XRP DeFi Ecosystem Explodes: cbXRP Now Live on Base & Flare with Game-Changing Staking

XRP's DeFi ambitions just got a turbocharge—cbXRP, the wrapped version of Ripple's flagship asset, is now live on both Base and Flare networks. This isn’t just another bridge; it’s a staking play that could finally make XRP holders earn more than just lawsuit updates.

Base and Flare roll out the red carpet

Coinbase’s Base network—Ethereum’s L2 darling—and Flare, the data-focused blockchain, are now fully integrated with cbXRP. Staking models on both chains promise yields that might actually compete with TradFi’s paltry savings accounts (if you ignore the volatility, of course).

DeFi’s quiet XRP revolution

While Bitcoin maxis obsess over ETFs, XRP’s ecosystem is stacking infrastructure. cbXRP’s expansion means more liquidity pools, more leverage, and—finally—a reason for XRP bags to do something besides collect dust.

Cynical take: Wall Street still won’t care

Even with staking, XRP’s regulatory gray zone keeps institutional players at arm’s length. But for crypto natives? This is one more step toward making Ripple’s vision—cross-border payments meets DeFi—actually work. Just don’t expect Jamie Dimon to notice.

Moonwell launches first-ever cbXRP market on Base ecosystem

Moonwell, a lending app on the Base ecosystem, announced extended utility for cbXRP, a 1:1 backed tokenized version of XRP by Coinbase. This begins the lending and borrowing of cbXRP on Base.

For the new DeFi service, XRP holders must exchange their tokens for cbXRP on Coinbase to borrow USD Coin (USDC) against it. With the borrowed USDC, XRP holders will have DeFi exposure without selling their XRP.

VivoPower and USDT0 on Flare boost XRPFi

VivPower pledged a $100 million investment in XRP for institutional yield gains through a partnership with Flare last week. It aligns with Vivopower’s goal to become the world’s first XRP-focused digital asset enterprise.

Adding a DeFi LAYER to XRP, Flare offers FXRP, a 1:1 tokenized, fully non-custodial version of XRP.

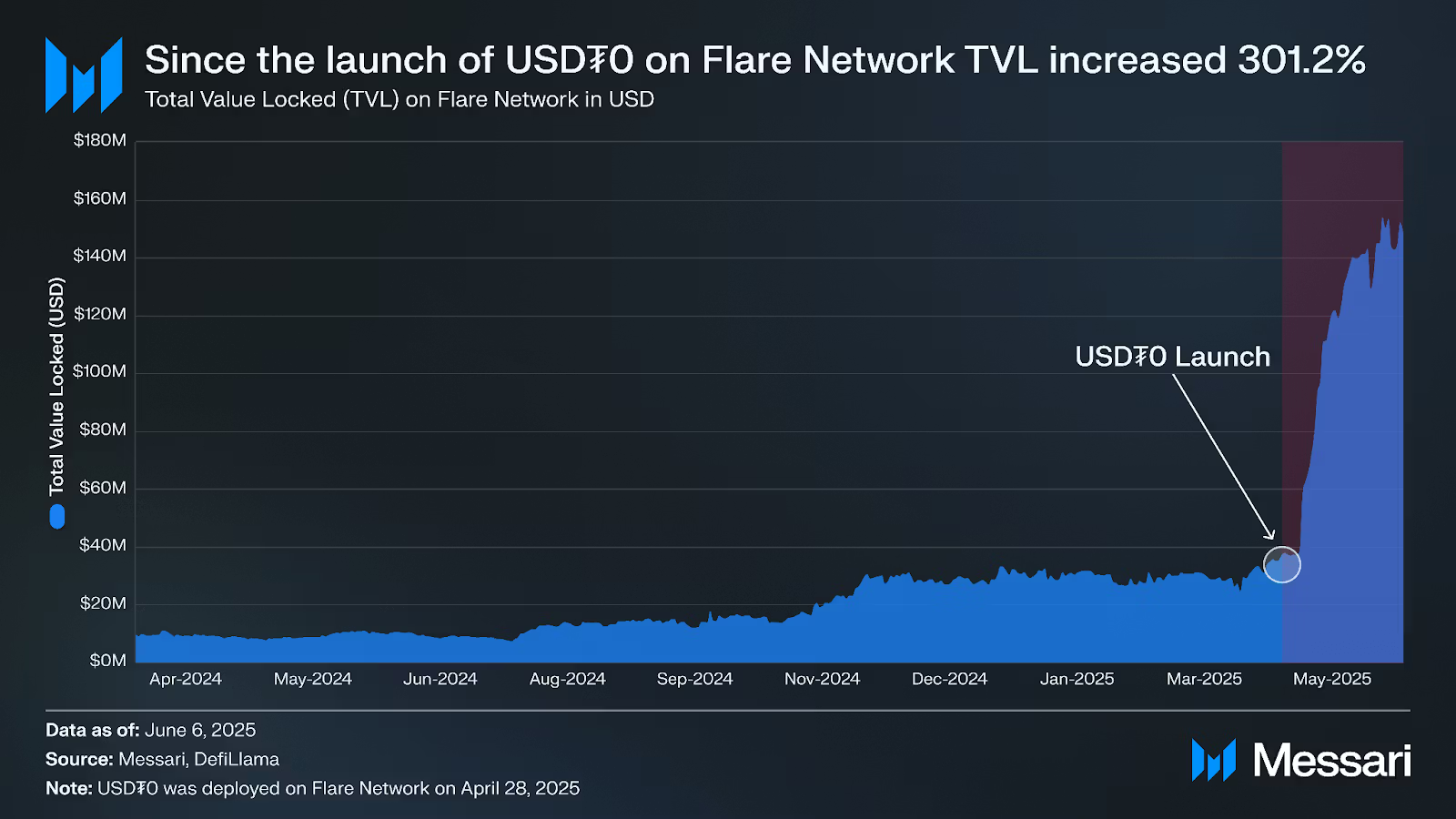

Alongside Vivopower’s investment, a Messari report notes that Flare experiences a liquidity spike with the integration of USDT0, the omnichain version of Tether’s USDT stablecoin, which utilizes LayerZero’s Omnichain Fungible Token standard.

Flare's TVL growth. Source: Messari

The Total Value Locked (TVL) on Flare has surged to an all-time high of $162 million on June 8, from $38 million on April 29. Currently, the DeFiLlama data shows Flare’s TVL stands at $144 million.

Flare TVL. Source: DeFiLlama

Flare also plans to advance XRP’s role in DeFi through liquid staking, which will reward users for staking FXRP with stXRP, similar to Liquid Staking Tokens (LST) earned on Lido DAO.