Pi Network Price Alert: 3 Red Flags That Could Send It Crashing Below $0.50

Pi Network's 'mine-from-phone' hype meets crypto's cold reality—here's why the bottom could fall out.

1. Mainnet limbo = investor exodus

Two years after open mainnet promises, Pi still trades like a speculative IOU. No major exchanges listing? That's not decentralization—that's obscurity.

2. Tokenomics that make meme coins look stable

With 80% of supply locked until... whenever, Pi's circulating coins play musical chairs. Guess what happens when the music stops?

3. The 'next Bitcoin' narrative unravels

While BTC ETFs hit all-time highs, Pi struggles to hold $1. Retail miners are realizing—you can't eat 'community.'

Bonus finance jab: At least Celsius customers got a bankruptcy claim. Pi holders? They've got... a mining app draining their battery.

Reasons for the PI token to drop under $0.50

As the PI token has declined by more than 10% so far this week, the technical outlook, alongside a glance at the increasing outflows from the Pi Core team and the surge in supply seen in Centralized Exchanges (CEX) wallets, warns of a potential supply wave on the horizon.

Reason 1: Declining Pi core team’s holding

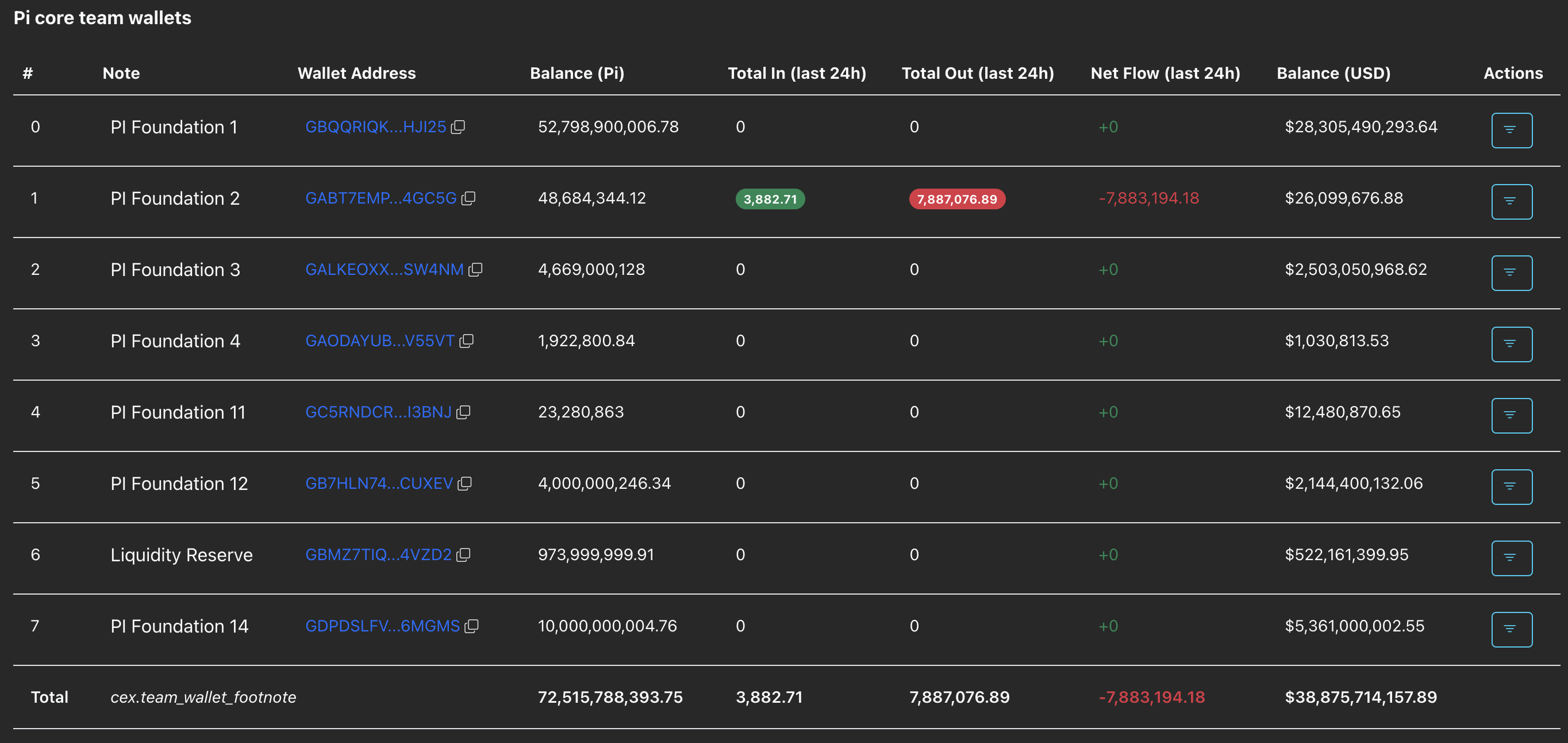

PiScan data shows a net outflow of -7,883,194.18 PI tokens from the Pi Foundation 2 wallet in the last 24 hours. As Pi Foundation wallets offload holdings, the increased supply dump dilutes the market demand, resulting in lower prices.

