bitcoin Exchange Inflow metric, as seen in the chart below, indicates fading sell-side pressure from fresh capital flows. Inflows to exchanges surged, exceeding 81,000 BTC on November 26, when bitcoin price first broke above the $100,000 mark.

Bitcoin Exchange Inflow metric | Source| CryptoQuant

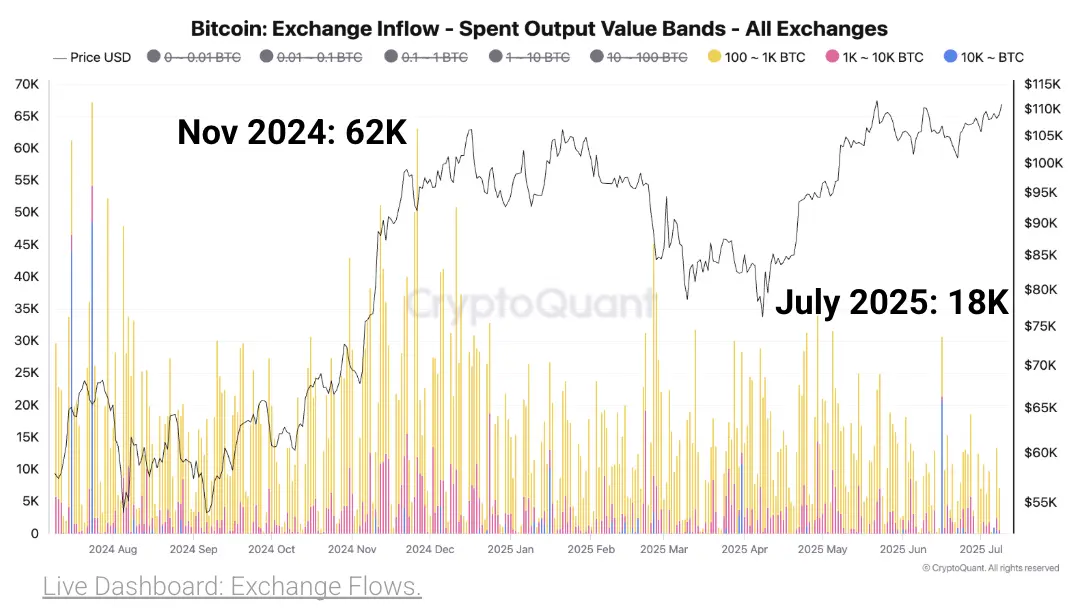

2. Bitcoin whales send fewer coins to exchanges

The amount of Bitcoin sent to exchanges by the cohort of investors with 100 or more BTC is down from 62,000, as of November 26, to only 7,000 BTC observed on Thursday, per the CryptoQuant chart below. Notably, the fewer BTC coins flowing into exchanges from large-volume holders indicate declining selling pressure.

Bitcoin Exchange Inflow metric | Source: CryptoQuant

3. Steady institutional interest could keep Bitcoin price elevated

Bitcoin spot Exchange Traded Funds (ETFs) have become an important gauge for institutional interest. All 12 spot ETFs licensed in the US amassed a combined $770 million in inflow volume last week, according to SoSoValue.

The uptrend is on track, with approximately $515 million coming in this week, as seen in the chart below. Meanwhile, the cumulative total net inflow volume has crossed the $50 billion mark, with net assets averaging $139.4 billion.

Bitcoin spot ETF data | SoSoValue

Factors could accelerate Bitcoin's price rally toward $120,000, as predicted by Bitget's Research Chief Analyst, Ryan Lee. Traders should consider monitoring institutional interest and exchange flows to gauge market sentiment in upcoming weeks, with further price increases likely to boost risk-on sentiment.

Technical outlook: Bitcoin enters fresh price discovery phase

Bitcoin is trading above $113,400 at the time of writing as bulls tighten their grip, backed by rising risk appetite. The path of least resistance appears upward, underpinned by a buy signal from the Moving Average Convergence Divergence (MACD) indicator. If the blue MACD line holds above the red signal line, traders could prefer to seek exposure, expecting an extended price discovery toward the $115,000 and $120,000 thresholds.

BTC/USDT daily chart

Still, market participants should tread cautiously, aware that macroeconomic uncertainty due to tariff developments in the US could trigger fresh volatility and dampen the uptrend. Other factors that could hinder the rally include potential profit-taking and the need to collect more liquidity to fuel the next leg up.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.