Solana at a Crossroads: 1.4 Million SOL Unstaked in 24 Hours—$150 Collapse or $200K Surge?

Solana’s network just bled 1.4 million SOL tokens from staking contracts in a single day—triggering alarm bells and moon-shot predictions in equal measure. Is this the prelude to a breakdown or a breakout?

The unstaking tsunami: Validators are fleeing like rats from a sinking ship—or cashing out before the next leg up. Market makers whisper about $150 support crumbling, while degens on Crypto Twitter already price in a $200K SOL future. Classic crypto.

Technical tightrope: The 200-day moving average coils like a spring at $180. Break north, and the ATH hunters swarm. Fail, and it’s a freefall to triple digits—with leveraged longs getting liquidated faster than a Wall Street banker’s moral compass.

One thing’s certain: When this much capital moves this fast, someone’s about to get rich. And it probably won’t be you.

Solana (SOL) tumbles below $170 support as bullish catalysts subside

Solana (SOL) posted significant losses on Thursday, as the market cooled down from a positive start to the week.

Earlier in the week, SOL price posted two consecutive days in profit, crossing the $184 mark on Tuesday for the first time since Trump’s crypto strategic reserve announcement in March.

Solana price action, May 15, 2025 | Source: TradingView

In terms of internal catalysts, bullish momentum surrounding SOL ETFs and institutional demand from the likes of DeFi Development company which recently upped its strategic SOL holdings to $100 million.

Facing intense rejection at the $185, Solana price has now tumbled as low as $169 on Thursday, reflecting up to 9.7% intraday losses according to TradingView data culled from the Binance exchange.

Why is Solana price down today?

Solana’s 4% price dip on Wednesday is linked to 3 major bearish factors, ranging from a cautious outlook surrounding top-ranked altcoins, rapid staking withdrawals, and rapid derivative market liquidations.

Solana’s sell-side pressure aligns with synchronized negative showing seen across top layer-1 altcoins.

Top 10 cryptocurrencies performance, May 15, 2025 | Coingecko

According to Coingecko data, ethereum fell 2.7%, floating above the $2,500 level at press time, while XRP and Cardano (ADA) are also posting 4% losses apiece.

Further exacerbating the bearish narrative, on-chain data shows that investors have been unstaking large amounts of SOL in the past week, a MOVE that often precedes profit-taking trends.

