BREAKING: XRP, SOL, LTC Spot ETF Approval Now 95% Likely as SEC Nears GDLC Fund Decision

The crypto market braces for a seismic shift as odds for spot ETF approvals on XRP, Solana, and Litecoin skyrocket to 95%.

Wall Street's about to get a crash course in blockchain—whether they like it or not.

With the SEC's GDLC verdict looming, traders are placing bets on which altcoin ETF gets the green light first. Spoiler: it's not Bitcoin this time.

Another day, another regulatory hurdle—but this time, the crypto crowd might actually win.

XRP, SOL and LTC approval odds jump 95%, says Bloomberg analyst

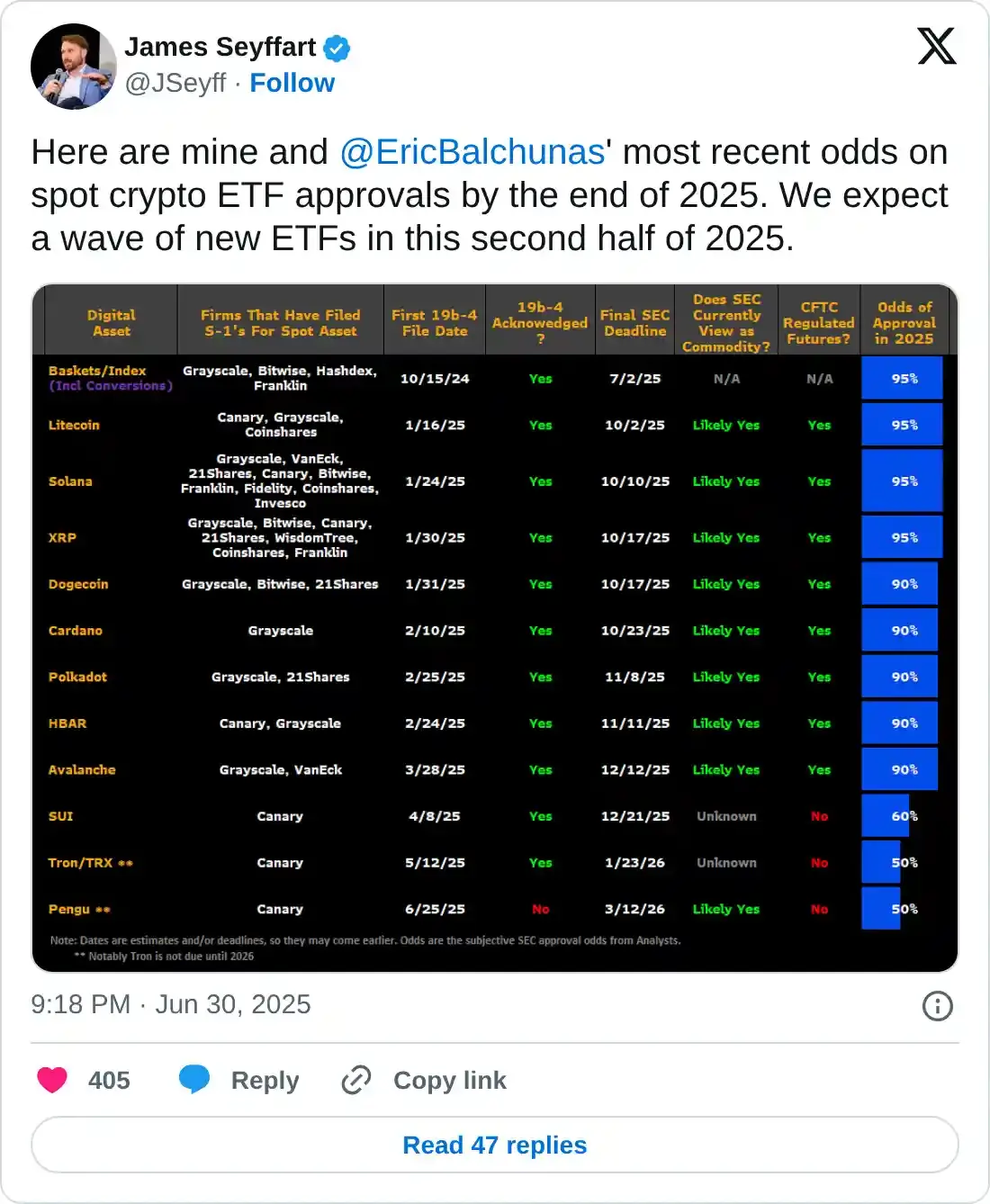

Bloomberg analyst James Seyffart posted on his X account on Tuesday that the odds of spot crypto ETF approvals by the end of 2025 have surged. XRP, SOL and LTC take the lead by 95%, while Dogecoin (DOGE), Cardano (ADA), Polkadot (DOT), Hedera (HBAR) and Avalanche (AVAX) chances stand at 90%.

