SOL Strategies to Launch Tokenized Shares on Solana—Can This Push SOL Past $250?

Solana’s ecosystem gets a Wall Street twist as SOL Strategies unveils plans for tokenized equity shares. The move could funnel institutional liquidity into SOL—just don’t expect bankers to ditch their Bloomberg terminals anytime soon.

Tokenization meets DeFi: By bridging traditional assets onto Solana’s high-speed blockchain, the project aims to attract capital that still thinks ’blockchain’ is a typo. Early specs suggest sub-second settlement and 24/7 trading—features that might finally justify those 3am VC Twitter threads.

Price implications: With SOL currently consolidating near its 2025 highs, traders are debating whether this institutional play could trigger the next leg up. Technicals show clear air until $220, but hitting $250 would require more than just crypto-native buyers jumping in. As always in finance: the product’s legit, but the hype cycle’s louder.

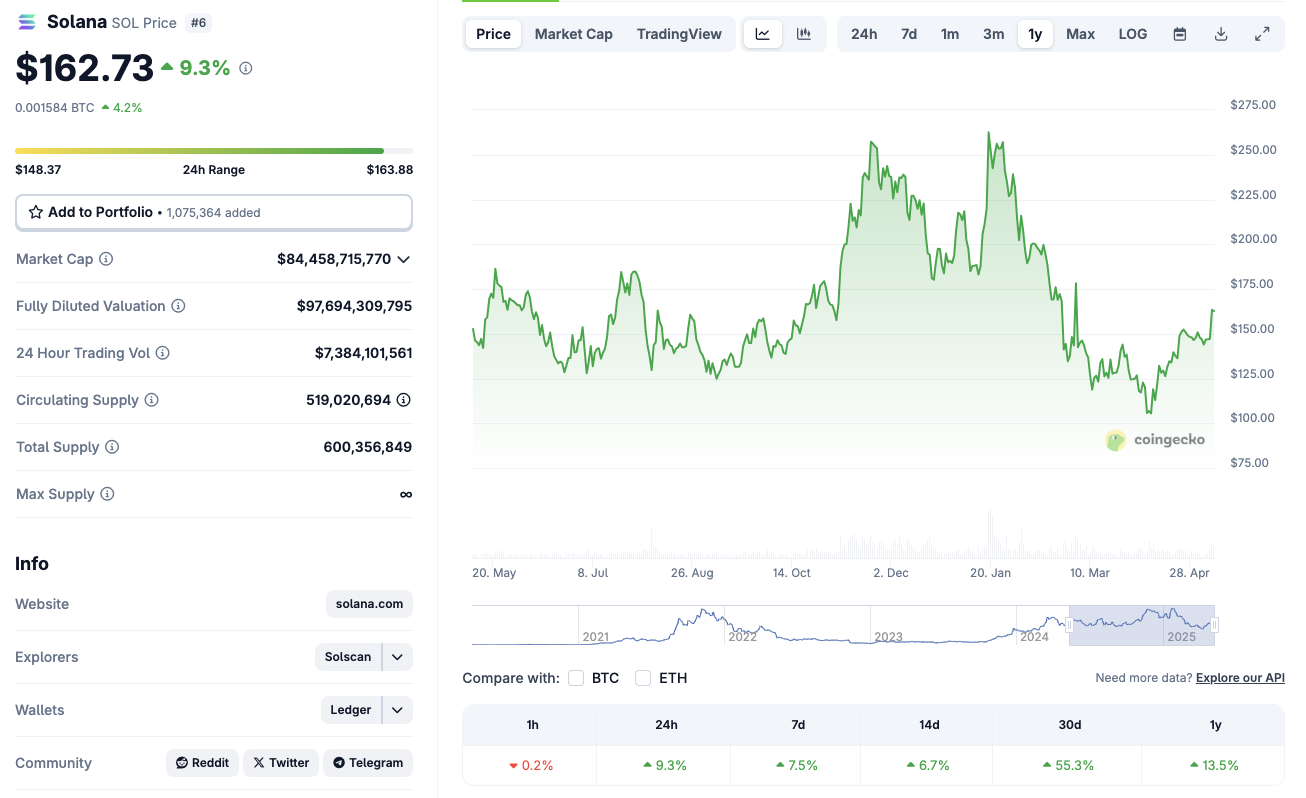

Solana Price crosses $160 for the first time since March amid Trump-fueled market rally

Solana price gains 9% from the crypto rally on Thursday, crossing the $162 mark for the first time since March.

