Bitcoin’s Bull Run Continues: Fourth Consecutive Weekly Gain Sets Stage for $100K

Bitcoin isn’t just knocking on $100K’s door—it’s kicking it down. With four straight weeks of gains, the king of crypto is flexing its muscles while traditional finance scrambles to justify its 2% bond yields.

Key drivers? Institutional inflows, ETF approvals, and that beautiful, brutal supply squeeze. The halving’s deflationary mechanics are now fully priced in—miners have stopped dumping, and whales are accumulating.

Watch the $70K resistance level this week. Break that, and we’re in price discovery mode. Just don’t tell the SEC.

Arizona could be the first state to hold BTC as reserve

Bitcoin started this week on a positive note. According to the Bloomberg Government report, Arizona’s Bitcoin Reserve Bill SB1025 was passed on Monday, which allows the state treasurer and retirement system to invest up to 10% of available funds in digital assets, specifically Bitcoin.

The bill is now sent to Democratic Governor Katie Hobbs’s desk, and if signed, the state would be the first to require public funds to invest in Bitcoin. Arizona will become the first US state to hold Bitcoin as a reserve asset, which could set a precedent for other states, such as New Hampshire and Texas, also listed in the State Reserve Race.

Public companies’ demand for Bitcoin remains strong

Pubic companies’ demand for the largest cryptocurrency by market capitalization strengthened this week. MicroStrategy’s Q1 earnings presentation on Thursday reported a loss of $4.2 billion, as the BTC declined from its all-time high of $109,588 in January and closed around $82,550 in March.

Despite the loss in Q1, the firm shows no signs of slowing its pace of Bitcoin acquisitions. Having used up its $21 billion at-the-market (ATM) shelf offering, as explained in the previous report, the company, alongside earnings, announced a fresh $21 billion at-the-market offering.

The injection of this fresh capital could boost BTC’s price and trigger new firms to set their reserves in BTC.

Following the announcement, Japanese company Metaplanet issued $24.7 million in 0% interest bonds on Friday to buy more Bitcoin. It followed a strategy to diversify its treasury with cryptocurrency amid Japan’s economic challenges, like a weakening Japanese Yen (JPY). The firm holds a total of 5,000 BTC in its reserve.

*Metaplanet Issues 3.6 Billion JPY in 0% Ordinary Bonds to Purchase Additional $BTC* pic.twitter.com/e3UIEP7csr

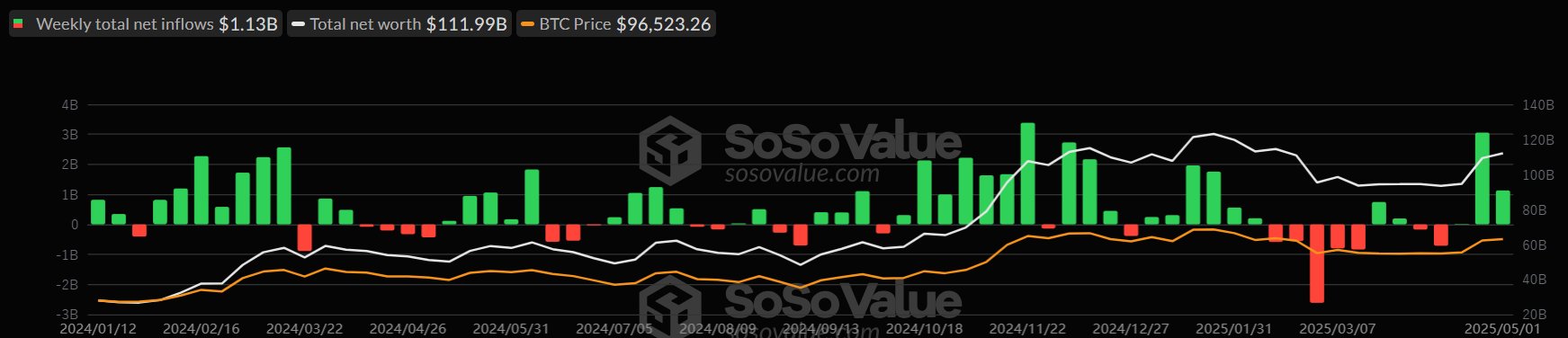

— Metaplanet Inc. (@Metaplanet_JP) May 2, 2025Looking at Bitcoin’s institutional demand, it supported its rally this week. According to SoSoValue data, the US spot Bitcoin ETF has recorded a total inflow of $1.13 billion as of Thursday, continuing its three-week inflow streak since mid-April. If these inflows continue and intensify, Bitcoin prices could rally further.

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

Bitcoin rallies despite weak economic conditions

Bitcoin price remains strong despite the weak economic conditions in the US. The Kobessi Letter report explains that the unexpected GDP contraction (the first since early 2022) came alongside inflation data exceeding forecasts, as shown by the PCE Price Index, also at 3.7% versus the expected 3.1%. Other data seem to point to a deteriorating economic outlook, such as Oil prices dropping below $60 and US consumer confidence falling sharply to 86, the lowest level since May 2020.

Such a slowdown in economic conditions indicates stronger chances of entering a stage of stagflation – when the economy is characterized by stagnant growth and high inflation.