Pi CORE team wallets. Source: PiScan.

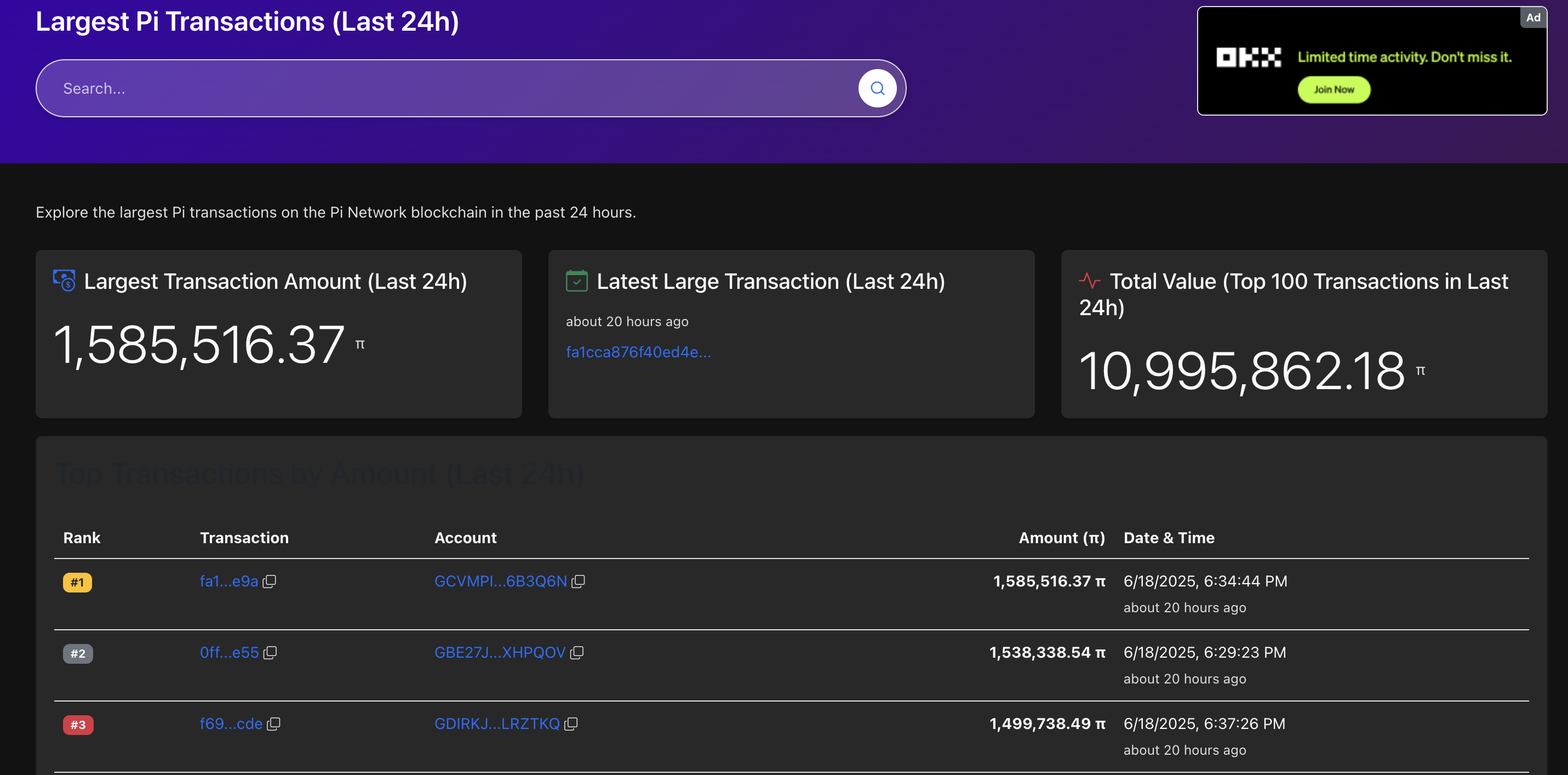

Additionally, the three largest Pi transactions in the past 24 hours are from addresses that received initial funding from the Pi Foundation 4 wallet. The wallets GCVMPI...6B3Q6N, GBE27J...XHPQOV and GDIRKJ...LRZTKQ each received 2,000,001 PI tokens over four years ago. The wallets transferred 1.58 million, 1.53 million and 1.43 million PI, respectively, in sync on Thursday, potentially indicating a strategic shift of funds or an over-the-counter deal. In either case, if the supply enters the spot market after four years, this WOULD signal a drop in confidence.

Largest Pi Transactions. Source: PiScan.

