Bitcoin Rockets to $94K—Macro Hopes and Investor Whiplash Fuel Rally, Says Glassnode

Bitcoin just punched through $94,000—a staggering surge that’s equal parts macro euphoria and traders flipping bullish faster than a Wall Street analyst downgrading a stock after it peaks. Glassnode’s latest data shows institutional FOMO is back, but let’s be real: half these ’investors’ still think ’HODL’ is a crypto-themed energy drink.

The rally’s backbone? A cocktail of Fed pivot hopes, spot ETF inflows, and that classic crypto narrative: ’This time it’s different.’ Meanwhile, traditional finance bros are too busy arguing about rate cuts to notice their 60/40 portfolios just got lapped by a meme-friendly digital asset.

Pro tip: When Bitcoin eats gold’s lunch while tech stocks flatline, maybe—just maybe—the ’uncorrelated asset’ crowd wasn’t entirely full of it. Or this is another pump before the inevitable ’macro headwinds’ tweetstorm. Place your bets.

Bitcoin’s cross above $90K sees short-term holders demonstrating high profit-taking behavior

This week, the crypto market rebounded from recent downturns, with Bitcoin climbing as high as $94,000 on Tuesday. Bitcoin’s rally stemmed from speculations of a calm in the US-China tariff war, which quickly sparked optimism among investors.

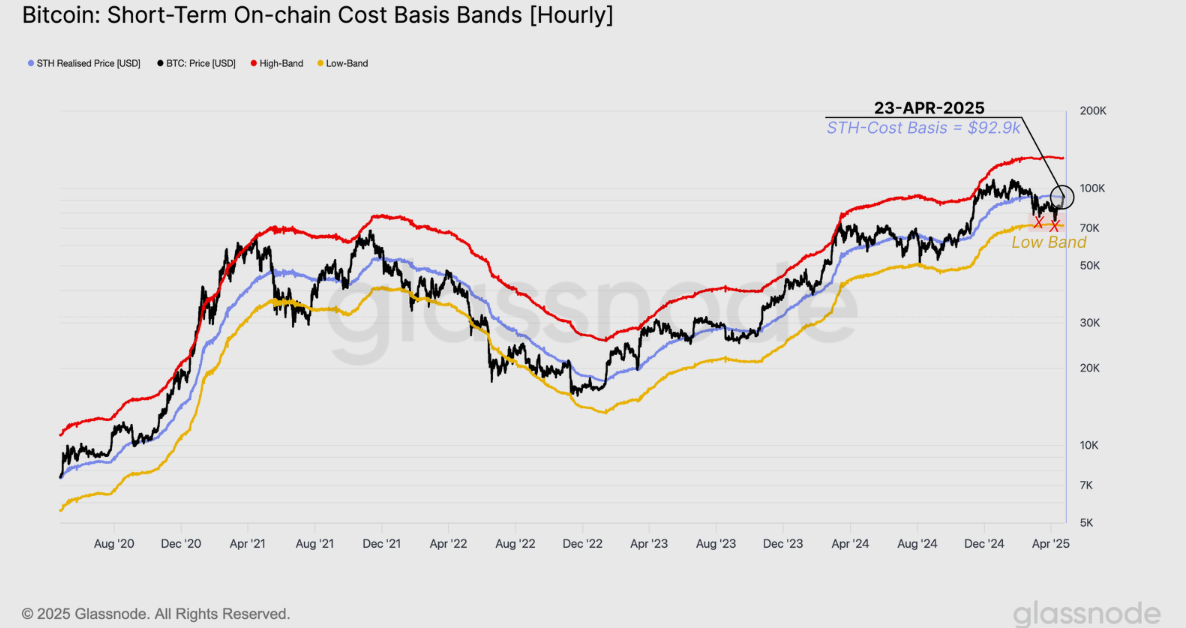

The rally caused Bitcoin to break above the Short-term Holder (STH) Cost Basis — a metric measuring the average purchase price of short-term holders — currently at $92,900, according to Glassnode’s weekly on-chain report. The report stated that a move above the STH Cost Basis historically signals the end of a bearish phase and the start of a new bullish trend.

