Solana (SOL) Primed for Rally as Stablecoin Boom Hits $13B and ETF Hype Intensifies

Solana’s price charts are flashing green as two massive tailwinds converge: the network’s stablecoin market cap just smashed the $13 billion milestone, while Wall Street oddsmakers ramp up bets on a SOL ETF approval.

Stablecoins—the lifeblood of crypto trading—are flooding onto Solana’s high-speed blockchain at a record pace. That liquidity surge typically precedes major price breakouts.

Meanwhile, institutional players are quietly positioning for what could be crypto’s next ETF gold rush. ’The SEC’s resistance is crumbling faster than a meme coin’s tokenomics,’ quips one trader.

Watch the $180 resistance level—a clean break here could send SOL racing toward its all-time high. Just don’t expect the suits in Washington to cheer when it happens.

Solana stablecoin activity soars

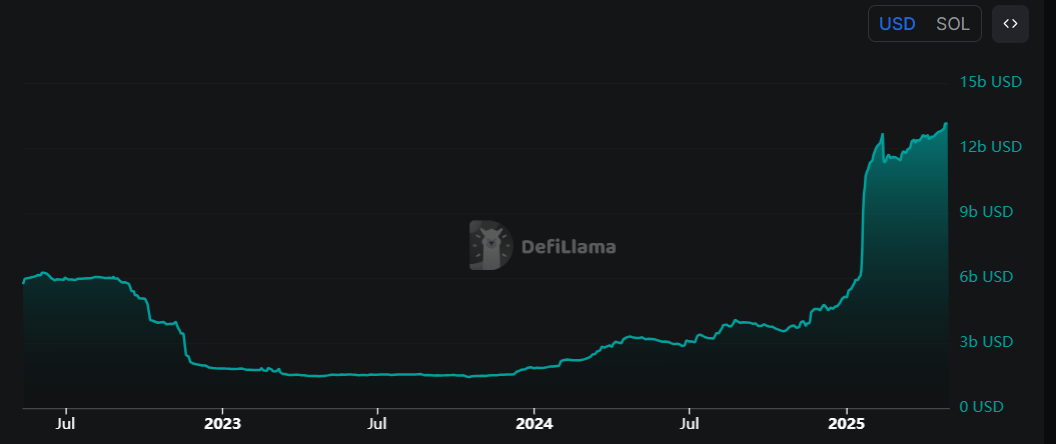

The value of stablecoins on the Solana blockchain has steadily risen since early February. According to DefiLlama data, the stablecoin market capitalization currently stands at $13.06 billion. Such stablecoin activity and value increase on the SOL project indicate a bullish outlook, as it boosts network usage and can attract more users to the ecosystem, driven by Decentralized Finance (DeFi), meme coins, and payment use cases.

Solana stablecoin market capitalization chart. Source: DefiLlama

Solana ETF approval chances rise to 90%, fueling market optimism

According to Bloomberg Intelligence, the likelihood of US regulators approving a Solana spot ETF in 2025 has risen to 90%. The report also shows that other spot crypto ETFs, such as Litecoin (LTC), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), Polkadot (DOT), Hedera (HBAR), and Avalanche (AVAX), have odds above 70%.

Six asset managers — Grayscale, VanEck, 21Shares, Canary, Bitwise, and Franklin — have filed for an SOL ETF and are awaiting clearance from the US Securities and Exchange Commission (SEC) to list the ETF. ETF filings by big investment companies are generally positive signs for Solana in the long term, as an ETF can make it easier for traditional investors to gain exposure to SOL without needing to purchase and store the cryptocurrency directly. Moreover, approving an ETF could lend more legitimacy to SOL and increase liquidity.

Spot crypto ETF filing chart. Source: Bloomberg Intelligence

Solana Price Forecast: SOL finds support around its 50-day EMA

Solana price faced rejection around its daily resistance level of $160 last week. It declined by 5% over the next five days, finding support around its 50-day EMA at $140.30 on Wednesday. At the time of writing on Thursday, it hovers around $149.

If the 50-day EMA at $140.30 continues to hold and SOL closes above $160, it could extend the rally to retest its next daily resistance at $177.66.

The Relative Strength Index (RSI) on the daily chart reads 61, above its neutral level of 50, indicating bullish momentum.

SOL/USDT daily chart

However, if SOL closes below $140.30, its 50-day EMA could extend the correction to retest its daily support level at $118.10.