Bitcoin’s landmark breakout above $100,000 has reignited institutional demand, following the Fed’s rate pause and renewed macro Optimism from Trump’s trade deal with the UK.

Solana (SOL) Price Action | Source: Coingecko

Beyond those, market sentiment brightened after Trump’s calls for a ceasefire in Russia, further shoring up investor confidence into the early hours of Friday.

Investor optimism intensified after reports of possible Trump-led trade reforms and aggressive future rate cuts if reelected.

“Talks with Russia/Ukraine continue. The U.S. calls for, ideally, a 30-day unconditional ceasefire. Hopefully, an acceptable ceasefire will be observed, and both Countries will be held accountable for respecting the sanctity of these direct negotiations. If the ceasefire is not respected, the U.S. and its partners will impose further sanctions. Thousands of young soldiers are dying on a weekly basis, and everybody should want it to STOP. I do, and the United States of America does, also," TRUMP said in a TruthSocial post on Thursday.

At press time, Solana traded at $162.76, gaining 10.4% on the day and outperforming BTC price considerably, despite the pioneer crypto asset trading at a four-month peak of $103,000

More so, a closer look at the Coingecko chart shows Solana’s 24-hour gains outpaced its seven-day and one-month performance, signaling the start of a new bullish cycle.

SOL Strategies to bring Tokenized shares to Solana Blockchain via an SEC-approved trading platform

Bitcoin’s momentum toward new all-time highs has spilled into Solana, with recent new reports further reinforcing SOL institutional appeal.

On Thursday, Canada-based investment firm, SOL Strategies (CSE: HODL) signed a memorandum of understanding with Superstate to explore tokenized equities on Solana.

This would make SOL Strategies the first public company to consider issuing common shares as tokens on Solana blockchain.

Superstate’s Opening Bell platform supports SEC-registered public equities issued and traded natively on blockchain infrastructure. The partnership aims to build investor trust in Solana by enabling real-time settlement and DeFi interoperability for equities.

“As leaders in the Solana ecosystem, our goal is to stay at the forefront of innovation...we believe publicly listed tokenized equity represents a natural evolution in capital markets, and Solana’s high-performance network is the ideal foundation for that future. By initiating this exploration, we’re reinforcing our technology-first approach while opening potential new channels for global investor participation,” said Leah Wald, CEO of SOL Strategies.

While no official launch timeline is set, the initiative is purely nascent and does not involve converting existing shares into tokens at this stage.

If successful, this would be the first regulated issuance of tokenized public equities on Solana, signaling institutional-grade innovation after many years of establishing retail-driven memecoins and staking protocols on the 5th largest cryptocurrency by market cap.

What’s Next: Institutional activity on Solana blockchain could drive SOL price above $200

SOL Strategies’ blockchain equity vision hints at expanding institutional interest in regulated tokenized securities on Solana. Regulatory clarity in the U.S. could allow pension funds, asset managers, and sovereigns to interact with SOL-based assets.

This adds to the institutional narrative from the Solana futures ETF recently approved for trading on Nasdaq and several SOL spot ETFs currently under-review with the US SEC.

With growing bipartisan support for cryptocurrencies adoption bills across the regional states and the US Senate, SOL strategies MOVE to launch SEC-approved securities and tokenized equities could see Pension funds, sovereign governments acquire SOL to interact with this nascent tokenized financial services.

