Ethereum Roars Back: Bot-Driven $480B Stablecoin Surge Reclaims DeFi Throne

DeFi's old guard flexes its muscles as Ethereum wrestles back dominance—proving once again that where the bots go, the money follows. Forget 'organic growth'—this is algorithmic warfare at scale.

The $480 billion stablecoin tsunami? Just another Tuesday in the land of synthetic liquidity. Traders cheer while purists weep into their decentralization manifestos.

Wall Street still doesn't get it—but their HFT algos are taking notes.

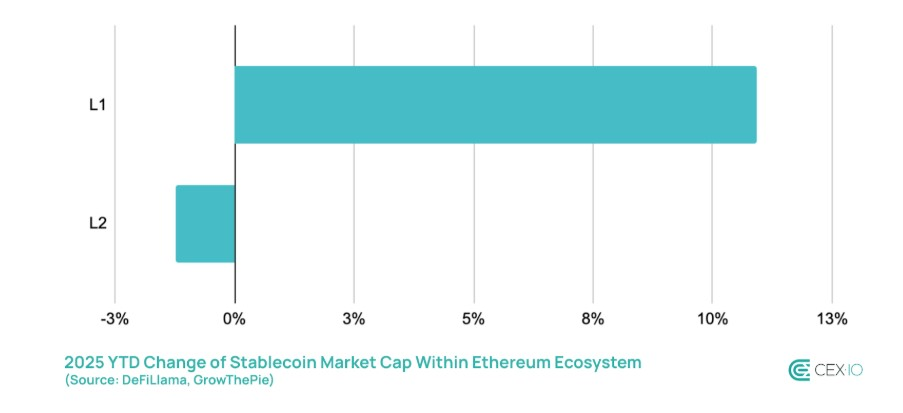

Ethereum stablecoin market cap year-to-date change within the Ethereum ecosystem. Source: Cex.io

Bots contribute to market efficiency and stablecoin adoption

Bots, which received a lot of criticism for controversial maximum extractable value (MEV) strategies and sandwich attacks, are now being recognized for their role in improving liquidity and efficiency on Ethereum’s decentralized exchanges (DEXs).

Cex.io said these bots pushed stablecoin swaps to the top of Ethereum DEX categories for the first time. In April, stablecoin swaps accounted for 37% of the total DEX trading volume on Ethereum and 32% in May.

The shift in trading behavior within the Ethereum ecosystem signaled a broader focus on utility and payment-driven use cases. During the shift, Circle’s USDC (USDC $0.9995) became the most-traded asset on Ethereum.

These changes indicate that Ethereum is regaining market share and pushing DeFi toward more stable and efficient mechanisms. If Ethereum can maintain a low-fee environment, the network is well-positioned to become a settlement LAYER for stablecoin, bots and DeFi infrastructure.

Analyst says stablecoin focus is not just a phase

Otychenko told Cointelegraph that Ethereum's growing focus on stablecoins is not just a market phase but a signal for real-world adoption taking root. “Speculative tokens come and go, but stablecoins stick because they solve real problems,” he said, pointing to rising demand for fast, reliable, borderless payments in emerging markets.

While utility-driven DeFi may cement Ethereum as a stablecoin settlement layer, the analyst warned that sustaining the lead requires more than just momentum; the network needs to address existing challenges like liquidity fragmentation.

“The network needs to solve cost and liquidity fragmentation across layers,” Otychenko told Cointelegraph. “This isn’t just a technical issue. It’s what will decide whether Ethereum leads or lags in the next phase of adoption.”