BlackRock’s Bitcoin ETF Outshines Its Flagship S&P 500 Fund—Crypto’s Wall Street Takeover Accelerates

Wall Street's crypto embrace hits a milestone: BlackRock's Bitcoin ETF now generates more revenue than its $300B S&P 500 counterpart. The ultimate 'sell the news' moment—except the news keeps getting better.

Mainstream money floods in

Institutional investors are voting with their wallets, funneling capital into Bitcoin exposure at a pace that's embarrassing traditional equity products. The ETF hauled in $1.2B last week alone—more than all commodity ETFs combined.

Regulatory irony alert

The same financial giants who dismissed crypto for years now profit most from its adoption. BlackRock's pivot from skeptic to market leader happened faster than a memecoin pump-and-dump cycle.

What's next? Watch for:

- More pension funds quietly adding BTC exposure

- SEC scrambling to justify its inconsistent crypto policies

- Jamie Dimon issuing another warning while JPM's blockchain division triples headcount

The takeaway: When the world's largest asset manager makes more money on crypto than index funds, the 'digital gold' narrative stops being speculative—it's just math. Now if only they'd stop charging 0.8% for the privilege.

Bitcoin has now captured Wall Street’s "undivided attention"

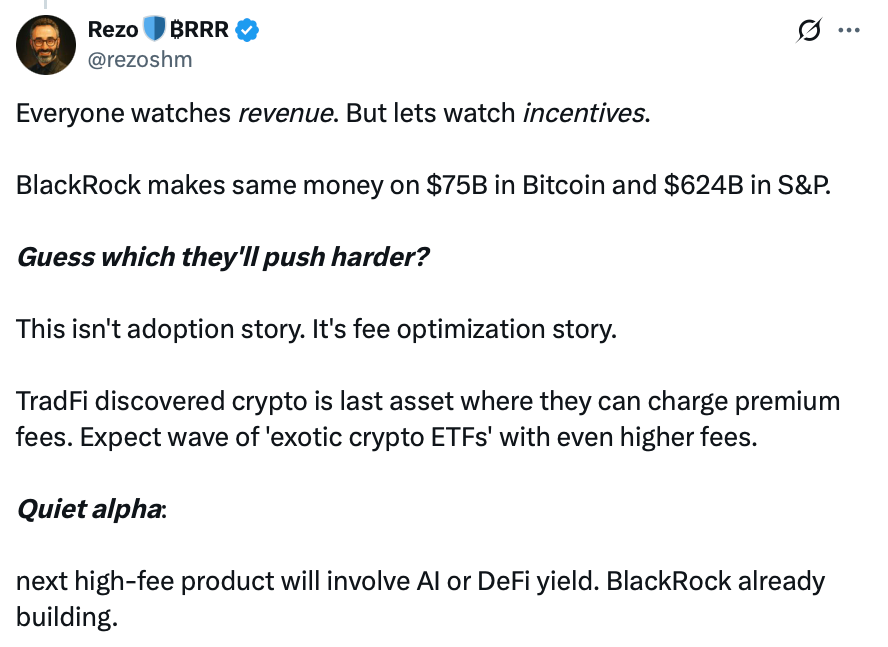

With an expense ratio of 0.25% and around $75 billion in assets under management (AUM), BlackRock’s iShares Bitcoin (BTC $109,373) ETF (IBIT) has generated $187.2 million in annual fees, approximately $100,000 more than its iShares Core S&P 500 ETF (IVV).

The IVV, which launched in 2000, is over eight times larger than the IBIT, with approximately $624 billion in assets, but charges almost nine times less, at just 0.03%.

Several crypto executives were quick to comment on the findings. Crypto entrepreneur Anthony Pompliano said in an X post, “Bitcoin has Wall Street’s full, undivided attention now.” Strive Funds chief financial officer Ben Pham said Bitcoin will be “the death” of active management and passive indexation portfolios.

Source: Rezo

Crypto trader Cade O’Neill said it “says everything about where capital is headed. Institutions aren’t just curious anymore, they’re committed.”

Meanwhile, McKay Research founder James McKay said the news was bullish and “Probably something.”

Since its January 2024 launch, BlackRock’s IBIT has recorded $52.4 billion in inflows, the highest of any US spot Bitcoin ETF, according to Farside data.

Bitcoin is up 2.37% over the past 30 days. Source: CoinMarketCap

The IBIT closed the trading day on Wednesday at $62.41, up 4.31% across the day, according to Google Finance data. The uptick comes as Bitcoin’s price spiked 2.82% over the same period, which is now trading at $108,660.

Meanwhile, the IVV closed the day at $623.42, up 0.44% over the day.

US-based spot Bitcoin ETFs marked their first net outflow day on Wednesday after 15 consecutive trading days of inflows.