Traders should be cautious as stagflation fears will likely drive a risk-off sentiment in the market, which does not bode well for risky assets such as Bitcoin. Moreover, high inflation reduces retail investor participation, and the US Federal Reserve’s (Fed) reluctance to cut rates immediately adds to the headwinds.

What is there for Bitcoin in May?

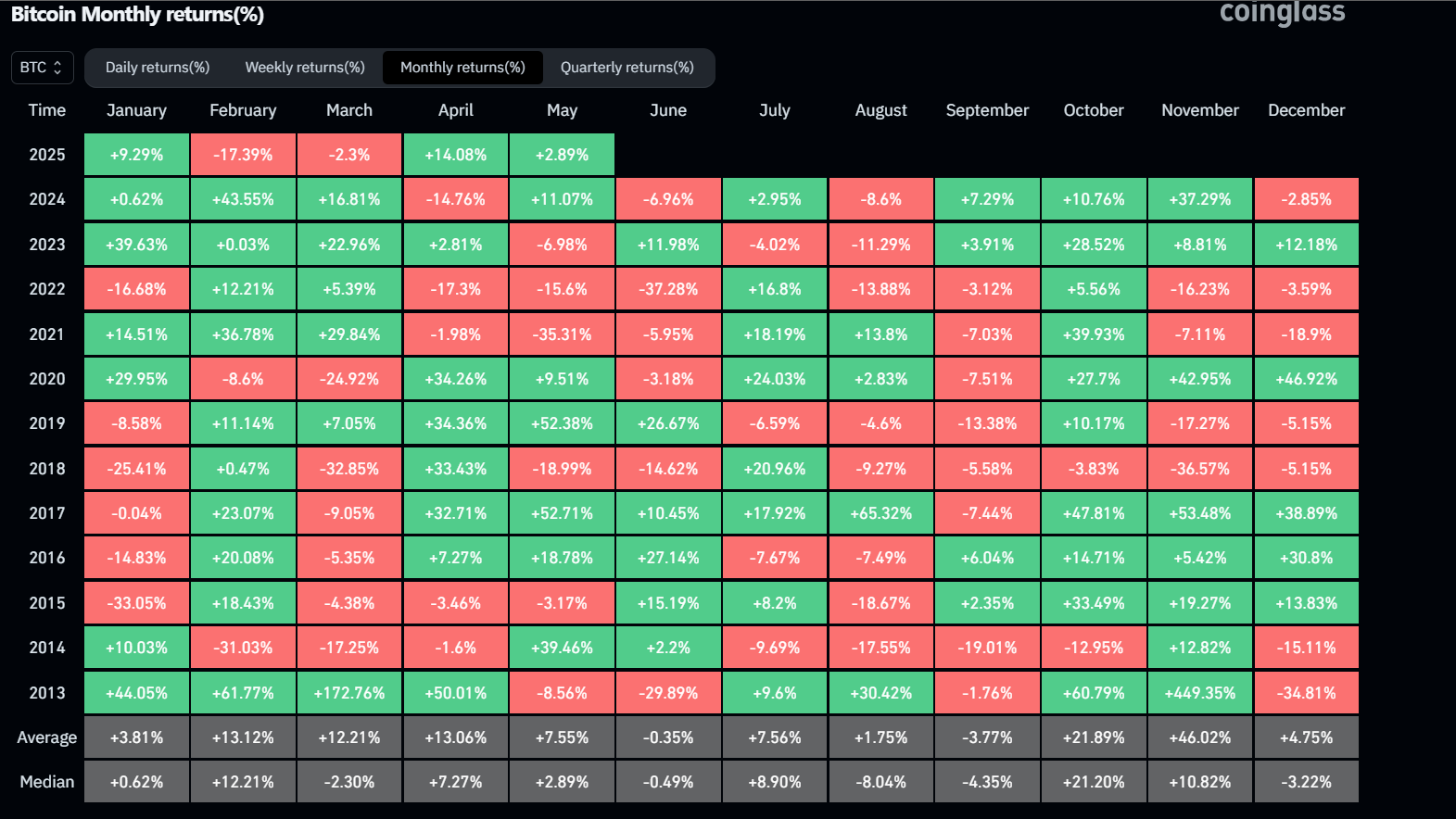

Bitcoin’s monthly returns for April came higher than its average returns, ending with an increase of over 14% in the month. According to Bitcoin’s historical data, BTC generally has a positive yield in May, averaging 7.5%.

Bitcoin monthly returns chart. Source: Coinglass

Will BTC reach the $100,000 mark?

Bitcoin price broke above its key resistance level of $95,000 on Thursday after consolidating around it for the past five days and reaching a high of $97,400. At the time of writing on Friday, it trades at around $97,000.

If BTC continues its upward momentum and closes above its daily resistance at $97,700, it could extend the gains to retest its psychological resistance at $100,000.

The Relative Strength Index (RSI) on the daily chart reads 70, hovering around overbought levels. Traders should be cautious as the chances of a pullback are high once the RSI reaches such an area. Another possibility is that the RSI will remain above the overbought levels and continue its price rally.

BTC/USDT daily chart

However, if BTC fails to close above $97,700, it could face a correction toward its next daily support at $95,000.