BlackRock’s Bitcoin ETF Hits Two-Week Inflow High as BTC Nears $112K

Wall Street’s favorite crypto wrapper keeps raking it in—just as Bitcoin flirts with another eye-watering price milestone.

Institutional money floods in while retail traders pray for a pullback. Some things never change.

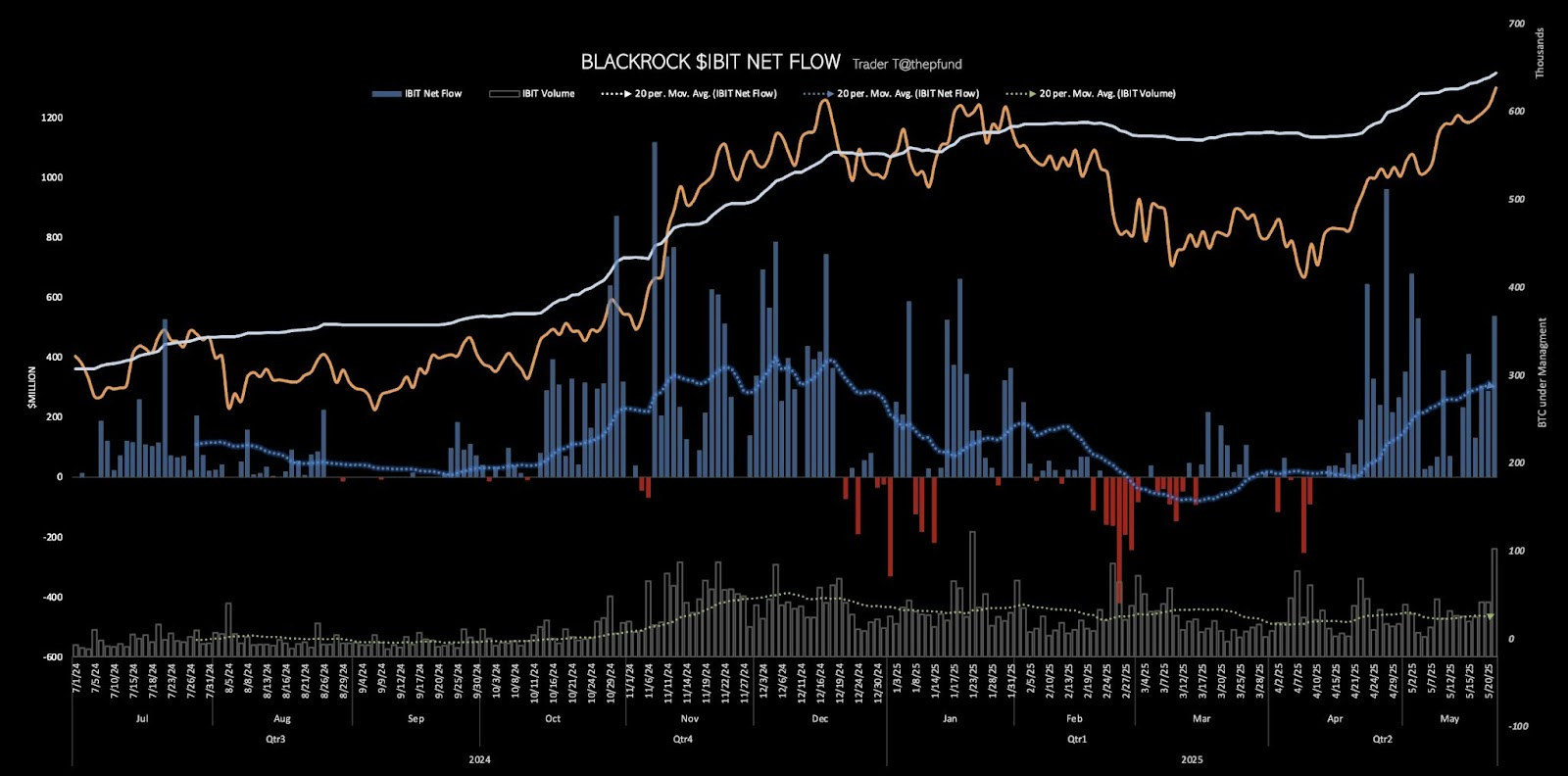

BlackRock IBIT net flows. Source: Trader T

The total inflow figure for all 11 spot ETFs was $607.1 million, with the Fidelity Wise Origin Bitcoin Fund (FBTC) seeing the second-most inflows for the day at $23.5 million.

Bloomberg ETF analyst Eric Balchunas called the ETF inflows a “classic feeding frenzy” caused by Bitcoin’s recent price rally, which has seen it extend to nearly $112,000 in early May 22 trading.

