PEPE Price Poised for Rally as Open Interest Hits Record High—Memecoin Mania Returns

Frogs are jumping again. PEPE’s Open Interest just smashed its ATH, signaling traders are doubling down on this memecoin gamble.

Derivatives data shows futures traders piling into PEPE positions—usually a precursor to volatile price action. Will this be another ’buy the rumor, sell the news’ circus or legitimate momentum?

Retail FOMO meets institutional hedging strategies in the most unserious corner of crypto. At least the leverage bonfire keeps things entertaining while traditional markets nap.

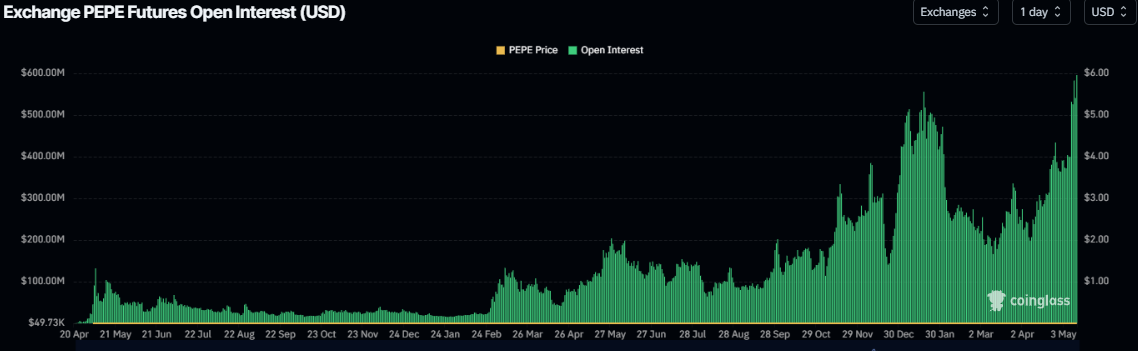

Pepe’s Open Interest reaches a new all-time high

Coinglass’ data shows that the futures’ OI in PEPE at exchanges rose from $398 million on Thursday to $595.36 million on Monday, a new all-time high. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current Pepe Price rally.

PEPE open interest chart. Source: Coinglass

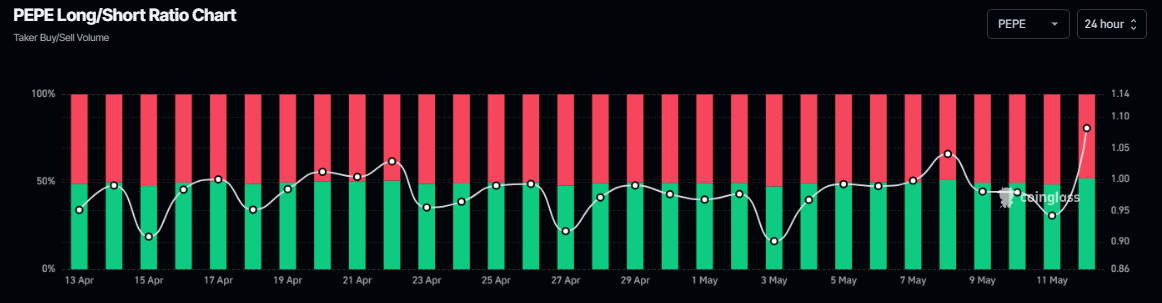

Another bullish sign is Coinglass’s Pepe long-to-short ratio, which reads 1.09, the highest level in over a month. This ratio above one reflects bullish sentiment in the markets as more traders are betting on the rise of the frog-themed meme coin price.

PEPE long-to-short ratio chart. Source: Coinglass

Pepe Price Forecast: Pepe bulls aim for the $0.000016 mark

Pepe price broke and closed above its 100-day Exponential Moving Average (EMA) at $0.000009 on Thursday and rallied over 64% until Saturday and closed above its daily resistance level at $0.000013. However, it faced a pullback the next day, and support was found at this daily level. At the time of writing on Monday, it continues to trade higher by 5% at around $0.000014.

If PEPE continues its upward trend, it could extend the rally to retest its next daily resistance at $0.000016. A successful close above this level will extend an additional gain toward its January 18 high of $0.000021.

The daily chart’s Relative Strength Index (RSI) moves above 70, indicating strong bullish momentum. However, traders should be cautious as the chances of a pullback are high due to the overbought condition. Another possibility is that the RSI remains above the overbought level of 70 and continues its upward trend.

PEPE/USDT daily chart

However, if PEPE faces a pullback, it could extend the decline to retest its next support level at $0.000013.