Crypto Rollercoaster: Bitcoin & Ethereum Stage Comeback While XRP Stumbles in Chaotic Derivatives Arena

Crypto markets flex their volatility muscles again as majors rebound—but not everyone's invited to the party.

BTC & ETH: Damage control mode

The big guns trim losses after yesterday's bloodbath, proving even crypto blue chips aren't immune to derivatives market tremors.

XRP: The odd token out

Ripple's favorite child keeps tripping over regulatory PTSD while traders treat it like a hot potato—some things never change.

Derivatives domino effect

Leverage liquidations spark more price swings than a Wall Street intern reading their first whitepaper. Meanwhile, 'stablecoins' prove they're anything but.

Markets claw back ground—for now. But with crypto, the only certainty is another 20% move before lunch.

Market overview: Bitcoin derivatives face elevated risk

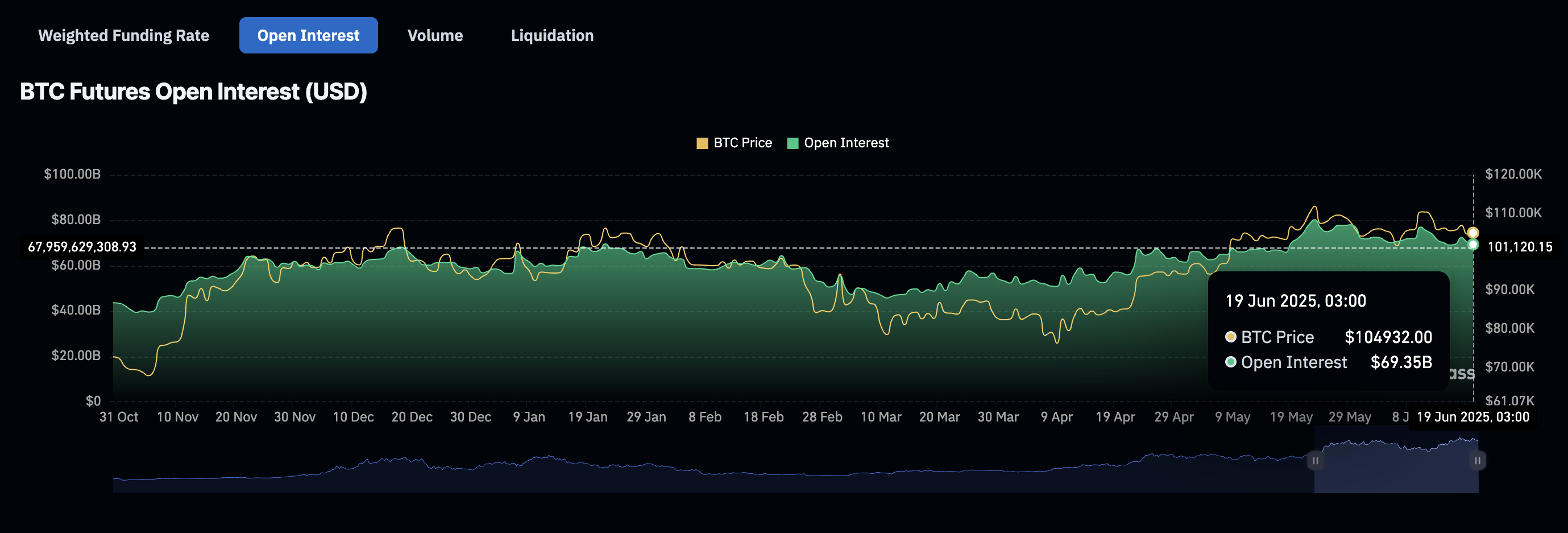

The Bitcoin futures contracts' Open Interest (OI) has maintained an overall downtrend after peaking at $80 billion on May 23, shortly after reaching all-time highs of $111,980. CoinGlass shows the OI, which represents the value of all active futures and options contracts that have yet to be closed or settled, standing at $69 billion on Thursday.

A persistent downtrend in OI indicates a lack of conviction among traders and reduced trading activity. This has the potential to mitigate price increases, especially with liquidations remaining relatively high.

