Bitcoin’s Silent Accumulators: Long-Term Holders Snatch Up $109K Dip

While Wall Street panics over a temporary pullback, Bitcoin’s OGs are doing what they do best—buying the damn dip.

The Quiet Capitalization Play

No press releases, no CNBC appearances. Just cold, calculated accumulation as BTC slides toward $109K. The hodl mentality isn’t dead—it’s loading up.

Finance’s Predictable Irony

Meanwhile, traditional investors are still waiting for a ‘safer entry point.’ Spoiler: it was 2012. Or last week. Or right now.

Bottom line: When volatility strikes, the crypto-savvy don’t pray—they pay (in satoshis).

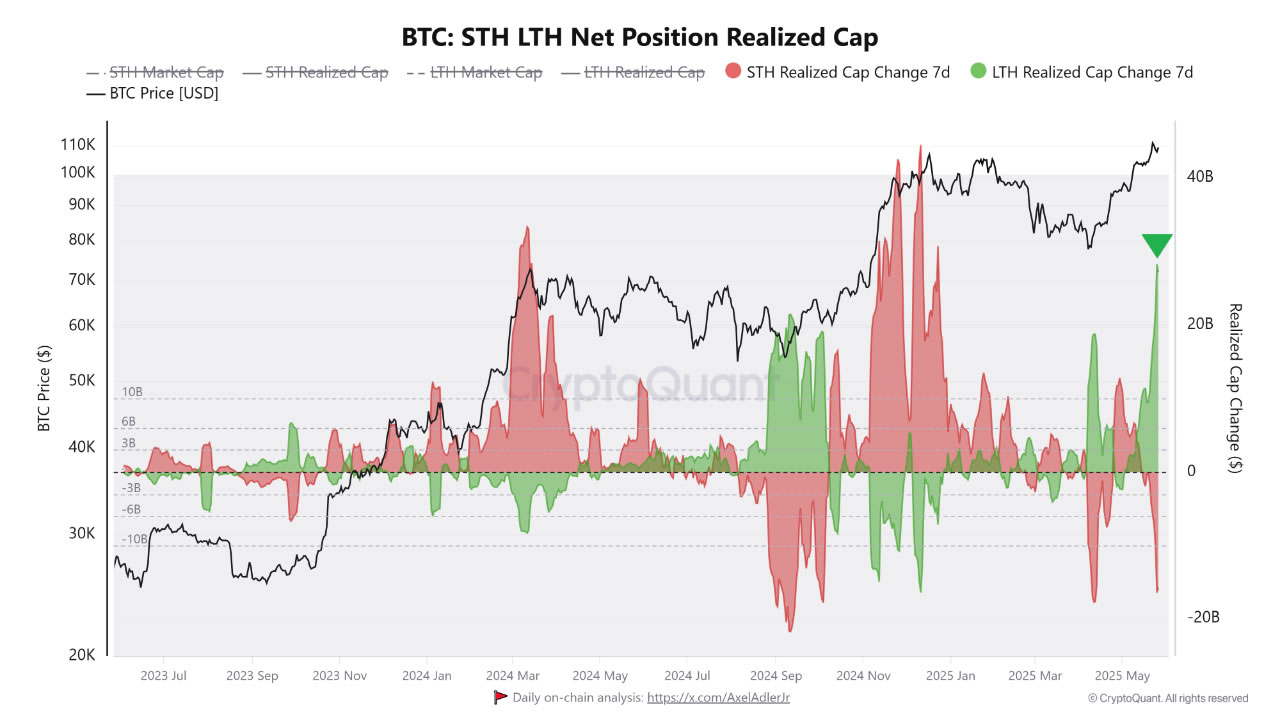

BTC short-term holders (red) and long-term holders (green) net realized cap. Source: CryptoQuant

Meanwhile, CryptoQuant analyst Ibrahim Cosar identified a double bottom chart formation, a reversal signal that indicates “bearish pressure is weakening and buyers are beginning to regain control,” he said.

“If this zone holds as support, levels above $112,000 are well within reach,” he predicted.

Bitcoin dips below $109,000

Bitcoin is trading at just under $108,700 on Coinbase at the time of writing, posting a slight rebound from a wick down to $107,550, according to TradingView.

However, it has retreated from a high on Monday, May 26, of $110,000, having hit resistance twice at that level.

BTC/USD holding around $109K on Coinbase. Source: TradingView