Mantra Announces Strategic Buyback Initiative and Massive 300M Token Burn, CEO Pledges Personal Stake

In a significant move to enhance tokenomics and investor confidence, Mantra has unveiled a comprehensive buyback program alongside the burning of 300 million tokens. Demonstrating strong leadership commitment, the company’s CEO has voluntarily pledged personal holdings to support the initiative. This strategic decision aims to reduce circulating supply, potentially increasing scarcity and long-term value. The token burn represents a substantial portion of the total supply, signaling a bullish outlook for the project’s future. Market analysts anticipate this could create upward price pressure while showcasing the team’s alignment with stakeholder interests.

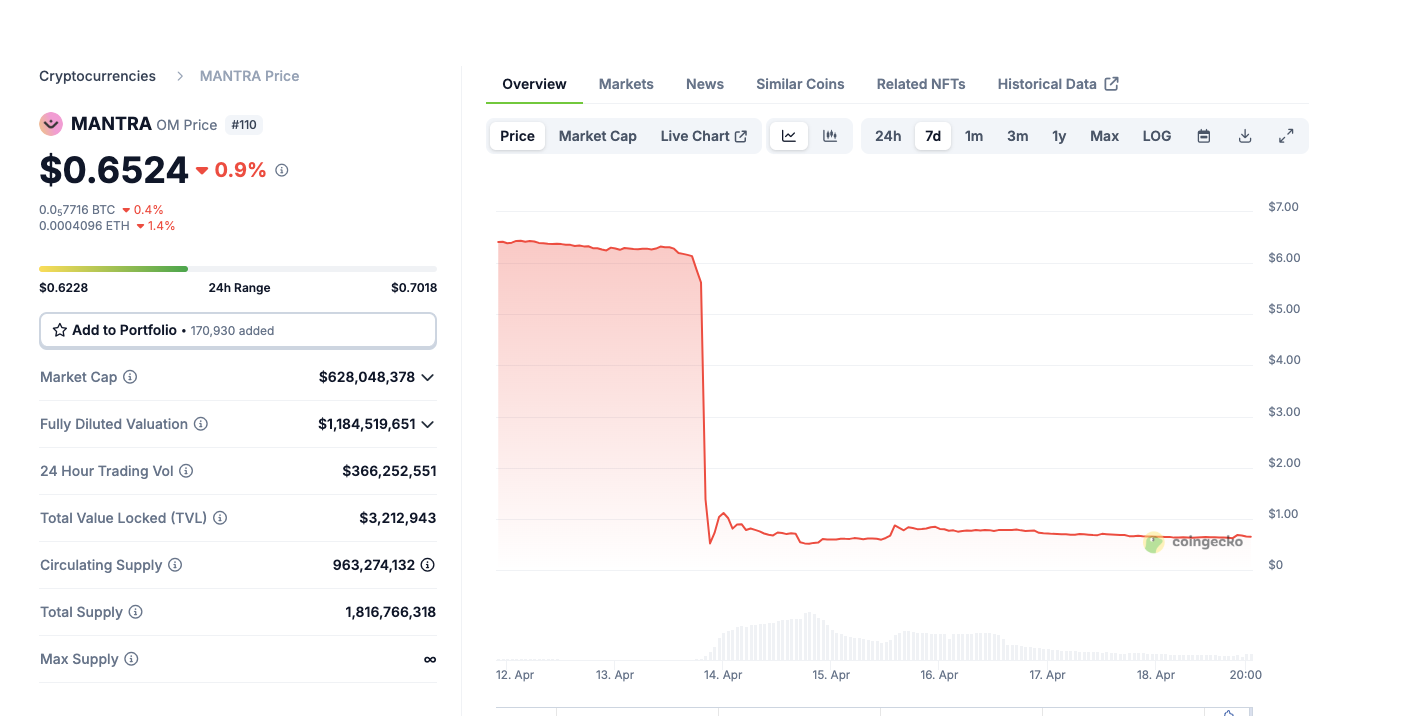

Mantra (OM) Token Price Action | Source: Coingecko

Notably, the Mantra CEO insists the price drop was not caused by insider selling, but forced liquidations during low-liquidity periods.

“There were no team sales during this event,” Mullin reiterated. “It was a result of reckless leverage and poor liquidity management on CEXs.”

A formal statement released on Wednesday also confirmed internal findings that the liquidation of OM-collateralized positions during low-volume trading hours caused the disruption. The token briefly recovered above $1 before settling around $0.65,still down over 88% from its pre-crash peak.