Bitcoin futures OI | Source: CoinGlass

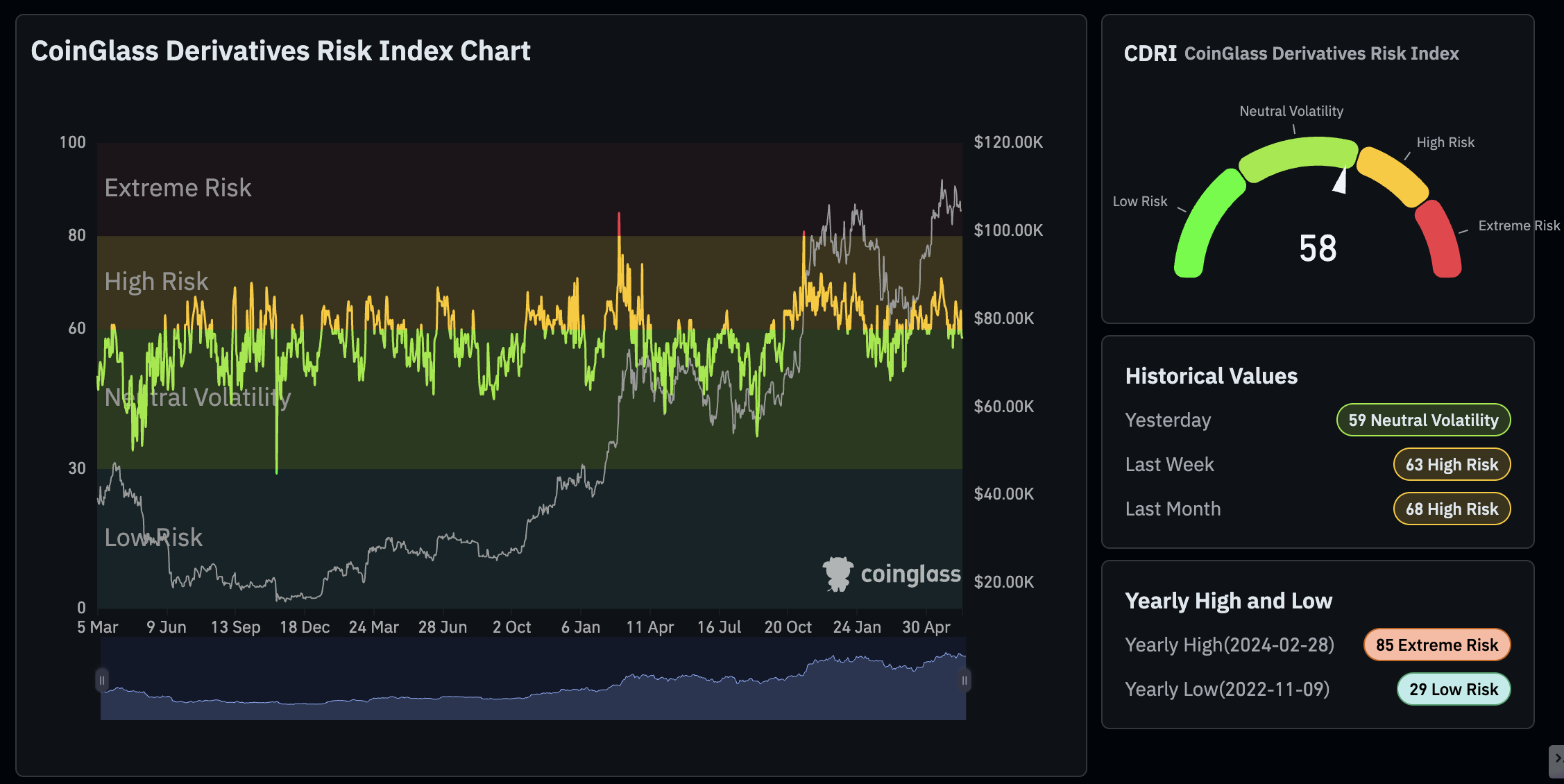

The newly launched CoinGlass Derivatives Risk Index (CDRI) indicator, which measures the intensity of the crypto derivatives market using OI, funding rates, volatility and liquidation volume, shows that the derivatives market is entering an unstable zone. In other words, both long and short positions are facing elevated risk.