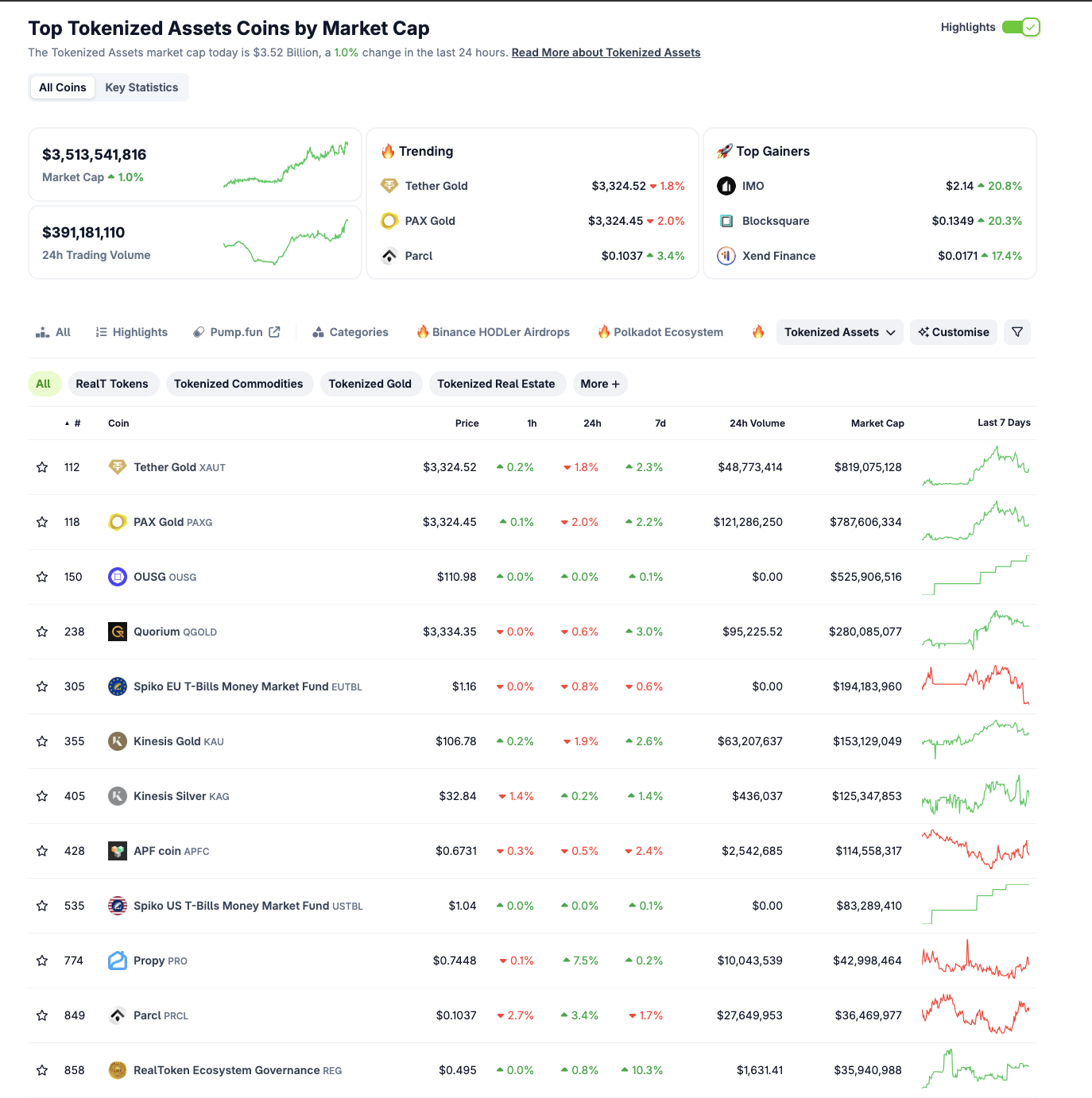

According to Coingecko data, the aggregate Asset tokenization sector valuation has crossed $3.5 billion at press time.

Asset Tokenization Sector Peformance as of May 9, 2025 | Source: Coingecko

As seen above, the current top 10 ranked tokenized assets are backed by a wide range of real-world assets, commodities and securities ranging from gold, silver, to real-estate.

Due to the sheer scale of transactions often involved with this class of assets, SOL Strategies launching Solana-hosted tokenized assets on Superstate’s Opening Bell platform could FORM long-term bullish catalysts.

🇺🇸 HISTORIC: NEW HAMPSHIRE BECOMES THE 1ST STATE TO ESTABLISH A STRATEGIC #BITCOIN RESERVE

THIS IS THE WAY 🚀 pic.twitter.com/rPM1bgSfmZ

Based on the rising spate of historic crypto reserve adoptions in major US regional states including Oregon, Arizona and New Hampshire, SOL could potentially attract billions in fresh demand, potentially driving prices above $200 in Q2, as tokenization infrastructure, corporate adoption and regulatory clarity improves in the coming months.