OpenAI Drops Truth Bomb: Robinhood’s Tokenized Stocks Aren’t Real Equity

Robinhood's latest crypto gambit just got a reality check—straight from OpenAI's playbook.

Synthetic shares, real confusion

The trading app's tokenized stock offerings—touted as democratizing finance—got slapped with a brutal clarification: these digital proxies don't confer actual equity rights. No voting, no dividends, just blockchain-flavored IOUs.

Regulatory roulette

While retail traders chase fractional Tesla tokens, regulators are circling. The SEC's been suspicious of crypto securities since day one—and now AI watchdogs are joining the fray. 'Innovation' meets 'investor protection' in what's becoming Wall Street's favorite cage match.

The fine print always wins

Turns out, when something sounds too good to be true (looking at you, 'free trading' pioneers), it usually is. Another reminder that in finance, if you're not paying for the product—you might just be the product. With extra steps.

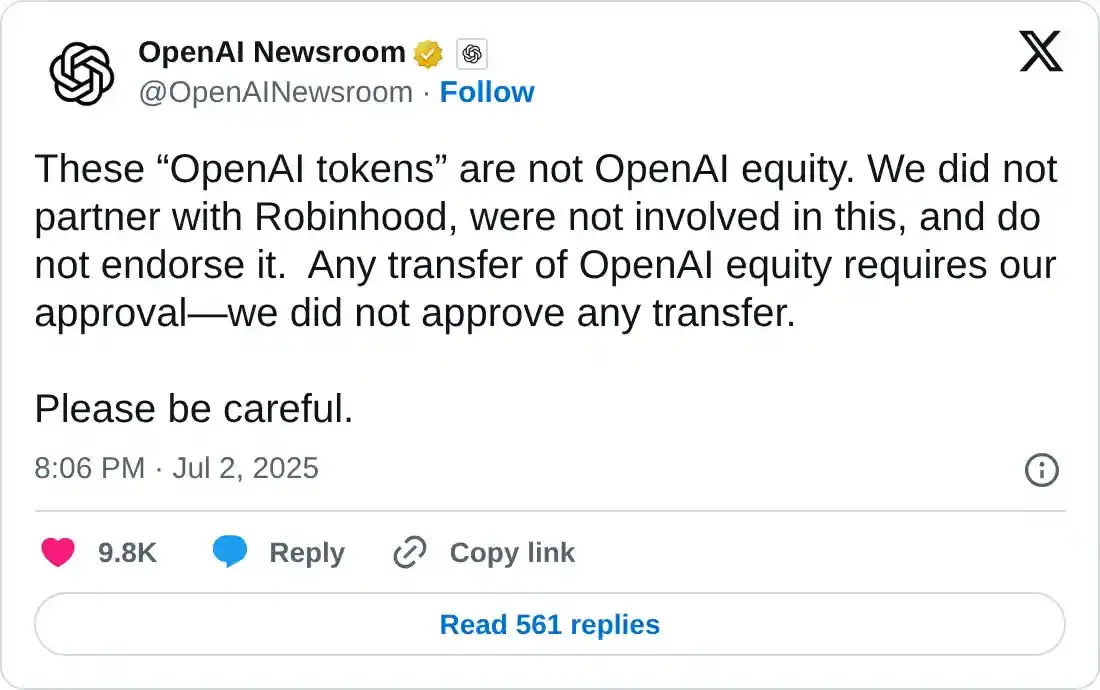

OpenAI warns on Robinhood tokenized equity offering

OpenAI, the parent company of ChatGPT, warns users against the tokenized stocks of its company, which were recently launched on Robinhood. The statement clarifies that no official partnership exists between the two companies, and OpenAI denies any official approval for the transfer of equity.

OpenAI does not endorse the tokenized equity and advises users to exercise caution.

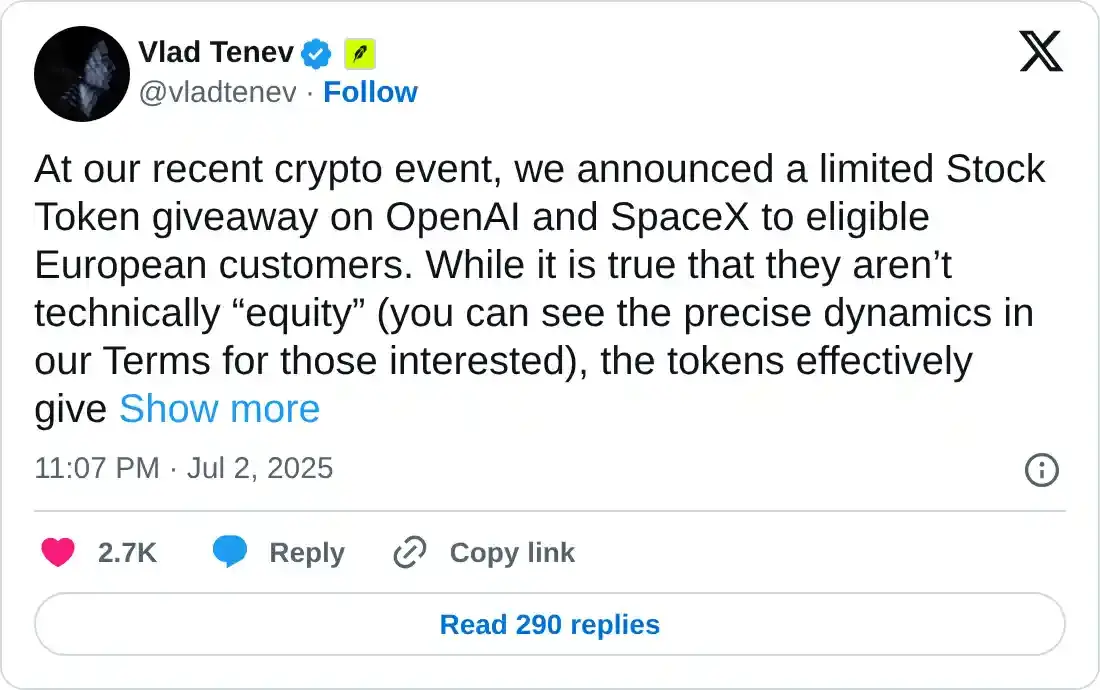

Robinhood announced the launch of tokenized equity for privately held shares of OpenAI and SpaceX to its European Union users. In an X post on Thursday, Robinhood provided exposure to private markets through its ownership stake in a Special Purpose Vehicle (SPV).

SPV is a legal entity, created by Robinhood in this case, as a common practice to isolate financial risk. Typically, in startups, SPVs provide exposure to retail investors, allowing them to pool capital.

Vlad Tenev, the CEO of Robinhood, clarified that the stock token giveaways are not technically equity, while they do provide retail investors with exposure to private assets.

Elon Musk remains nonchalant on SpaceX tokenized equity

Elon Musk, the founder and CEO of Tesla and SpaceX, maintains a calm demeanor as Robinhood offers tokenized equity in SpaceX and OpenAI. In a reply to the official X post, Musk commented, “Your ‘equity’ is fake.”

Equity in a company represents part ownership of it. However, to realize gains on it, investors WOULD either sell it once it is listed on a stock exchange or acquire debt against it through banks.

Elon holds 54% of SpaceX shares, making him the largest shareholder and providing him with direct financial benefits from the company’s growth. The tokenized offering in EU markets opens up a gate for Elon to dilute shares, if needed, without making SpaceX public.