BTC STH Cost Basis. Source: Glassnode

The rise was also accompanied by a recovery in unrealized profit held by investors. Bitcoin’s percentage supply in profit metric ROSE to 87.3%, 5% more than the previous range of 82.7% — when Bitcoin last traded around $94,000 in early March. This indicates that 5% of Bitcoin’s circulating supply has changed hands at lower price levels since early March.

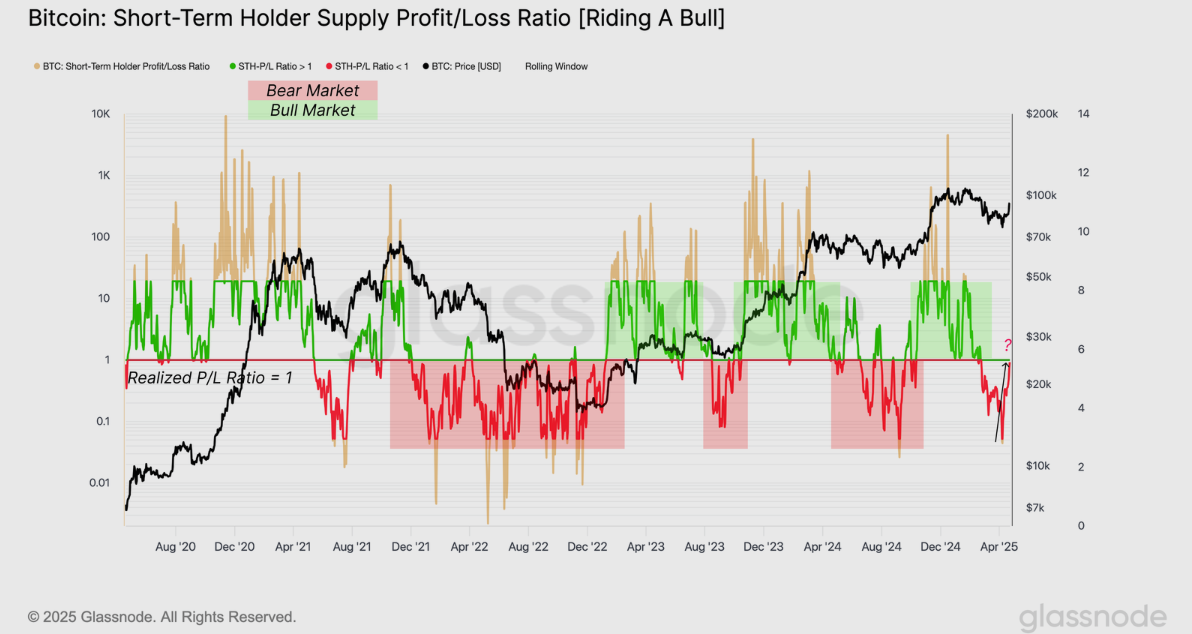

Alongside the unrealized profit metric, Glassnode’s analysts revealed a rise in the STH Supply Profit/Loss Ratio to a neutral level of 1.0.

"This suggests that short-term supply is more evenly split between coins in profit and loss, making this a point of balanced sentiment for this cohort," Glassnode stated in the report.

A movement to neutral levels is significant, as it signals that Bitcoin has risen out of a bearish phase to more stable ground. A push or pullback from here will either lead to a local top for BTC or a more robust recovery.

Bitcoin STH Supply Profit/Loss Ratio. Source: Glassnode

However, the recent surge in prices has been accompanied by high profit-taking behavior among short-term investors, showing that many are taking advantage of the rally to realize profits.

Glassnode stated that if the market can withstand this wave of selling without a major pullback, it would signal a healthier and more resilient outlook for BTC.

On the other hand, if current levels fail to hold under the weight of this profit-taking, the recent price rise could prove to be yet another "dead cat bounce." This indicates that the recovery could be short-lived, mirroring previous relief rallies, which ultimately lost momentum under similar conditions.

Additionally, Bitcoin has received strong support among institutional investors during this period, with ETFs netting inflows of $1.83 billion between Tuesday and Wednesday, according to Farside Investors data. This implies that bullish sentiment is gradually rising among traditional investors.