FARTCOIN Plummets as Bullish Channel Collapses—$1.18 Support in Sight

FARTCOIN’s technical structure just cracked under pressure, slicing through its bullish trendline like a hot knife through memecoins. Traders are now bracing for a drop to $1.18—because nothing says ’sound investment’ like a crypto named after bodily functions.

The breakdown follows textbook chart patterns, proving once again that crypto markets move faster than a hedge fund manager exiting a sinking ship. Will this be a quick shakeout or the start of something uglier? Grab your popcorn—and maybe a risk management plan.

Fartcoin concludes the two-month-long bull run

The Fartcoin Price action formed a rising channel pattern over the last two months with multiple higher highs and higher lows creating parallel resistance and support trendlines.

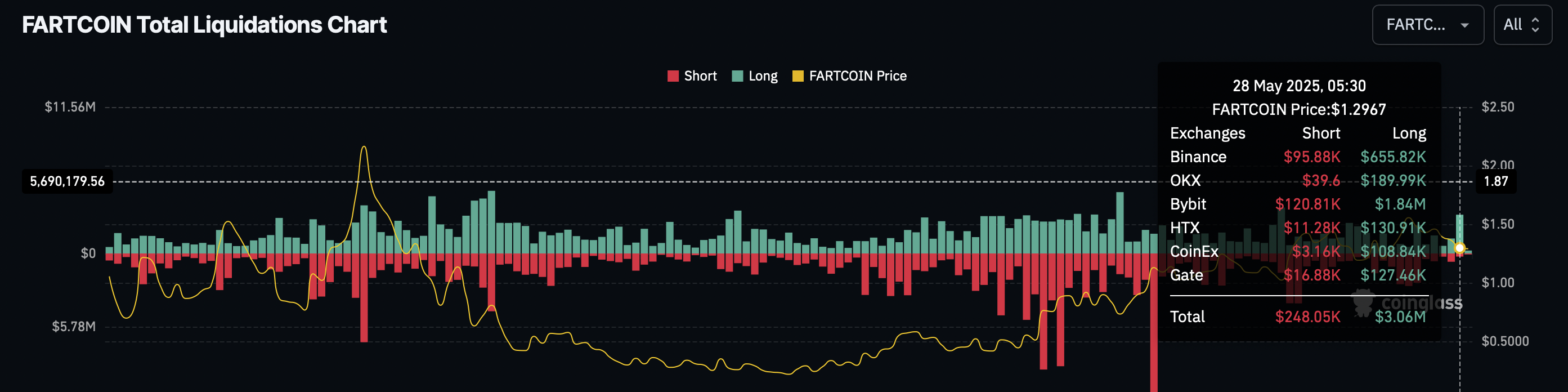

However, a 4.79% drop on Wednesday led to a massive wipeout of bullish-aligned traders in the Fartcoin derivatives. According to Coinglass, the daily long liquidations accounted for $3.06 million on Thursday compared to a minor $248K in short liquidation.

Fartcoin Liquidations Chart. Source: Coinglass

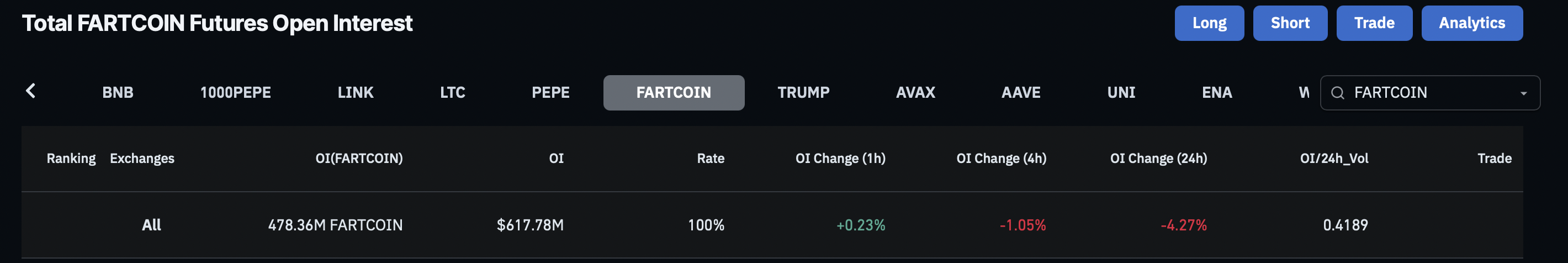

With the exodus of FARTCOIN bulls, the Open Interest (OI) takes a 4.27% hit in the last 24 hours, dropping to $617.78 million. This suggests a significant decline in trading activity and a loss of interest among traders.

