SUI Price Alert: Triangle Breakdown Threatens Deeper Drop as Bears Take Control

Technical storm clouds gather over SUI as its price teeters on the edge of a triangle breakdown. The once-bullish pattern now risks flipping into bearish territory—and traders are bracing for impact.

Here's why the charts scream caution:

The dreaded triangle breakdown isn't just textbook technical analysis—it's a self-fulfilling prophecy when enough traders pile in. Liquidity hunters smell blood in the water as stop-loss orders cluster below key support levels.

Meanwhile, perpetual funding rates tilt negative for the first time in weeks. Nothing gets crypto traders panicking like the sound of margin calls echoing through the derivatives market.

Of course, this could all be another fakeout before the next leg up. Crypto markets have a habit of shaking out weak hands before mooning—because why make 10% when you can risk it all for 100%?

One thing's certain: the SUI chart just turned into a high-stakes poker game. Will bulls call the bluff, or fold under pressure?

Bullish sentiment wanes in SUI derivatives market

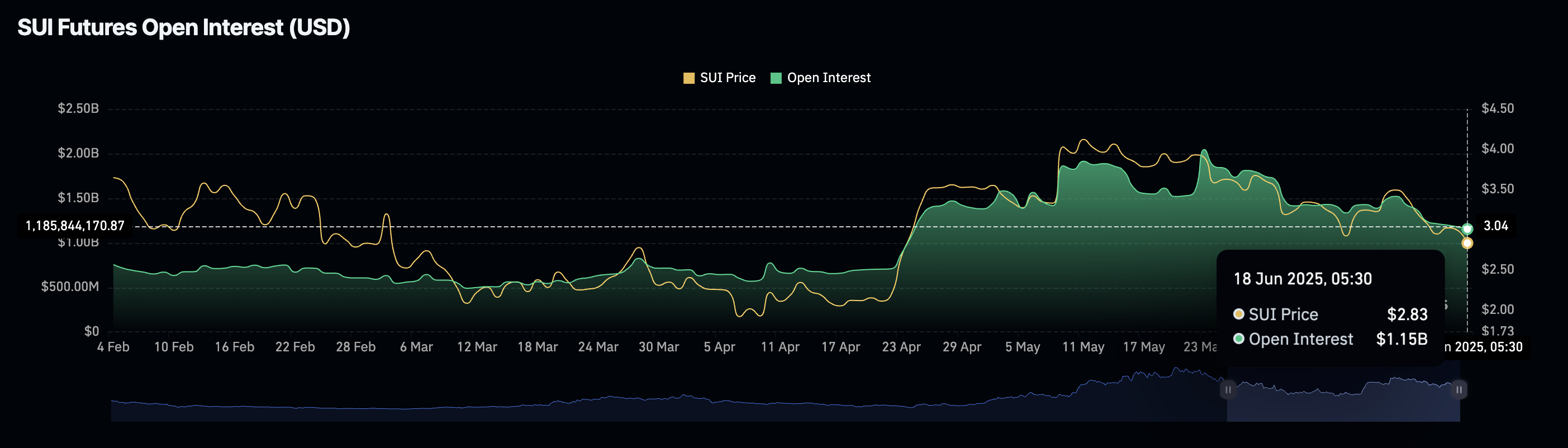

Coinglass’ data shows a drop in Open Interest to $1.15 billion on Wednesday, the lowest value since April 25. In comparison to the all-time high of $2.05 billion recorded on May 23, the OI has decreased by over 43% in less than four weeks.

A declining Open Interest indicates decreased buying activity, likely due to increased capital outflow from the derivatives market. Hence, a decline in sui OI signals a lowered bullish sentiment.

