$484 Million Token Tsunami Hits Market: SUI, ENA, OP, SOL, AVAX, and DOGE Unlocks Shake Crypto This Week

Crypto markets brace for impact as six major projects unleash nearly half a billion in tokens—just when you thought volatility couldn't get wilder.

SUI, ENA, OP, SOL, AVAX and DOGE all hit their scheduled unlock periods this week, flooding the market with fresh supply. Traders are scrambling to position themselves before the liquidity wave hits.

The $484 million unlock event comes as the market shows signs of fatigue after last month's rally. 'Perfect timing,' quipped one sardonic trader. 'Nothing boosts prices like a sudden supply glut.'

Watch for price action around these assets as unlocked tokens hit exchanges. History shows these events often create short-term pressure—and opportunistic entry points for bulls who believe in the projects long-term.

Memo to traders: The market giveth, and the unlock schedule taketh away.

Token unlocks could bring volatility in SUI, ENA, OP, and others

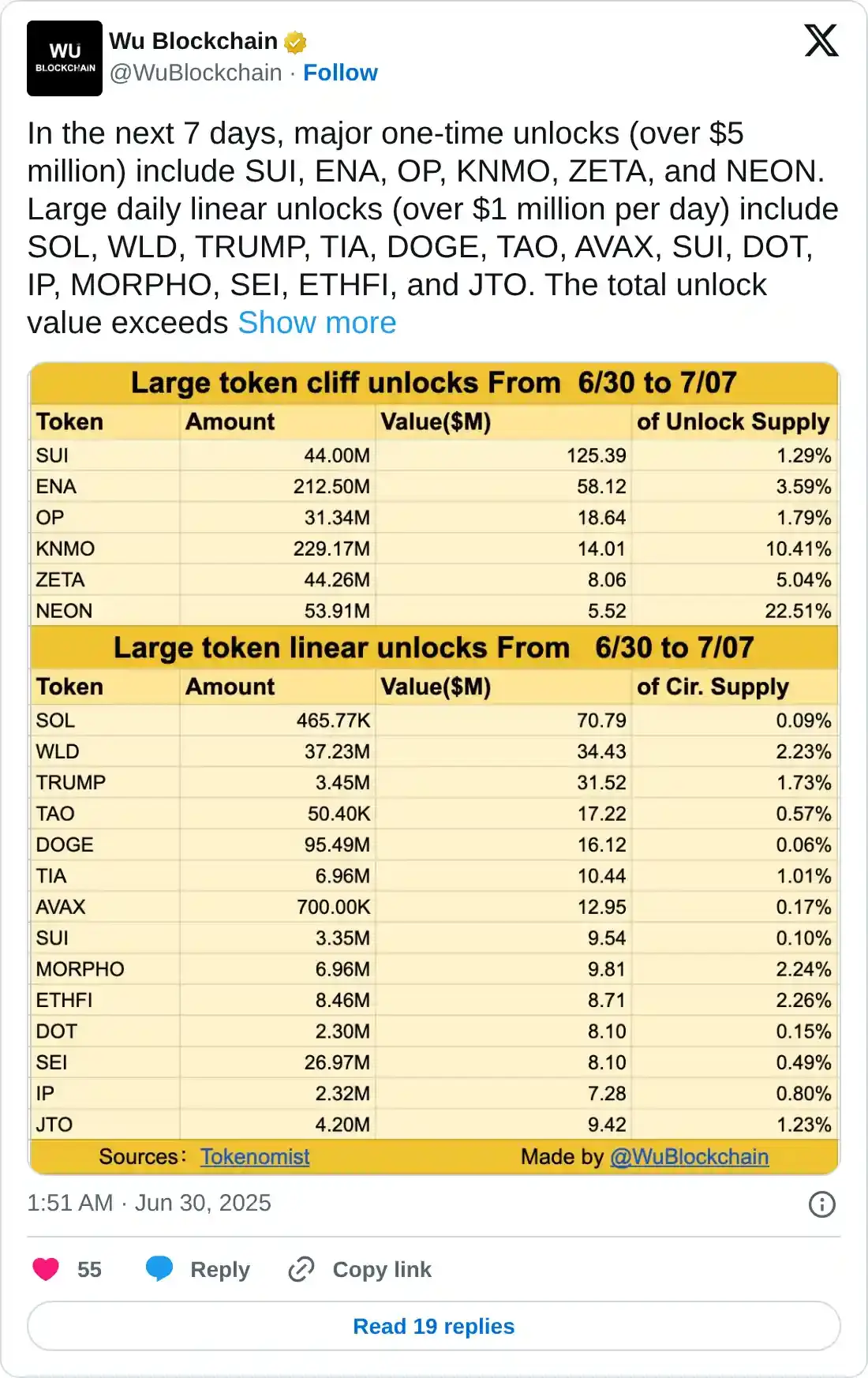

Wu Blockchain reports that six altcoins with one-time token unlock (cliff unlocks) are worth more than $5 million each over the next seven days. The cliff unlock allows a certain number of tokens to be unlocked immediately after a specific vesting period.

The list includes Sui (SUI), Ethena (ENA), Optimism (OP), Kamino (KNMO), ZetaChain (ZETA) and Neon (NEON). Neon and Kamino are unlocking tokens more than 10% of their circulating supply, while Sui, Optimism, ZetaChain and Ethena are unlocking tokens more than 1%.

Typically, when a token unlocks accounts for over 1% of the cryptocurrency’s circulating supply, it will likely have a negative impact on the price. Therefore, traders should monitor these six assets for increased volatility this week, specifically Neon and Kamino, as they unlock more than 10%.

Moreover, the large token linear (daily unlock amounts to over $1 million) unlocks this week include Solana (SOL), Worldcoin (WLD), OFFICIAL TRUMP (TRUMP), Bittensor (TAO), Dogecoin (DOGE), Celestia (TIA), Avalanche (AVAX), Sui (SUI), Morpho (MORPHO), Ether.fi(ETHFI), Polkadot (DOT), Sei (SEI), Story (IP), and Jito (JTO).

While an increase in a cryptocurrency’s circulating supply is typically bearish, planned unlock schedules may have a less significant impact as the trading community anticipates the unlock and likely positions itself accordingly.

However, traders should remain cautious as the increased supply from token unlocks frequently generates negative sentiment among investors, which can weigh down prices.