Coinbase Stock Tanks 3% After Hours as Q1 Earnings Stumble—Wall Street Yawns, Crypto Bros Groan

Another quarter, another ’transitional period’ for Coinbase. COIN shares dipped post-market as the exchange reported weaker-than-expected Q1 earnings—proving even crypto’s blue-chip darling isn’t immune to the ’buy the rumor, sell the news’ circus.

The numbers: Revenue missed by $120M, trading volumes slumped, and those juicy institutional inflows? More of a trickle. But hey—at least their legal team’s staying busy battling the SEC.

Silver lining? Retail traders still love losing money on dog-themed tokens. Some things never change.

Coinbase misses Q1 earnings estimates

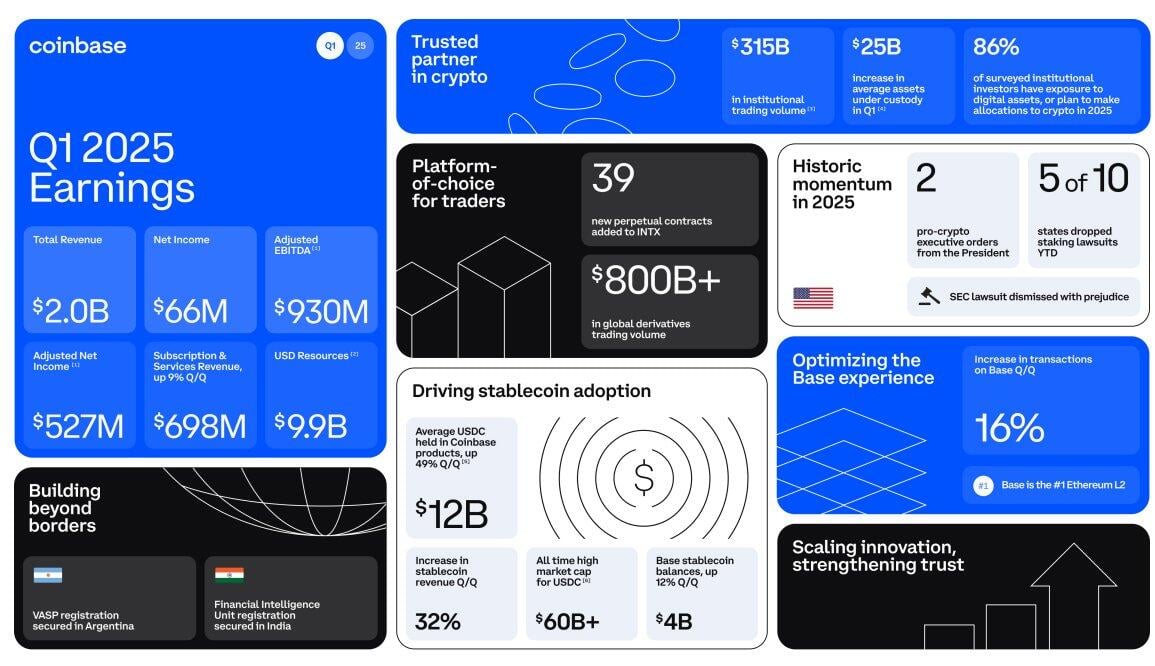

Crypto exchange Coinbase reported a total revenue of $2.03 billion, below analysts’ estimated $2.2 billion and 10% below its revenue in Q4. Its transaction revenue declined 19% Q/Q to $1.26 billion, while subscription and services revenue ROSE 9% Q/Q to $698 million.

Following the decline in total revenue, Coinbase’s adjusted earnings per share (EPS) came in at $1.94, beating estimates of $1.85, but were 40% below that of Q4, per Nasdaq data.

The drop in revenue follows the general crypto and stock market crash in Q1 after President Trump announced tariffs on international trading partners.

However, Coinbase managed to rack up points in its stablecoin sector, with revenue rising 32% Q/Q and the average USDC balance across its products jumping 49% Q/Q to $12 billion. The growth in its stablecoin sector can be traced to positive sentiment surrounding stablecoin regulation in the United States. The Senate Banking Committee approving the GENIUS Act with bipartisan support in March likely contributed to interest in the exchange’s USDC products.

Coinbase Q1 earnings. Source: Coinbase

Other key points in the report include Coinbase securing a VIRTUAL Asset Service Provider (VASP) registration in Argentina and Financial Intelligence Unit registration in India. Coinbase also recorded a major legal win in Q1, with the Securities and Exchange Commission (SEC) dropping its lawsuit against the exchange.

Coinbase earlier announced on Thursday that it WOULD acquire Deribit, the largest crypto options trading platform, in a $2.9 billion deal involving cash and stocks.

Coinbase’s stock COIN rose over 5% on Thursday following the announcement but has retraced in after-trading hours, down over 3% since releasing its Q1 earnings report. The decline comes amid Bitcoin and ethereum surging above $100,000 and $2,100, respectively.