SUI and Bitcoin Defy Gravity – Crypto Markets Flex Muscle in June 2025 Surge

Crypto bulls trample bearish sentiment as SUI and Bitcoin post unexpected gains. While traditional markets obsess over Fed whispers, decentralized assets write their own rules.

Bitcoin shrugs off regulatory FUD – again – proving institutional adoption isn’t slowing down. Meanwhile, SUI’s ecosystem growth suggests Layer 1 wars are far from over.

Analysts scramble to update price targets (better late than never). Meanwhile, Wall Street still can’t decide if crypto’s a ’risk asset’ or the future of finance – typical hedge fund indecision.

SUI Price Forecast: Fallout from triangle pattern could lead to further losses toward $2.70

Sui (SUI) is down over 1.50% at press time on Monday after three consecutive weekly closings on a bearish note. As sui survives the 58.35 million tokens unlocked on Sunday, avoiding a panic sell-off, a potential fallout from a triangle pattern could extend the losses to $2.71.

Bitcoin price rebound hinges on clearing Fibonacci and EMA confluence near $105,800

Bitcoin price began Monday’s European session by staging a mild rebound at $105,500, after last week’s 5.5% drop from $109,000 to $103,200.

That retracement pulled price below the 0.786 Fibonacci level of the rally that ended at the all-time high of $112,000, signalling profit-taking into month-end.

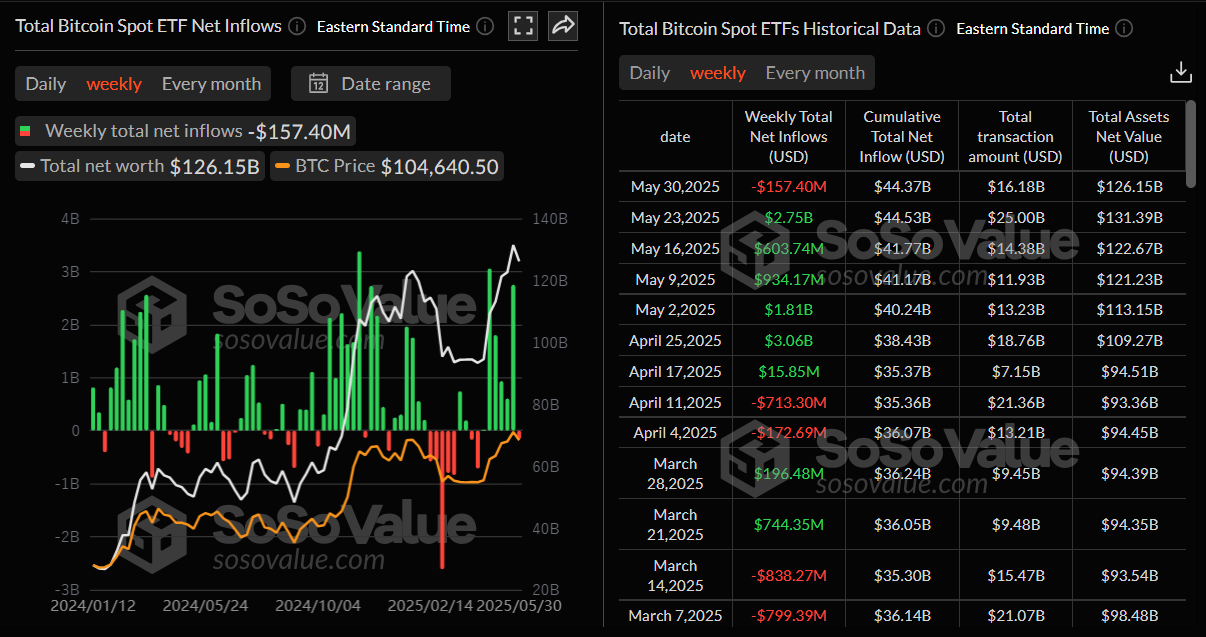

Crypto Today: Market sentiment weakens amid Russia-Ukraine tensions; Bitcoin ETFs see first weekly outflow since mid-April

The cryptocurrency market is showing early signs of weakness at the start of this week on Monday as risk-off sentiment escalates amid rising tensions in the Russia-Ukraine war.

Bitcoin (BTC) spot Exchange Traded Funds (ETFs) recorded their first weekly outflow since mid-April, signaling a pause in institutional inflows. Traders should keep a watch on three altcoins: Ethena (ENA), Taiko (TAIKO), and Neon (NEON), which are set to undergo upcoming token unlocks worth over $5 million each, potentially adding sell-side pressure.