Bitcoin Holds Firm as ’Digital Gold’ Amid Political Turmoil—NYDIG Analysis

As Washington reels from policy chaos, Bitcoin quietly does what it does best: acts as a volatility sponge for macroeconomic uncertainty.

The Unflappable Asset: While traditional markets twitch at every Trump-era headline, BTC’s price action resembles a bored Swiss banker—unimpressed by political theater.

Behind the Numbers: NYDIG data shows institutional flows into Bitcoin ETFs actually accelerated during peak political drama this week. Because nothing says ’hedge against dysfunction’ like a decentralized asset that ignores DC entirely.

The Punchline: Turns out when you can’t trust politicians or central banks, people suddenly remember why Satoshi invented this thing in the first place. (Take notes, goldbugs—your shiny rock just got outmaneuvered by math.)

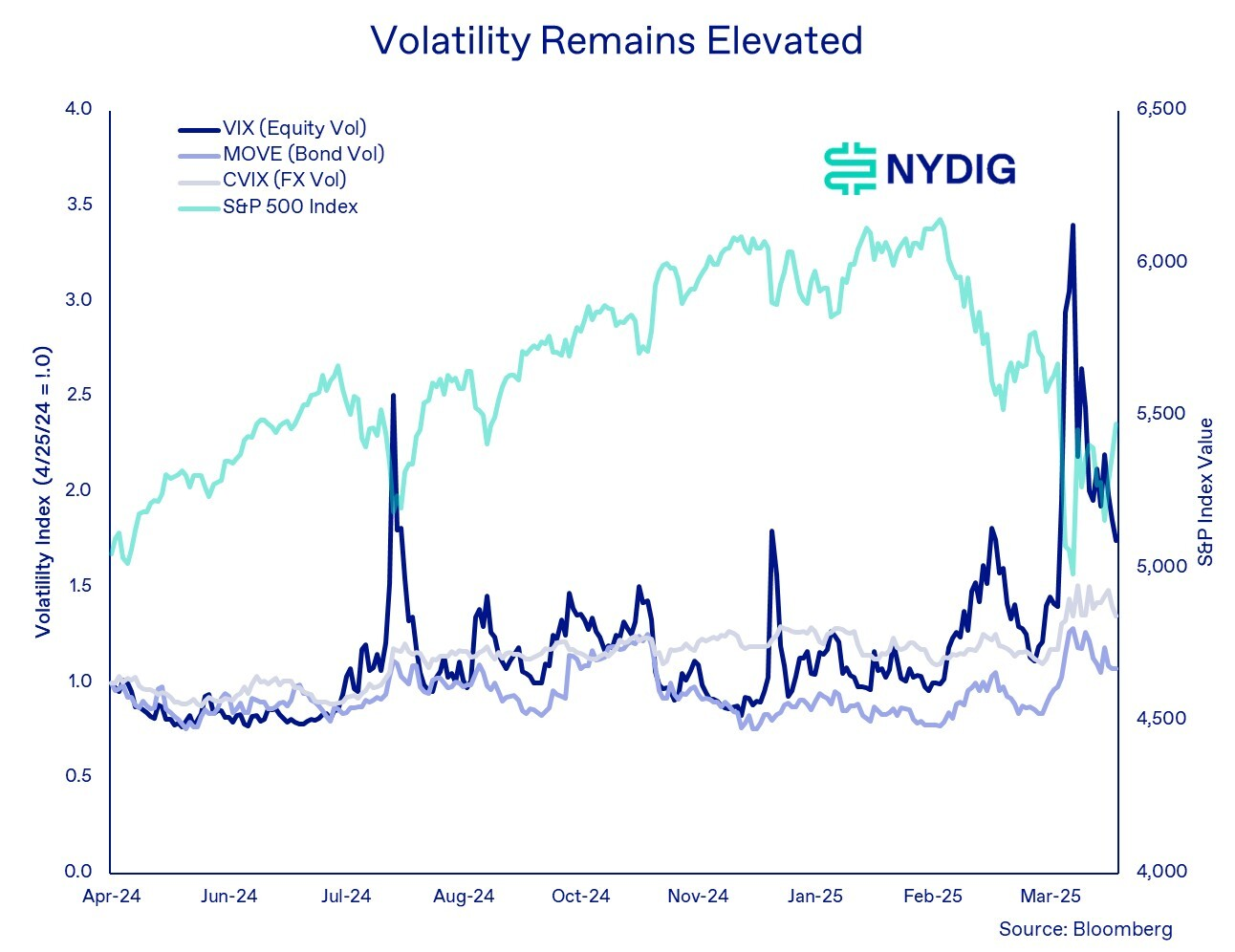

Several asset classes have recently seen high volatility. Source: NYDIG

Cipolaro said investors are also seeking alternatives to US hegemony, whether that is stocks, bonds, forex, or commodities.

Few large liquid options

However, Cipolaro said investors seeking alternatives outside traditional financial systems have few large, liquid options.

Gold remains the largest non-sovereign store of value at around a $22 trillion market cap, while Bitcoin has just a fraction of that at $1.8 trillion.

Additionally, Bitcoin is the only top crypto asset listed that “solely focuses on monetary or store of value use cases,” while the others are better described as the fuel for decentralized application platforms, he said.

Cipolaro concluded that despite Bitcoin’s recent gains, “there are few signs of the market overheating,” and the recovery is still in early stages.