Bitcoin Open Interest Soars to All-Time High Even as Price Dips Below $111K

Futures traders double down on BTC bets while spot markets wobble—because what’s a little volatility among friends?

Open interest hits record levels as Bitcoin plays tug-of-war with the $111K support level. Someone’s getting liquidated, and Wall Street’s probably charging 2-and-20 to watch.

Total Bitcoin futures OI. Source: Coinglass

When OI surges, it indicates massive Leveraged positions are built up in the market, with lots of traders holding large positions with borrowed money.

If Bitcoin’s price moves against these over-leveraged positions, traders get forcibly liquidated, and the flushout can create selling pressure on Bitcoin, which can cause a rapid drop in prices and high volatility.

However, analysts suggest the surge in spot bitcoin exchange-traded fund (ETF) inflows, which have seen more than $2.5 billion this week, can counter some of that extended leverage.

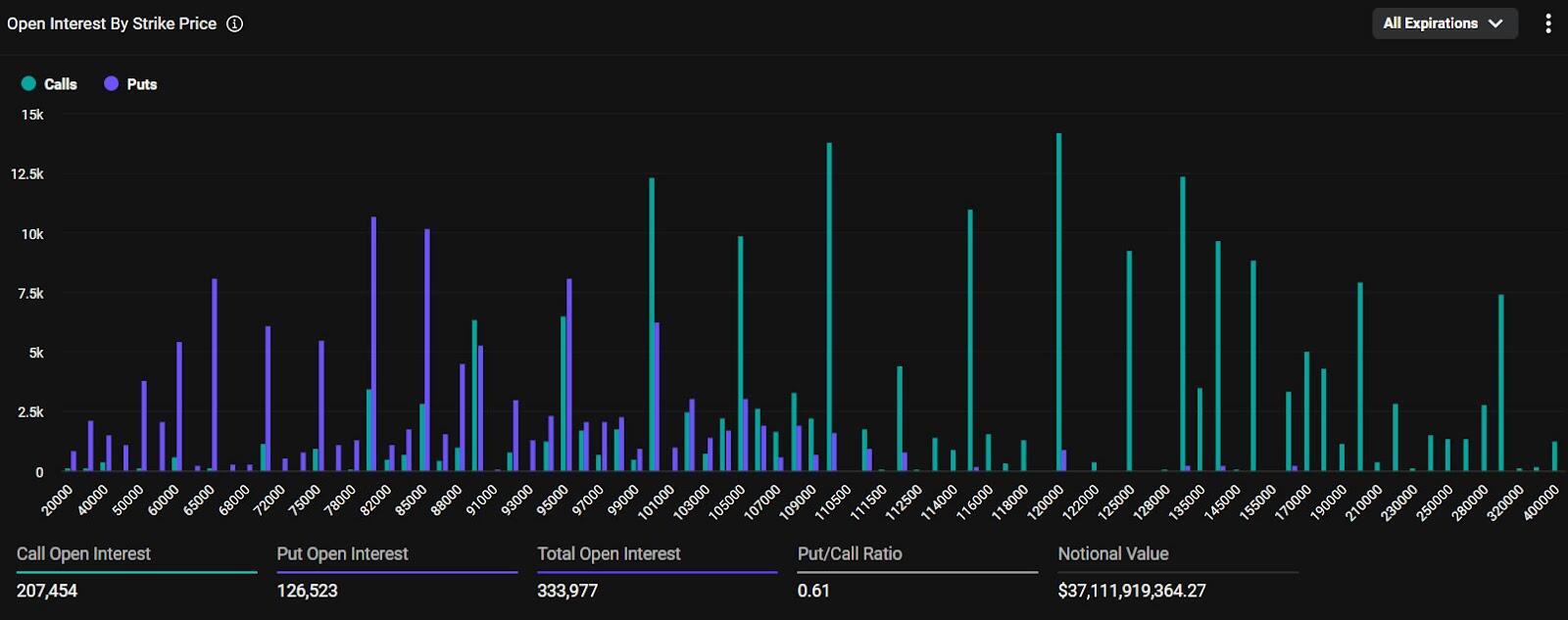

Bitcoin options markets show a similar pattern with open interest over $1.5 billion at the $110,000 and $120,000 strike prices on the Deribit exchange. There is also more than $1 billion in OI at strike prices of $115,000, $125,000, and $130,000.

Around $2.76 billion worth of notional value contracts are due to expire on May 23 with a put/call ratio of 1.2%, meaning there are more short (put) sellers than longs (call), and a max pain point of $103,000, where most losses will be made on expiry, according to Deribit.

Bitcoin options OI by strike price. Source: Deribit

Bitcoin slips below $111,000

Meanwhile, Bitcoin has slightly lost its recent gains and briefly slipped below $111,000 on Coinbase, according to TradingView.

The asset has now gained almost 20% since the beginning of the year and almost 50% since its crash to $75,000 on April 7 following US President Donald Trump’s announcement of global tariffs.

Bitcoin hit an all-time high of $112,000 on May 22 and had mostly traded just above $111,000 over the last 24 hours, but had again slipped below the level at 4:15 am UTC on May 23.