Bitcoin Defies Gravity Near $97K as Hedge Fund Goes All-In

BTC clings to record highs—just shy of the psychological $100K barrier—as institutional players double down. One quant fund quietly shifts its entire derivatives portfolio into bitcoin futures, betting against traditional hedges.

Wall Street’s latest love affair with crypto looks suspiciously like FOMO dressed in algorithmic clothing. Meanwhile, gold bugs sob into their safety-deposit boxes.

Bitcoin hovers near $97,000, is $100,000 next?

Bitcoin trades less than 5% away from $100,000 on Friday. The largest cryptocurrency made strides despite market uncertainty and sentiment among crypto traders improves.

The crypto Fear & Greed Index signals “greed” among traders, swinging from Thursday’s “neutral” stance and signaling that sentiment is turning bullish.

Crypto Fear & Greed Index | Source: Alternative.me

Bitcoin’s technical indicators are throwing mixed signals. The Relative Strength Index (RSI) reads 70, right in overbought territory. Meanwhile, the Moving Average Convergence Divergence (MACD) flashes green histogram bars, meaning the underlying momentum in Bitcoin’s upward trend is positive.

Traders need to watch the indicators carefully for potential signs of a trend reversal since RSI has crossed into the “overvalued” or “overbought” zone. Typically a drop from this zone could trigger a sell signal. MACD histogram bars are consecutively shorter as observed in the chart below.

BTC/USDT daily price chart

A flash crash could send Bitcoin to test support at $91,935, the upper boundary of a Fair Value Gap (FVG) on the BTC/USDT daily price chart.

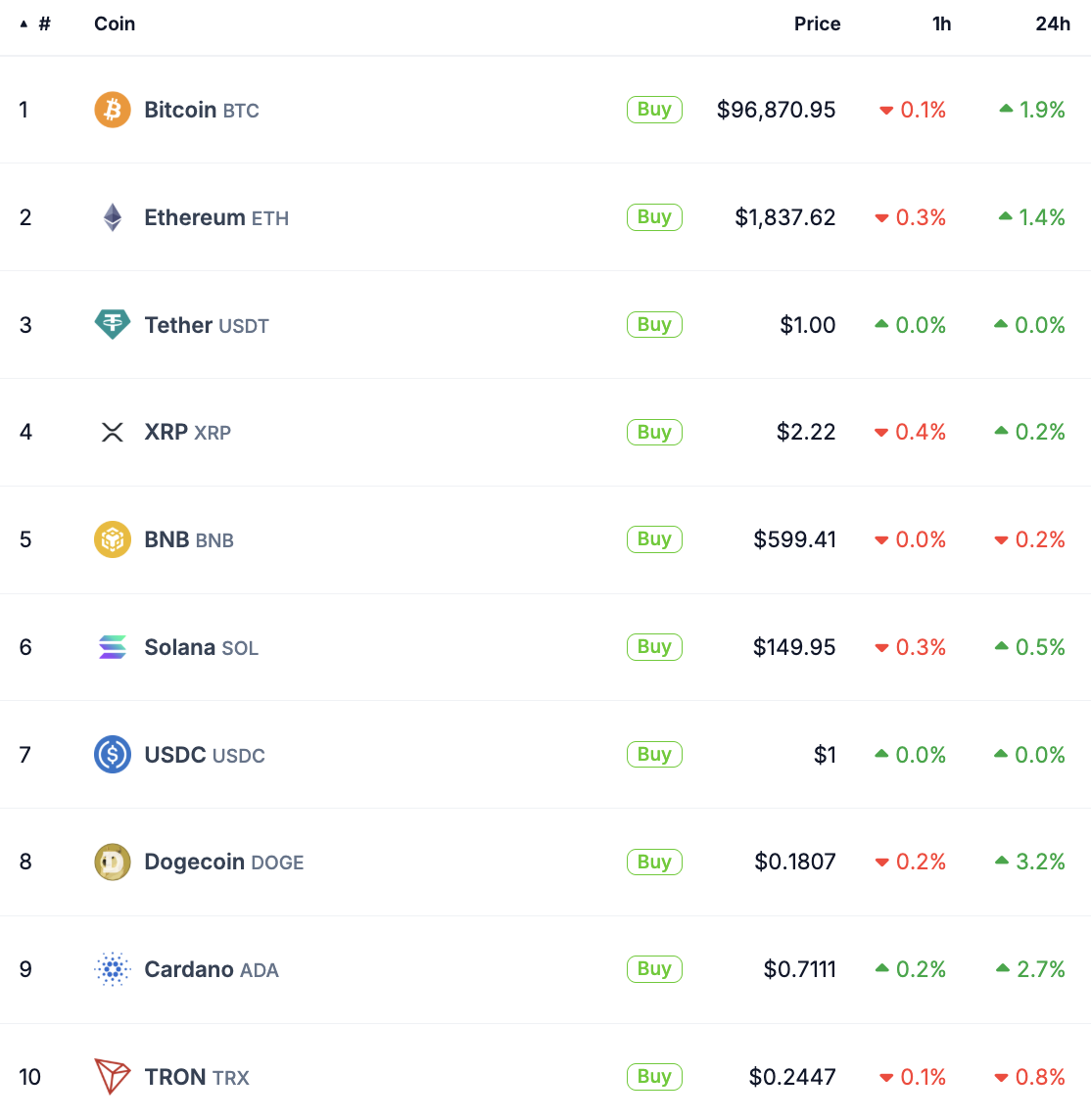

Top 10 cryptos gain on Friday, trader sentiment bullish

Barring Binance Coin (BNB) and Tron (TRX), nearly all cryptocurrencies in the top 10 gained in the last 24 hours, as seen on CoinGecko. Bitcoin’s rally to $97,000 pushed other assets higher alongside the top crypto.

The performance of the top 10 cryptocurrencies is considered an indicator of the state of the crypto market.

Top 10 cryptos price in 1 hour and 24 hours | Source: CoinGecko

Strategy doubles down on Bitcoin bet

In its Q1 2025 earnings call, Strategy’s former CEO Michael Saylor announced that the business intelligence firm has pushed expectations for Bitcoin gains to $15 billion in 2025. Saylor explained how corporates look at MSTR stock as a “shortcut” to owning BTC.

Strategy announces BTC Yield of 13.7% and BTC $ Gain of $5.8B year-to-date, doubles capital plan to $42B equity and $42B fixed income to purchase bitcoin, and increases BTC Yield target from 15% to 25% and BTC $ Gain target from $10B to $15B. $MSTR $STRK $STRF

— Strategy (@Strategy) May 1, 2025To back Saylor’s claims, MSTR stock has outperformed Bitcoin over a 12-month and a five-year period. Strategy currently holds nearly $50 billion worth of Bitcoin, a large stockpile, and competes with BTC as a “proxy”.

Saylor explained that Strategy, whose quarterly results missed Wall Street’s expectations by a wide margin, looks forward to raising $42 billion in debt to buy more BTC this year.

With MSTR holding Bitcoin on its balance sheet, investors seeking exposure to the largest crypto token have the option to buy BTC directly, or choose between US-based Spot Bitcoin ETFs (that hold Bitcoin) or stocks of firms like MSTR ().

Saylor’s statements likely catalyzed the bullish sentiment among traders on Friday.