Wall Street’s Gatekeepers Finally Crack Open Bitcoin ETFs—Your Clients Are Waiting

After years of foot-dragging—and missing Bitcoin’s 1,000%+ rally—the Big Four wirehouses are rolling out spot BTC ETFs to millions of accredited investors. Cue the compliance theater.

Why now? Pressure from clients who’ve watched crypto-natives outperform their 60/40 portfolios for a decade. The irony? These same firms blocked GBTC conversions for years... while charging 2% for underperforming alts.

The playbook: Expect a flood of ’educational’ webinars (read: sales pitches), carefully curated ’risk frameworks,’ and of course, juicy new management fees on what’s essentially a commodity play. The real unlock? When these products hit 401(k) platforms—Wall Street’s last moat.

Meanwhile in crypto-land: Vanguard still won’t touch BTC, Citadel’s building a dark pool, and every family office now runs a ’blockchain strategy.’ Just don’t call it FOMO.

$12 billion Bitwise CIO expects big four wirehouses to allow their advisors to access #Bitcoin ETFs this year.

$12 billion Bitwise CIO expects big four wirehouses to allow their advisors to access #Bitcoin ETFs this year.

– Merrill Lynch

– Morgan Stanley

– Wells Fargo

– UBS

Institutions are here.

— Next Layer Capital (@nextlayercap) April 30, 2025

These firms manage a combined $10 trillion in assets, so when they move, the whole market feels it. Right now, their clients don’t have direct access to Bitcoin ETFs on their platforms. But Hougan says that is changing. Behind the scenes, due diligence reviews are happening, systems are being updated, and conversations are heating up.

The expectation? By the end of 2025, advisors at these firms could be recommending Bitcoin ETFs right alongside stocks, bonds, and mutual funds.

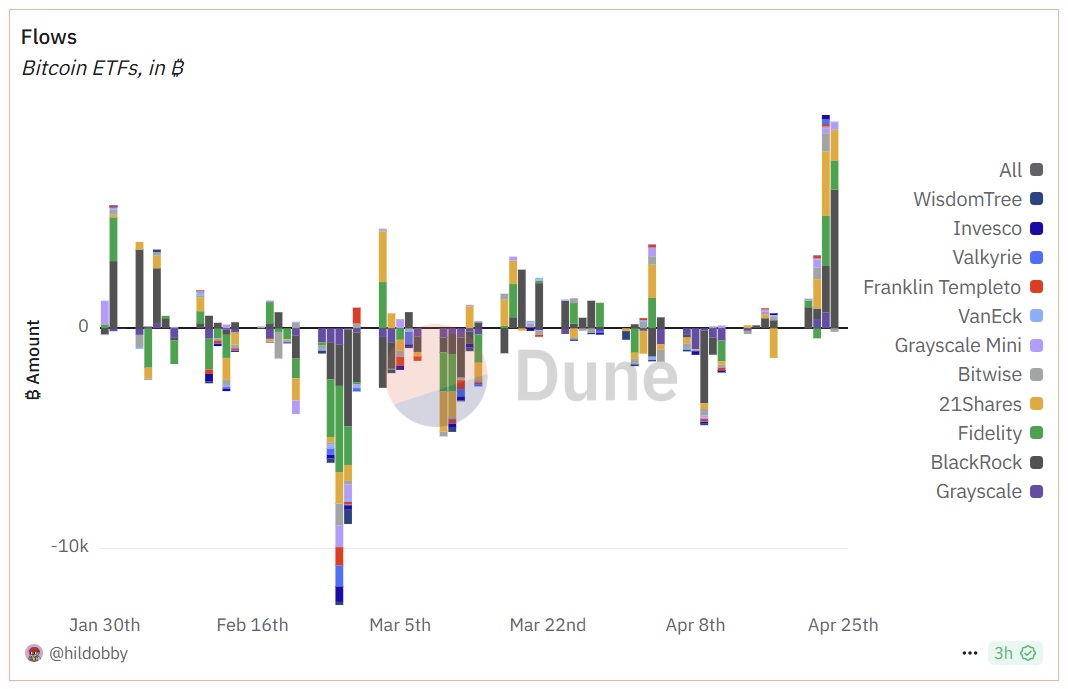

Bitcoin ETF Inflows So Far in 2025

So far, Bitcoin ETF flows show big investor shifts. Grayscale saw major outflows, while BlackRock and Fidelity gained most inflows. Late April marked a strong comeback with over $500M flowing in.

Projected Record Inflows into Bitcoin ETFs

So far, 2025 has been slower for Bitcoin ETF inflows compared to last year. In 2024, the launch frenzy brought in a jaw-dropping $35 billion. This year, we’re sitting at around $3.7 billion so far. But if wirehouses open the gates, Hougan says those numbers could explode again, maybe even set new records before year’s end.

It’s a case of “slow now, big later.” Hougan believes that once Bitcoin ETFs are offered on the same platforms that manage most Americans’ retirement and brokerage accounts, inflows will go from a trickle to a flood. Financial advisors tend to move carefully, but once they’re in, they often stay for the long haul.

Shift from Retail to Institutional Investment

One big trend that is already playing out? The handoff from retail to institutional investors. While individual crypto investors helped get the ETF party started, institutions are quickly taking over.

DISCOVER: Best New Cryptocurrencies to Invest in 2025Robert Mitchnick, BlackRock’s Head of Digital Assets, noted that wealth managers and institutional clients are now responsible for a bigger share of Bitcoin ETF assets than individual investors. That’s a strong vote of confidence from some of the most cautious players in finance.

What Can We Expect to See from the Crypto Market?

If the big four wirehouses really do start offering Bitcoin ETFs, we’re likely to see more liquidity, fewer price swings, and potentially a sturdier floor under the market. It also opens the door for other crypto assets to follow a similar path into traditional portfolios.

This isn’t just a win for Bitcoin fans. It’s a sign that crypto is finding its place in the broader financial system, not as a fringe bet, but as something serious investors are now expected to consider.

Conclusion

We’re not there yet, but the wheels are turning. If Hougan’s prediction comes true and the major wirehouses jump on board by the end of 2025, the crypto market could enter a whole new phase. It would mark one of the most important steps so far in bringing digital assets fully into the financial mainstream. Investors, take note, your advisor might be talking Bitcoin sooner than you think.

Key Takeaways

- The four largest U.S. wirehouses, Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS, are preparing to offer Bitcoin ETFs to their clients.

- These firms manage a combined $10 trillion in assets, and opening access to Bitcoin ETFs could significantly boost mainstream crypto adoption.

- Bitwise CIO Matt Hougan predicts that Bitcoin ETF inflows could hit new records by the end of 2025 once wirehouse platforms go live.

- Institutional players are increasingly dominating ETF allocations, marking a shift away from retail-driven investment in crypto.

- If approved, Bitcoin ETFs on wirehouse platforms could lead to greater market liquidity, reduced volatility, and wider portfolio integration.