CoinGlass Derivatives Risk Index chart | Source: CoinGlass

Data spotlight: Bitcoin and Ethereum ETFs uphold inflows

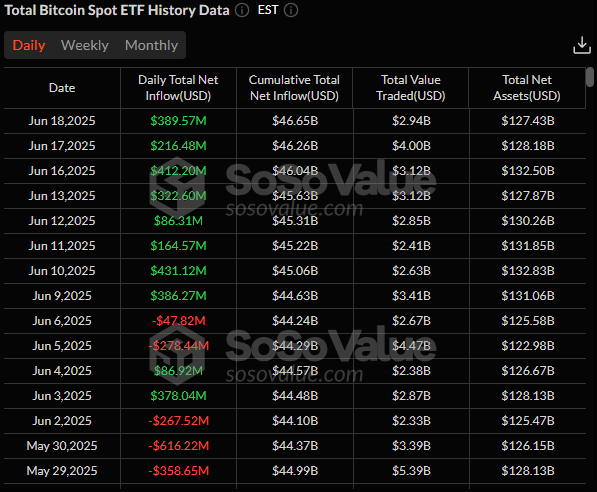

Bitcoin spot ETFs attracted daily net inflows of $390 million on Wednesday, signaling interest in the asset as a store of value and a hedge against global market uncertainty amid tensions in the Middle East. BlackRock's IBIT led with a $279 million inflow, followed by Fidelity's FBTC with $104 million. Grayscale's GBTC was the only product in the red with outflows of $16 million.

Bitcoin spot ETF stats | Source: SoSoValue

Ethereum spot ETFs experienced their third consecutive day of steady inflows, with $19 million streaming in on Wednesday, compared to $11 million on Tuesday. BlackRock's ETHA led with $15 million in inflow volume, followed by Grayscale's ETHE with $4 million in inflow volume.

Ethereum spot ETF stats | Source: SoSoValue

Chart of the day: Bitcoin holds support

Bitcoin's price remains above a key support level, provided by the 50-day Exponential Moving Average (EMA), at approximately $103,146. Attempts to push to lower areas have left traders liquidated, with CoinGlass data showing $16 million wiped out on Thursday.

The Relative Strength Index (RSI) at 48 offers signs of a potential reversal above the 50 midline as bullish momentum builds.

Key areas of interest are the resistance at $107,000, which capped the BTC price in January and acted as resistance in May as well as $110,000, a psychological round number. On the contrary, beyond the 50-day EMA support, levels traders may want to monitor include the 100-day EMA at $98,991 and the 200-day EMA at $93,301.

BTC/USDT daily chart

Altcoins technical update: Consolidation takes center stage

Ethereum's price holds close to support provided by the 200-day EMA, currently at around $2,476 at the time of writing. Despite the widespread concerns about the conflict in the Middle East between Israel and Iran, recovery signs are still strong, with the RSI returning above the midline.

The path of least resistance could remain upward if the RSI sustains the uptrend. Key levels to watch out for include the recent range resistance at $2,876 and the coveted $3,000 round number. On the other hand, tentative support levels relevant to intraday traders are the 200-day EMA at $2,476, the 50-day EMA at $2,439 and the 100-day EMA at $2,372.

ETH/USDT & XRP/USDT daily charts

Meanwhile, XRP's price action remains limited below the confluence resistance established by the 50-day EMA and the 100-day EMA at around $2.24, as well as support highlighted by the 200-day EMA at $2.09.

The Moving Average Convergence Divergence (MACD) indicator's sell signal sustained from Friday suggests a prolonged downtrend if traders reduce their exposure to XRP. Movement on either side of the confluence resistance and the support at $2.09 WOULD determine the direction the price of XRP could take in upcoming sessions.

The lethargic performance exhibited by XRP suggests a lack of interest and conviction in the uptrend despite the Canadian securities regulator's approval of spot ETF products. Investors in the region now have access to 3iQ, Purpose and Evolve spot ETFs.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.