This bullish narrative comes ahead of the US SEC, which is preparing to rule on Grayscale’s proposal to convert its Digital Large Cap Fund (GDLC) into a spot ETF later this week.

On Monday, Grayscale’s revised S-3 filing to convert GDLC into a spot ETF was acknowledged by the US SEC, and the clear ruling WOULD come later this week.

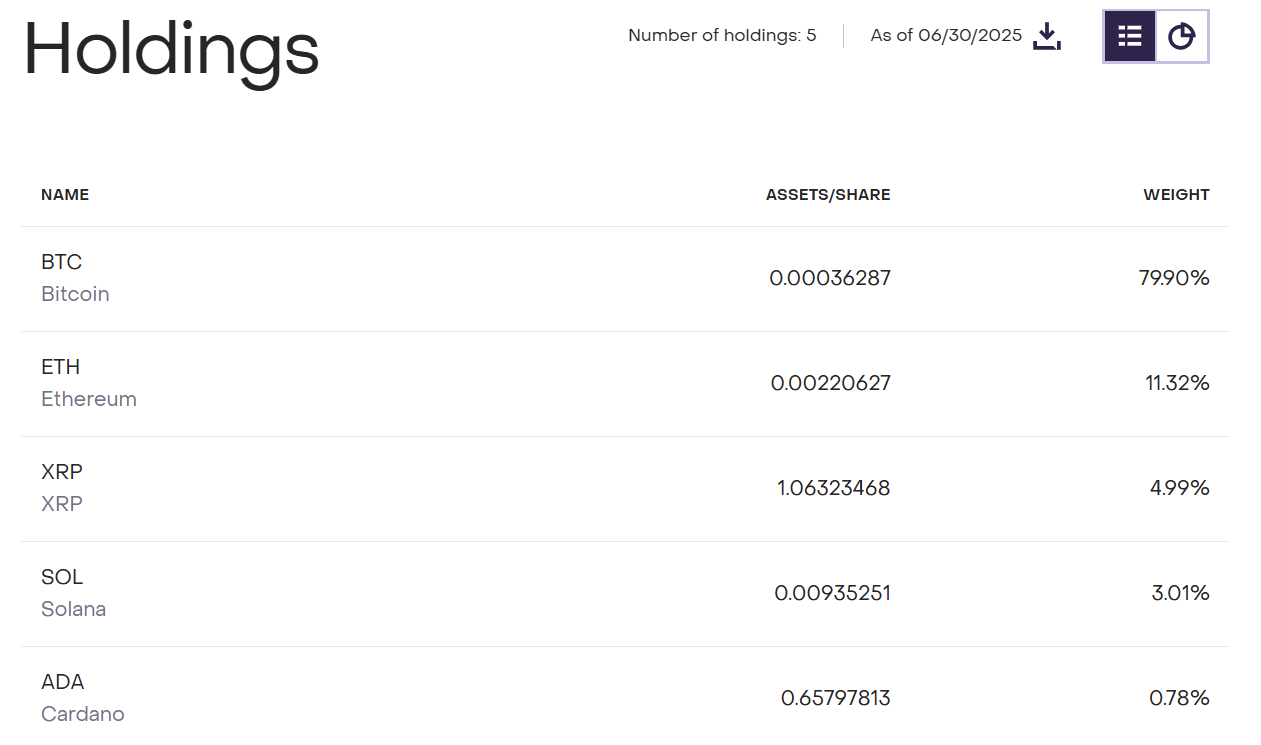

The Grayscale’s GDLC fund, as shown in the chart below, holds a mix of five major cryptocurrencies, including Bitcoin (79.90%), ethereum (11.32%), Ripple (4.99%), Solana (3.01%), and Cardano (0.78%). Moreover, on Monday, the fund had nearly $774 million in assets under management.

Nate Geraci, ETF Store President, says there is a “high likelihood” of the GDLC fund being approved this week.

Geraci continued that “would then be followed later by approval for individual spot ETFs on XRP, SOL, ADA, etc."

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Yes. The SEC approved in January 2024 the listing and trading of several bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

Which are the pros and cons of crypto ETFs?

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.