SUI Open Interest. Source: Coinglass

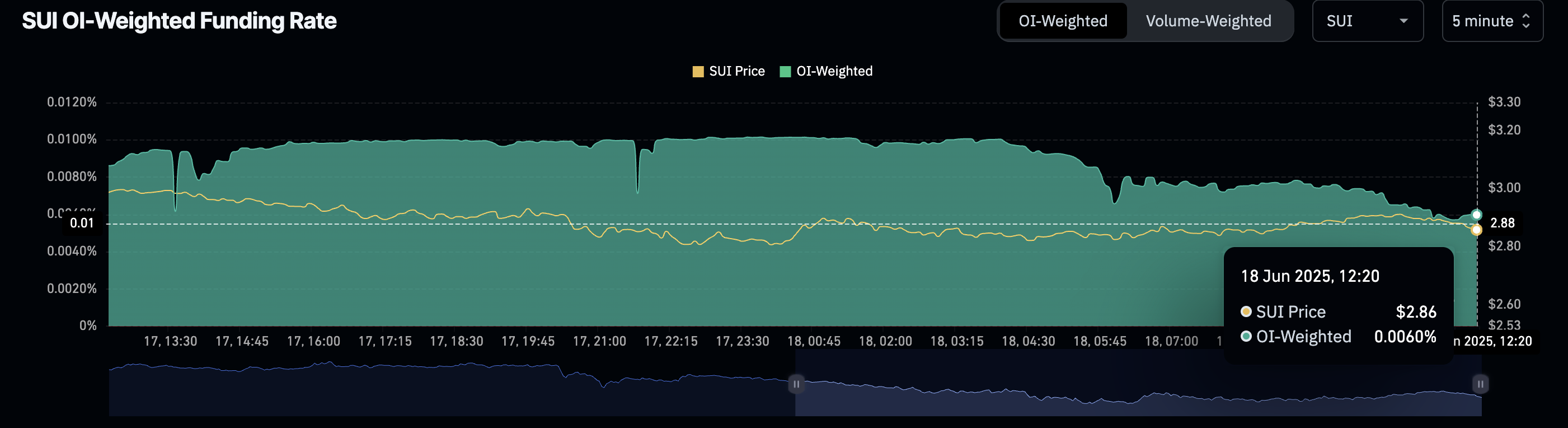

The OI-weighted funding rate is on a downward trend, currently at 0.0060% from a peak of 0.010% earlier in the day. Positive funding rates are imposed on bulls during periods of increasing buying activity to align swap and spot prices. A declining OI-weighted funding rate cements the thesis of decreased buying in SUI derivatives.

SUI OI-weighted funding rate. Source: Coinglass

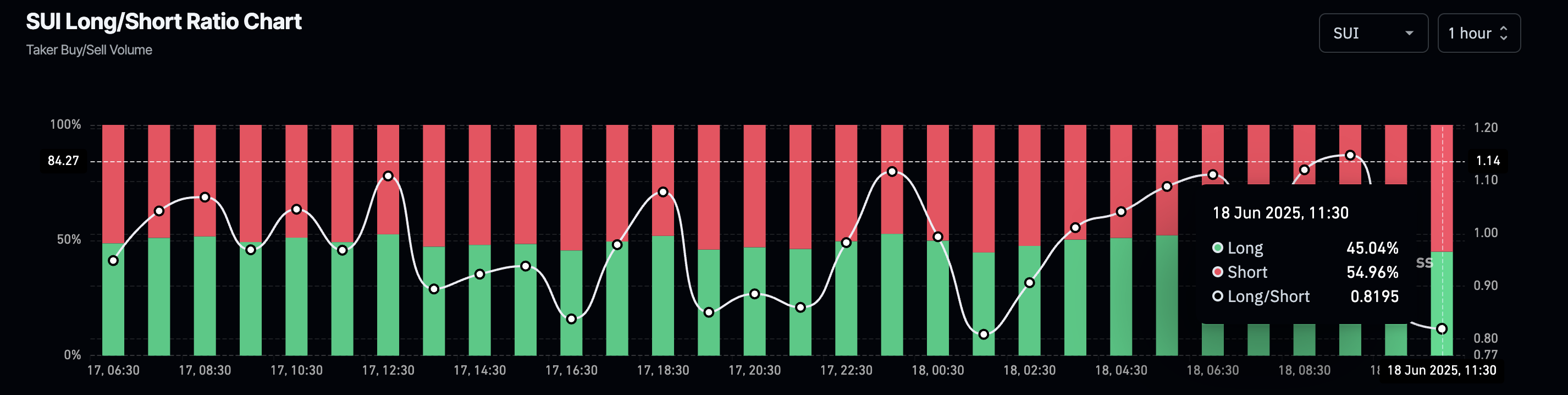

According to the Taker buy/sell volume, shorts account for nearly 55% of the volume. In comparison to 45% of longs, a bearish bias is evident as the long/short ratio reads 0.8195.

SUI long/short ratio. Source: Coinglass

SUI triangle breakdown risks downhill

SUI is under pressure, struggling to hold above the $2.78 support level last tested on March 27. At the time of writing, the altcoin trades at $2.85, with the daily low of $2.68 marking the lowest trading price since April 23.

The path of least resistance after the triangle breakdown in the daily chart points to the downside. Failing to hold above the $2.78 support on a daily close could extend the correction, with the next support for SUI at $2.24, aligning with the 23.6% Fibonacci retracement from the all-time high of $5.36 and the year-to-date low of $1.71.

Amid rising downside risk, the momentum indicators flash mixed signals on the daily chart. The Relative Strength Index (RSI) at 36 heads lower towards the oversold boundary, signaling increased selling pressure. However, RSI forms a higher low compared to the June 5 bottom, diverging from the declining sui price trend. Traders consider this bullish divergence to be a reversal signal.

Meanwhile, the Moving Average Convergence/Divergence (MACD) indicator declines in the negative region alongside its signal line, implying a bearish trend in motion.

SUI/USDT daily price chart.

If SUI bounces back from the $2.78 support, the $3 psychological mark, aligned with the 50% Fibonacci level at $3.03, will act as immediate resistance. A closing above this region could nullify the downside risk and prolong the recovery to $3.55, the monthly high.