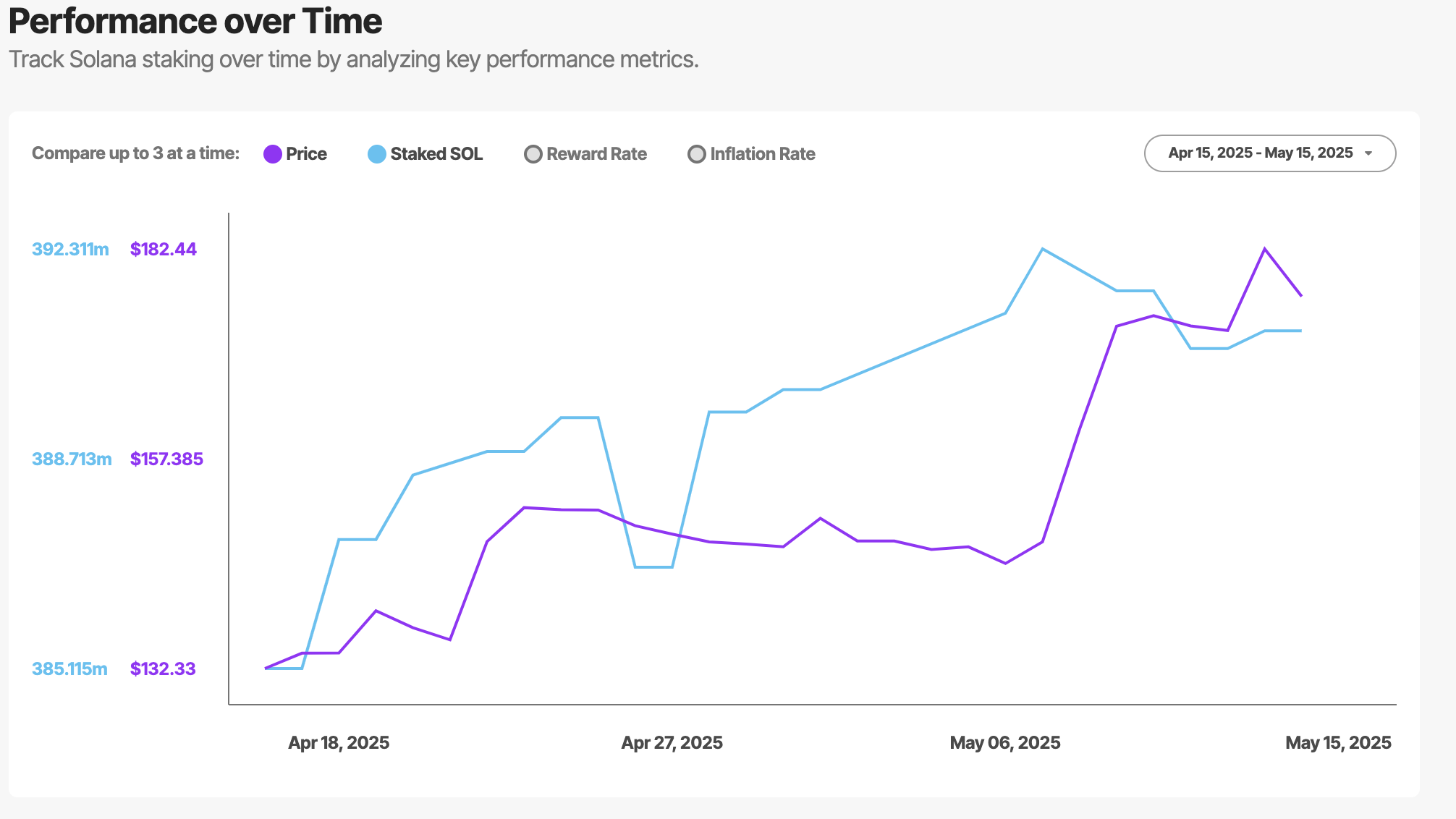

Solana staking flows, May 15, 2025 | Source: StakingRewards.com

As depicted above, Blockchain analytics firm StakingRewards shows how Solana’s staking deposits dipped by 1.4 million SOL from 392.3 million on May 7 to 390.9 million SOL at the time of writing on Thursday.

Valued at the current prices of $169 per coin, investors effectively withdrew over $236 million from solana staking contracts in the past week.

Such large-scale staking withdrawals intensify sell-side pressure as large amounts of previously locked coins trickle into the circulating supply. This may explain why SOL failed to advance above the critical $185 support earlier this week.

What’s Next for Solana price action?

Solana price decline on Thursday could extend into the coming trading sessions as over $236 million of newly unstaked SOL trickled into exchanges.

However, it’s important to note that Bitcoin price has now held steady above $100,000 for seven consecutive days of trading, the first time since January 2025.

Solana ETF approval odds on Polymarket suddenly fell 9% several hours before news aggregators began posting about the SEC delaying its Grayscale spot ETF decision.

Someone seems to have gotten the news before Twitter found it — and placed a big (kind of dumb) trade on it. pic.twitter.com/0g7MP31Ukh

If Bitcoin’s resilience continues to anchor the broader crypto market sentiment, its SOL traders could halt the sell-off and begin seeking re-entry opportunities.

More so, the US SEC’s scheduled date for altcoin ETFs verdict on June 16 is now 30 days away.

With PolyMarkets bettors pricing in 82% approval odds, Solana could begin to attract pre-emptive demand from investors looking to front-run the potential approval verdict

Solana technical price analysis: Bullish pennant highlights $212 upside target if $140 support holds

Solana’s recent retracement to $168.85 (-4.41%) marks a critical retest within a still-valid bullish structure. As seen below, SOL rice action broke out of a textbook bullish pennant on May 8, confirmed by strong bullish volume and a daily candle that closed well above the upper trendline.

That breakout propelled SOL into multi-month peaks at $188.69 before stalling. The current 9.67% single-day decline, while significant, has yet to invalidate the bullish setup, as solana price still trades well above the pennant apex near $150.

Solana technical price analysis, May 15, 2025 | Source: TradingView

More so, with BTC consolidating above $100,000 for the seventh consecutive day, this macro-anchoring gives room for SOL to consolidate above key levels as bulls await the next market catalyst.

On the downside, short-term profit-taking is evident, especially amid the recent 2 million SOL staking withdrawals. From a technical perspective, bearish invalidation WOULD only occur below the pennant base around $140.