Bitcoin Braces for Impact: Trump-Musk Feud Threatens $100K Plunge

Political drama meets crypto volatility as a high-stakes clash between two billionaire egos sends shockwaves through Bitcoin markets. The orange-tinted elephant in the room? A potential nosedive to six figures—because apparently even decentralized assets aren't immune to old-fashioned rich guy pissing contests.

Market watchers are buckling up for what could be Bitcoin's most politically-charged correction yet. When the 'free speech absolutist' and the 'stable genius' start trading blows, your portfolio might need a helmet.

Remember when crypto was supposed to escape traditional finance's circus? So much for that revolution—welcome to the era where memecoins and megalomaniacs move markets. Place your bets, folks.

Bitcoin bear thesis: Large volume profit-taking, long liquidations

Bitcoin holders took over $23 billion in profits between Monday, June 2 and Thursday, June 5,, according to Santiment data. The large positive spike in the Network Realized Profit/Loss metric corresponds to the dip in BTC price.

Large volume profit-taking is typically associated with further correction in the token’s price.

%20%5B18-1749219417523.51.43,%2006%20Jun,%202025%5D.png)

Bitcoin NPL chart | Source: Santiment

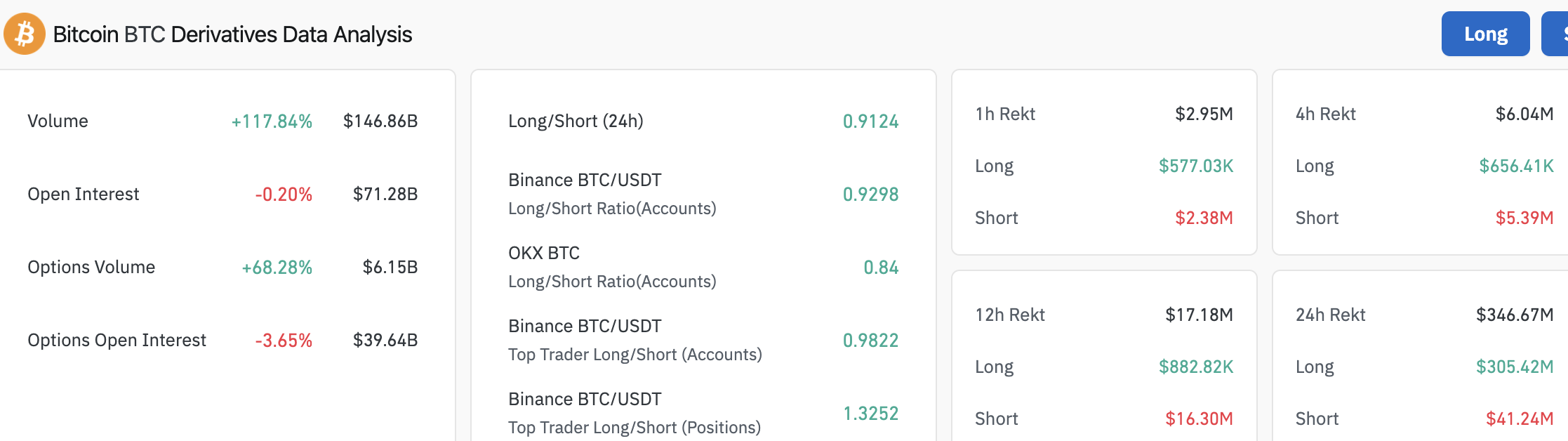

Derivatives data from Coinglass shows over $305 million in long positions were liquidated in the last 24 hours, against $41 million in short positions. The long/short ratio, a metric that compares bullish bets against bearish ones, reads 0.91. A value less than one signals higher bearish bets, supporting a thesis of further price decline.

Bitcoin derivatives data analysis | Source: Coinglass

Bitcoin ETF to be accepted as collateral for loans: JPMorgan insiders

A Bloomberg report published earlier this week on June 4 shows that insiders at JPMorgan say the banking giant is set to offer loans against Bitcoin ETF collateral.

JPMorgan’s wealth management clients could soon use BlackRock’s iShares bitcoin Trust (IBIT) as collateral to obtain loans. According to the report, clients’ holdings in crypto ETFs will be counted toward their net worth and liquidity calculations for loans.

Strategy announces nearly $100 million for Bitcoin purchase and working capital

Strategy announced its Initial Public Offering (IPO) of Stride Preferred Stock (STRD) to raise approximately $979.7 million to use for general corporate purposes like working capital and the acquisition of Bitcoin, per the release.

The bullish development failed to catalyze gains in BTC price and the largest crypto extended its consolidation.

Bitcoin could re-test support at $100,000

Bitcoin is currently consolidating under resistance at $106,000. The BTC/USDT daily price chart shows the likelihood of a nearly 4% correction and a retest of milestone $100,000, a key support level for the crypto.

A nearly 3% increase could see BTC test resistance at $106,794, the upper boundary of a Fair Value Gap (FVG) on the BTC/USDT daily price chart.

The Relative Strength Index (RSI) reads 50, neutral and Moving Average Convergence Divergence (MACD) shows red histogram bars flashing under the neutral line.

In the event of further decline in Bitcoin price, $97,732 could act as support.

BTC/USDT daily price chart | Source: TradingView

Conversely, a daily candlestick close above $106,794 could pave the way for Bitcoin to climb towards the $111,980 level, the previous all-time high.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.