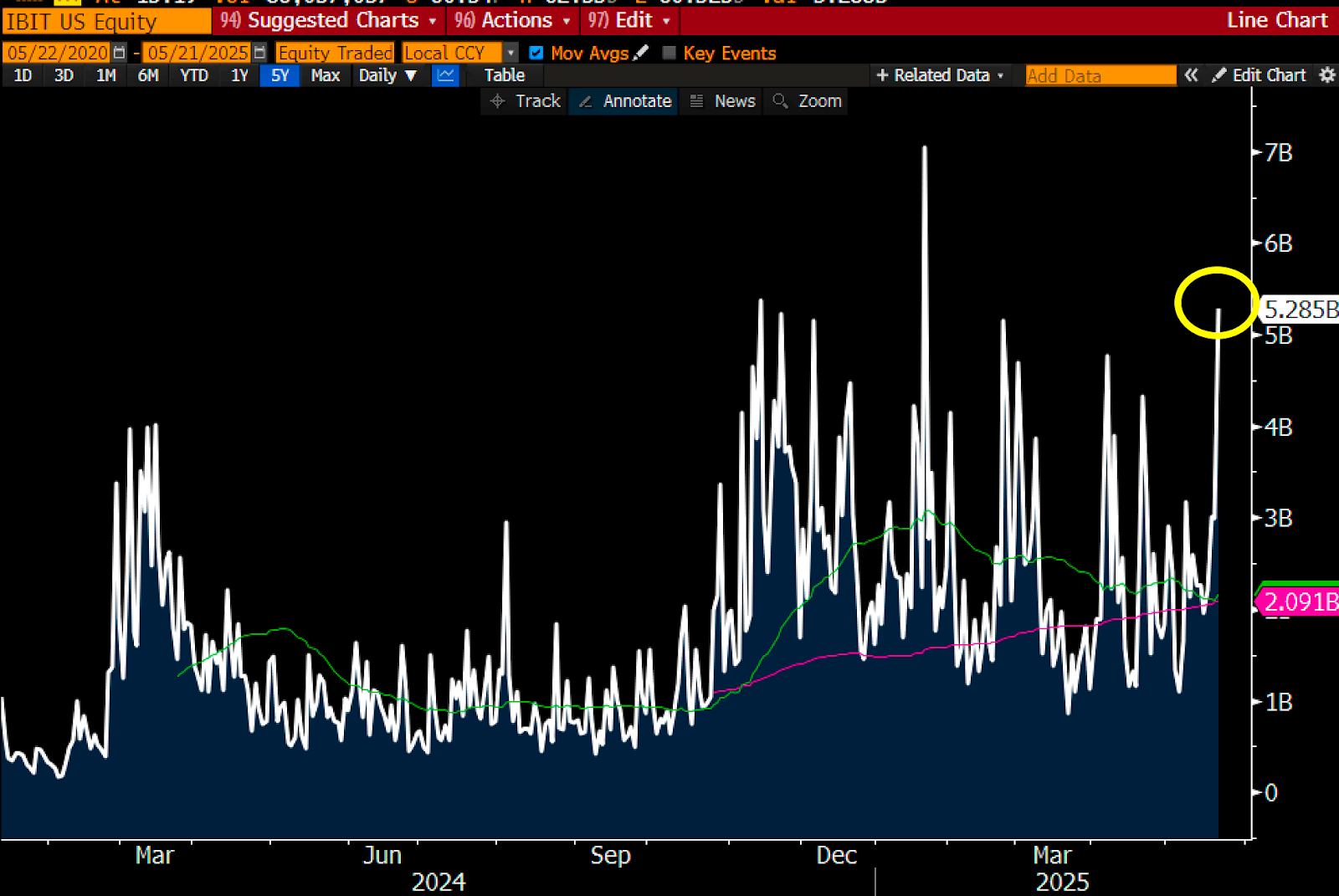

Balchunas added that the last time ETF trading volumes soared to current levels was in January, around Bitcoin’s then all-time high. “All the Bitcoin ETFs are elevated, most are gonna see 2x their average flows incoming,” he said.

IBIT trading volume surges to January levels. Source: Eric Balchunas

The big ETF inflow and volume day came as Bitcoin notched a new all-time high above $110,000 late on May 2, and it has continued to rally to a top of just under $111,897 on Coinbase, according to TradingView.

Bitcoin ETF pile in to continue

Jeff Mei, operations chief at the crypto exchange BTSE, told Cointelegraph in a note that investors are “crowding into Bitcoin ETFs,” which saw $3.6 billion in net inflows in May.

“We believe this trend will continue as long as companies continue to tap public markets for more capital,” he added. “This could even accelerate if the Fed decides to cut interest rates in the coming months.”

Jupiter Zheng, HashKey Capital partner, anticipated more volatility once Bitcoin breaks above $110,000, telling Cointelegraph that it was “entering uncharted price discovery territory, while unstable geopolitical and macroeconomic factors lead investors to consider the long-term value of Bitcoin.”