Reason 2: Inflating centralized exchanges' wallet balances

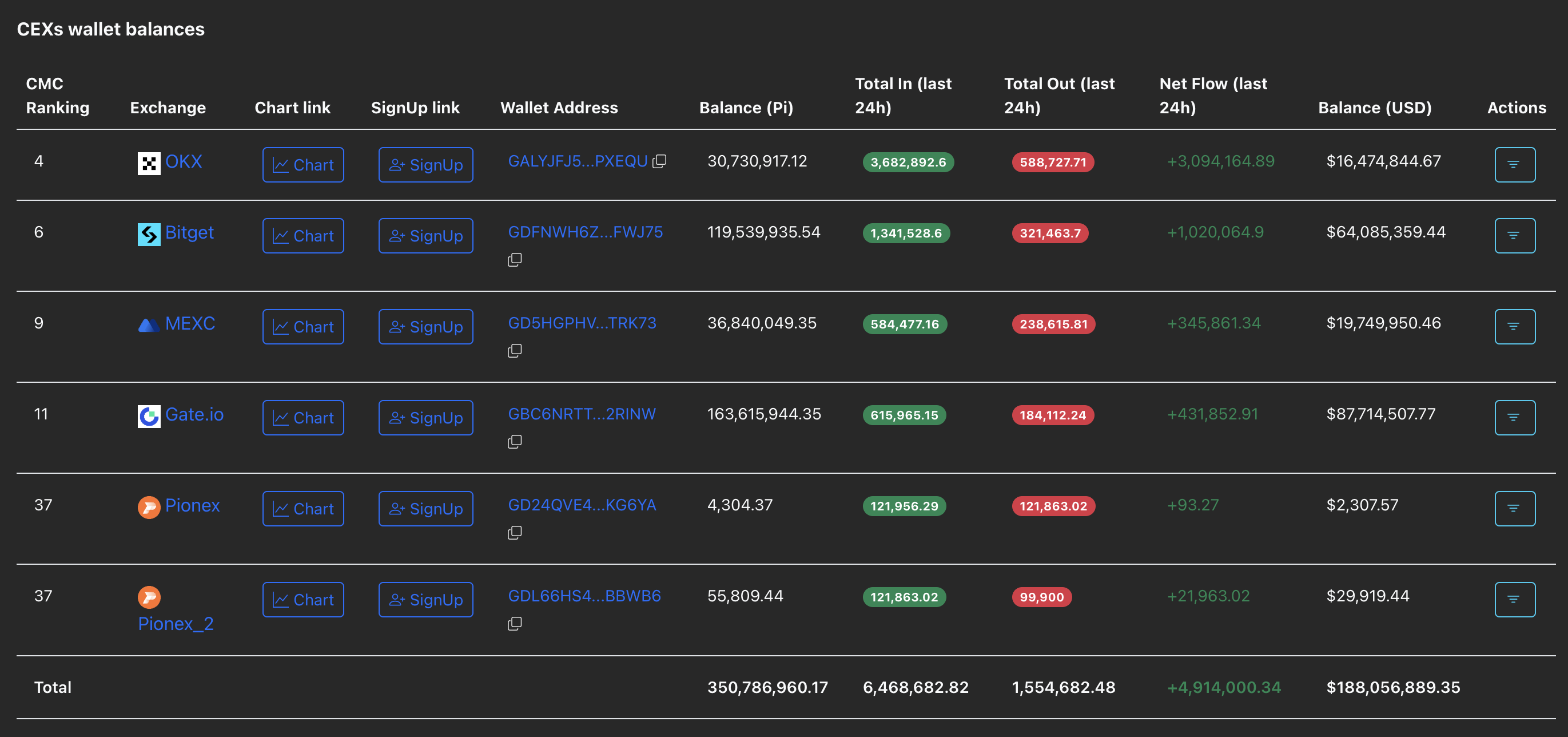

PiScan data shows a significant increase in wallet balances of CEXs, indicating a potential sell-off from investors, either retail or whales. The balance on the OKX exchange has surged by 3.09 million PI, while Bitget's balance has grown by 1.02 million PI in the last 24 hours.

MEXC and Gate.io witnessed a net FLOW of 345K and 431K PI, respectively, while Pionex wallets grew by over 22K PI. The data reveals a cumulative total net flow of 4.91 million PI across the five exchanges.

CEX wallet balances. Source: PiScan.

The increased supply of PI tokens on exchanges is potentially waiting to be dumped, which projects a risk of an impending crash.

Reason 3: Technical outlook projects bearish bias

Pi Network has been losing strength against the USDT in June, accounting for a drop of around 18% so far. The declining trend price action has created a streak of consecutive bearish candles since Sunday.

As PI struggles to hold ground above $0.5223, the weekly low, the downtrend has breached the $0.5524 support marked by the April 29 low. A closing below the weekly low could extrapolate Pi Network’s correction towards the $0.5090 level marked on April 4. The last line of defense is at $0.4000, a round figure tested twice on April 5 and June 13.

The momentum indicators signal a surge in bearish momentum, as the Moving Average Convergence/Divergence (MACD) on the daily chart failed to produce a bullish crossover twice last week. As the declining trend in the MACD and signal lines extends, it marks a surge in bearish strength.

The Relative Strength Index (RSI) at 31 draws closer to the oversold boundary line, indicating an increase in selling pressure.

PI/USDT daily price chart.

To nullify the bearish risk, Pi Network must print a bullish candle and avoid a steeper weekly low. A decisive closing above $0.6000 could reinstate the uptrend, targeting the monthly high at $0.6600.