Governance vote, tokenomics dashboard aim to restore confidence

Mantra is pursuing multiple strategies to restore investor trust, including new transparency tools, financial commitment from its leadership, and community-driven governance votes.

First, the team plans to launch a real-time tokenomics dashboard, enabling the public to monitor OM’s circulating and locked supply. This comes after Mullin committed to burning his personal OM allocation as part of the recovery effort, a move intended to signal leadership accountability.

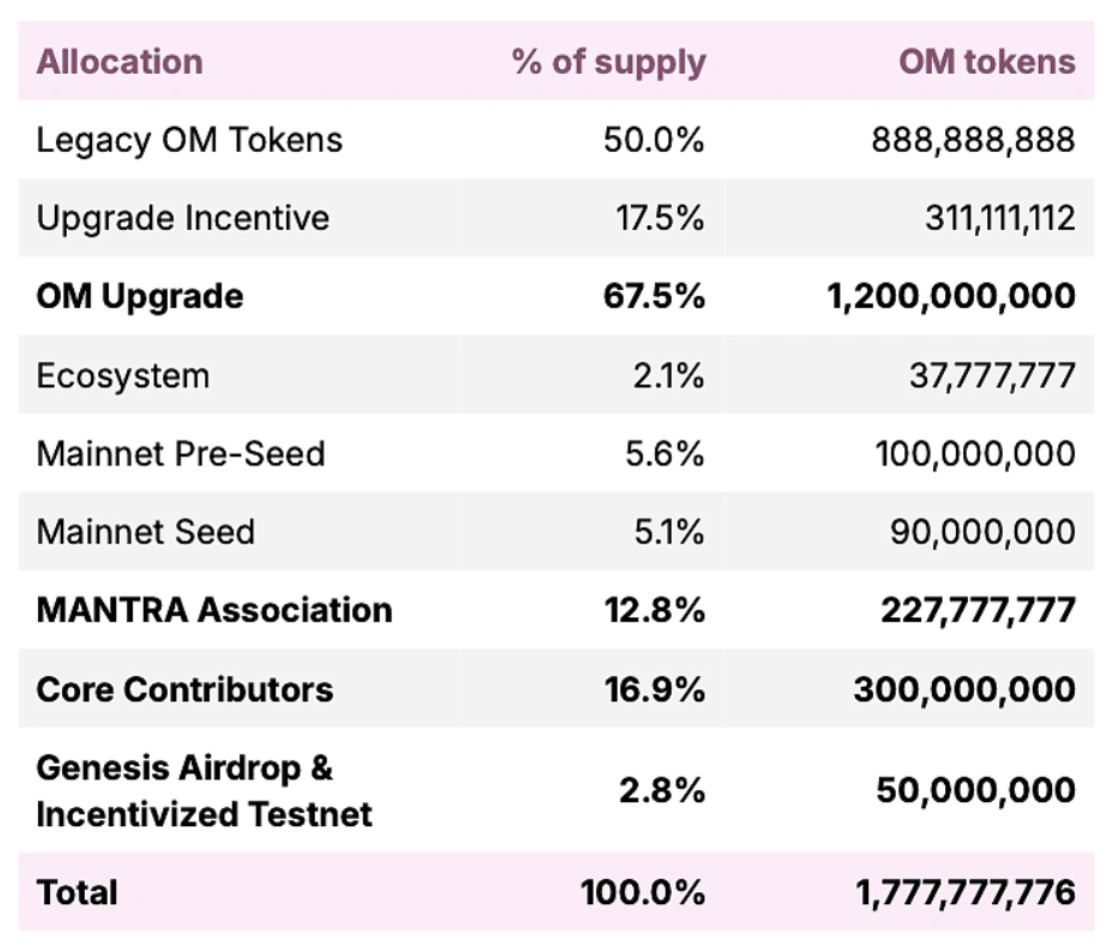

Mantra (OM) Tokenomics | source: https://docs.mantrachain.io/mainnet-om-information/chain-features

One of the most contentious proposals involves a DAO vote to determine whether the community will support burning 300 million OM tokens allocated to CORE contributors and team members. These tokens—representing about 17% of OM’s total supply—are currently locked and set for gradual release between April 2027 and October 2029.

“Some have voiced concerns about burning too many tokens allocated for team incentives,” Mullin said. “We’ll leave it to the community to decide via decentralized governance.”

The value of this team allocation has dropped from nearly $1.8 billion pre-crash to about $200 million as of Friday.