Bitcoin Holds Strong at $108K as Trump’s Tariff Chaos Fuels Market Jitters

BTC defies political turbulence—again.

While traditional markets reel from fresh trade war threats, Bitcoin's price floor proves shockingly resilient at $108,000. The orange coin's latest stability act comes as Trump-era protectionism makes a violent comeback, sending risk assets into a tailspin.

Digital gold narrative intensifies

No mainstream analyst predicted this level of institutional indifference to geopolitical fireworks. Yet here we are—BTC weathering the storm while gold bugs and forex traders scramble for cover. The 'uncorrelated asset' thesis just got a $108K stress test.

Wall Street's loss is crypto's gain

As tariff headlines dominate CNBC, Bitcoin's quiet consolidation suggests what crypto natives always knew: when the old financial system starts eating itself, money flows where the rules can't change overnight. (Take notes, Jamie Dimon.)

The kicker? This could just be the calm before the halving frenzy—because nothing says 'store of value' like an asset that moonwalks past economic chaos while bankers recalculate their Excel models.

Bitcoin shows resilience to Trump’s tariff uncertainty

Bitcoin price holds steady at around $108,000 during the European trading session on Tuesday, following a slight dip the previous day. BTC shows some signs of resilience despite the trade uncertainty caused by US President Donald Trump's announcement on Monday.

The Kobeissi Letter reported that Trump sent out more “tariff letters” with the following tariff rates announced on Monday, outlining higher trade tariffs against a slew of Asian and African countries. Trump also threatened that any country aligning with the anti-American policies of BRICS WOULD be charged an additional 10% tariff, and there would be no exceptions to this policy.

These tariffs are scheduled to take effect on August 1.

This news sparked a fresh wave of global risk aversion, causing risky assets, such as BTC, to dip below $109,000 on Monday.

“In the absence of any relevant market-moving economic data from the US on Tuesday, the market focus will remain glued to the release of FOMC meeting minutes on Wednesday,” reports Haresh Menghani, an analyst at FXStreet.

Investors will look for more cues about the Fed's rate-cut path, which, in turn, will drive the USD demand in the near term and provide a fresh directional impetus to the largest cryptocurrency by market capitalization.

Nasdaq-listed hotel chain Murano joins Bitcoin treasury race

Murano Global Investments PLC, a Nasdaq-listed real estate firm with a focus on hotels and resorts, announced on Monday that it will enhance its corporate strategy to establish a Bitcoin Treasury.

As part of its BTC treasury initiative, Murano has recently purchased 21 BTC and joined the "Bitcoin for Corporations" alliance, backed by Michael Saylor's Strategy, to support and accelerate the corporate adoption of Bitcoin.

Moreover, the firm also entered into a Standby Equity Purchase Agreement (SEPA) with Yorkville, with a potential value of up to $500 million, to utilize proceeds from the sale of shares under the SEPA for general corporate purposes, primarily for investing in BTC.

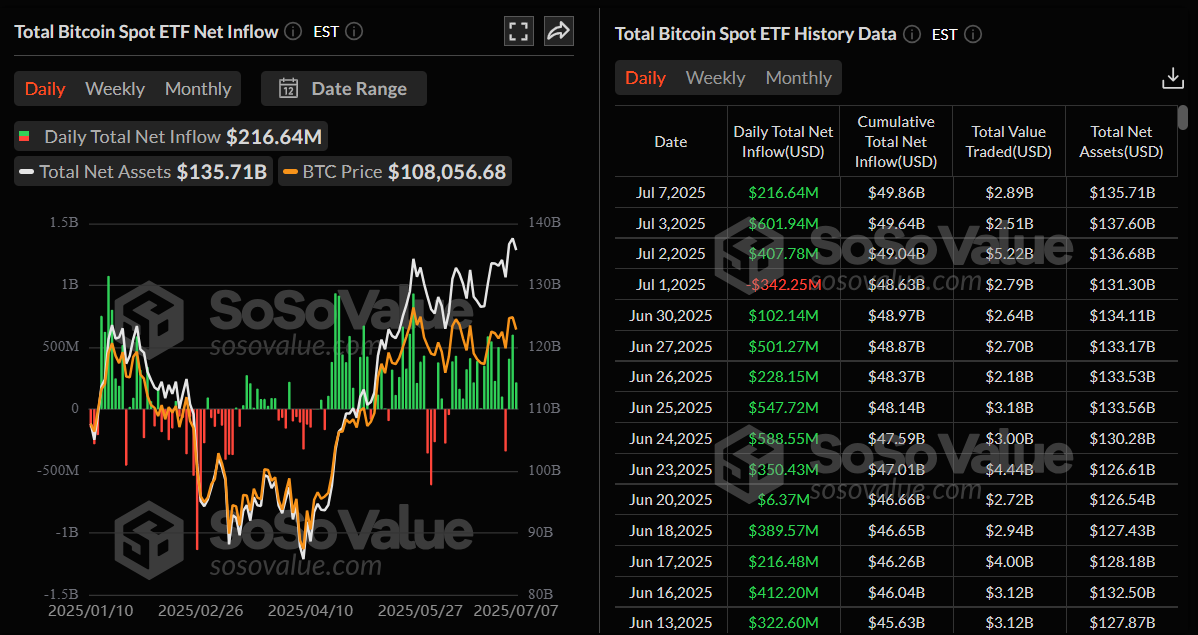

Apart from the demand from corporate companies, the institutional investors' demand for BTC also remains robust. SoSoValue data show that spot bitcoin ETFs recorded an inflow of $216.64 million on Monday, continuing its three-day streak of inflow since July 2. If the inflow continues and intensifies this week, BTC could reach or even surpass its all-time highs.

Total Bitcoin spot ETF net inflow daily chart. Source: SoSoValue

Some signs of concern

BBC reports on Tuesday highlights that Donald Trump has said that the US will resume sending weapons to Ukraine after an announcement last week that Washington would halt some shipments of critical arms to Kyiv.

During a meeting with Israeli Prime Minister Benjamin Netanyahu, Trump said he was "not happy" with Russian President Vladimir Putin and that Ukraine was "getting hit very hard."

Pentagon Chief spokesman Sean Parnell released a statement, saying that “at President Trump's direction, the Department of Defense is sending additional defensive weapons to Ukraine to ensure the Ukrainians can defend themselves while we work to secure a lasting peace and ensure the killing stops.”

This announcement signals that the war in Ukraine is intensifying and not de-escalating. Any further escalation of these rising war tensions and geopolitical uncertainties could drive investors toward safe-haven assets, such as Gold (XAU), which brings a risk-off sentiment to the market, not boding well for the prices of risky assets like Bitcoin.

Bitcoin Price Forecast: BTC holds strong around $108,000 support level

Bitcoin price has been consolidating around the upper boundary of a previously broken consolidation zone at $108,355 since Friday. On Monday, it dipped slightly at retested this support level. At the time of writing on Tuesday, it rebounded slightly, trading at around $108,800.

If the support level at $108,355 continues to hold, BTC could extend the rally toward the May 22 all-time high at $111,980.

The Relative Strength Index (RSI) on the daily chart reads 56, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) on the daily chart displayed a bullish crossover on June 26. It also displays green histogram bars above its neutral level, indicating bullish momentum and suggesting an upward trend.

BTC/USDT daily chart

However, if BTC faces a correction and closes below its support at $108,355, it could extend the decline to retest the lower boundary of the consolidation zone at $105,333, which roughly coincides with the 50-day Exponential Moving Average (EMA) at $105,276, making this a key support zone for BTC.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a VIRTUAL currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.