Total Fartcoin Futures Open Interest. Source: Coinglass

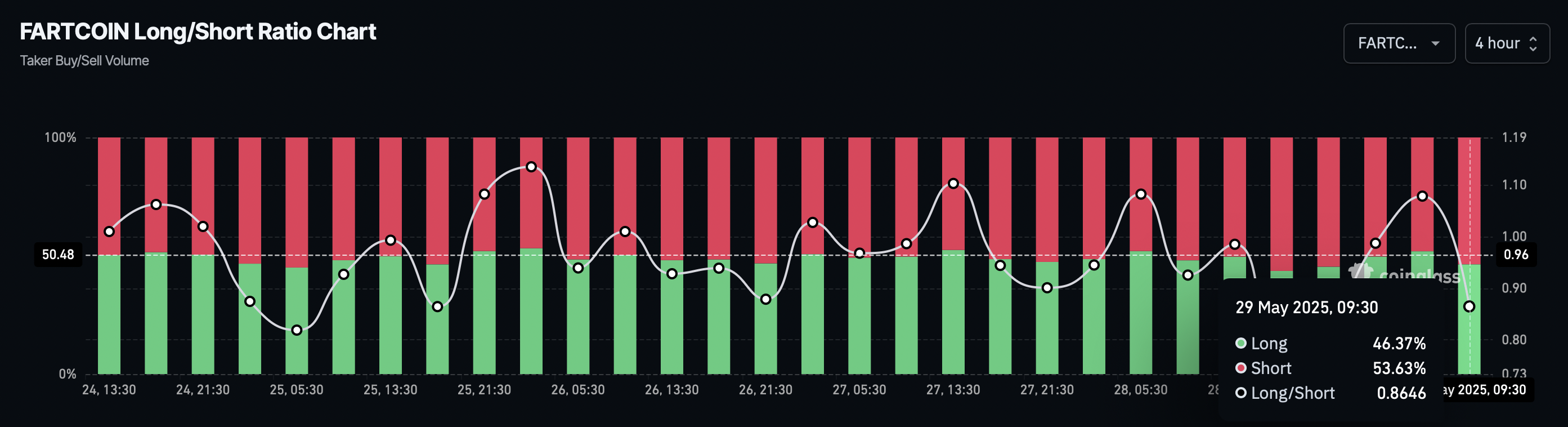

As the tables turn, the taker buy/sell volume, as measured by the Long/Short Ratio, reveals that the taker sell volume has risen to 53.63% of all taker activity over the last four hours, pushing the long/short ratio down to 0.8646.

Fartcoin Long/Short Ratio Chart. Source: Coinglass

With the 4.79% drop on Wednesday, the meme coin broke below the channel’s lower boundary line, triggering a sell signal.

With a fourth consecutive daily bearish candle in the making, Fartcoin is down 11% this week. Supporting the downside risk, the momentum indicators are losing strength.

The Moving Average Convergence/Divergence (MACD) indicator drops below its signal line, flashing a bearish crossover, and trends closer to the centre line. This suggests a weakness in bullish momentum.

The Relative Strength Index (RSI) at 50 turns flat NEAR the halfway point after reversing from the overbought boundary line. A bearish divergence is visible in RSI, as it formed lower peaks while the Fartcoin price maintained a higher high formation, foreshadowing the ongoing correction. If the RSI line falls below 50, a bearish trend is likely to gain momentum.

Based on the Fibonacci levels drawn from the opening prices of January 20 ($2.15) to March 11 ($0.20), Fartcoin’s immediate support is the 50% Fibonacci retracement level at $1.18. A potential breakdown below $1.18 will trigger a sell signal, targeting a drop to the next support level at $1.02, a previous low formed on May 7.

FARTCOIN/USDT daily price chart. Source: Tradingview

On the contrary, a new leg formation at $1.18 could help Fartcoin sustain the uptrend. For bullish-aligned traders, the breakout of the $1.41 level (61.8% Fibonacci retracement) could be an entry opportunity with a target at $1.74 (78.6% Fibonacci retracement).