Canada Pioneers Global Financial Markets with Inaugural Solana ETF Launch Amid $270M Staking Influx, Driving SOL Past Bitcoin and Ethereum

In a landmark move for digital asset adoption, Canada has become the first nation to approve a Solana-focused exchange-traded fund (ETF). This regulatory milestone coincides with a surge of $270 million in new staking deposits flowing into the Solana ecosystem, creating sufficient buy pressure to propel SOL’s price performance beyond both Bitcoin (BTC) and Ethereum (ETH) on weekly charts. The ETF launch signals growing institutional recognition of Solana’s high-throughput blockchain architecture, while the staking influx demonstrates strong network participation during this bullish phase. Market analysts suggest these developments may trigger competitive ETF filings in other jurisdictions as regulatory frameworks for alternative Layer 1 cryptocurrencies mature.

Solana price skips past Bitcoin and Ethereum as Canadian firm launches first SOL spot ETF

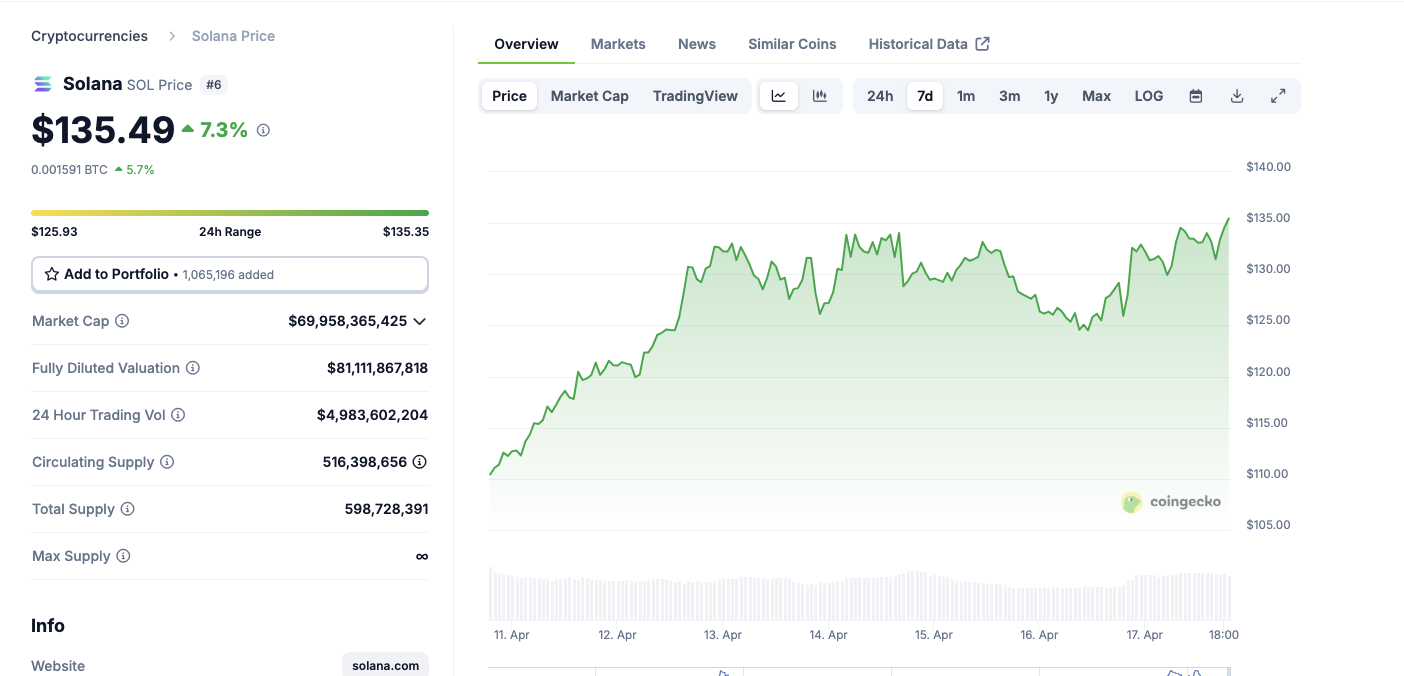

While bearish sentiment from the United States (US) trade war remains active, Solana price climbed 6% on Thursday, crossing the $135 mark and outperforming both Bitcoin and Ethereum.

This bullish SOL price breakout coincides with the historic launch of the world’s first Solana spot ETF by Canada-based Purpose Investments, which began trading on Thursday on the Toronto Stock Exchange under the ticker CSOL.

Solana price action, April 17 | Source: Coingecko

In a press release, Purpose Investments said the ETF offers direct exposure to SOL without requiring investors to engage in self-custody or complex wallet management. The firm emphasized that institutional demand for alternative Layer-1 blockchains is rising sharply, and the Solana ETF meets this demand by offering a regulated and accessible vehicle to gain exposure.

Som Seif, CEO of Purpose Investments, noted: “With the growing adoption of Solana’s ecosystem in DeFi, NFTs, and gaming, we believe this ETF will bridge a critical gap for Canadian investors seeking secure, compliant access to high-growth digital assets.”

He added that Solana’s combination of scalability and low-cost transactions positions it as a credible contender to Ethereum’s dominance, particularly as institutional capital begins to diversify beyond BTC and ETH.

Why is Solana ETF launching in Canada?

The ETF launch comes amid renewed interest in crypto assets following dovish signals from central banks globally. With the European Central Bank expected to cut rates and growing pressure on the US Federal Reserve to follow suit, liquidity conditions are turning favorable for risk assets, including crypto.

The launch of a spot ETF in a major G7 economy adds a layer of legitimacy to Solana, a network often scrutinized for its occasional downtime but praised for its rapid throughput and developer-friendly architecture.

$270 million staking deposits in 4 days could propel Solana price rally further

Market watchers view the ETF not just as a bullish trigger for price action, but as a structural shift in how institutions might approach altcoin exposure moving forward. The gains observed on Thursday suggest many investors see it as a precursor to Solana gaining market share, as Ethereum falters.

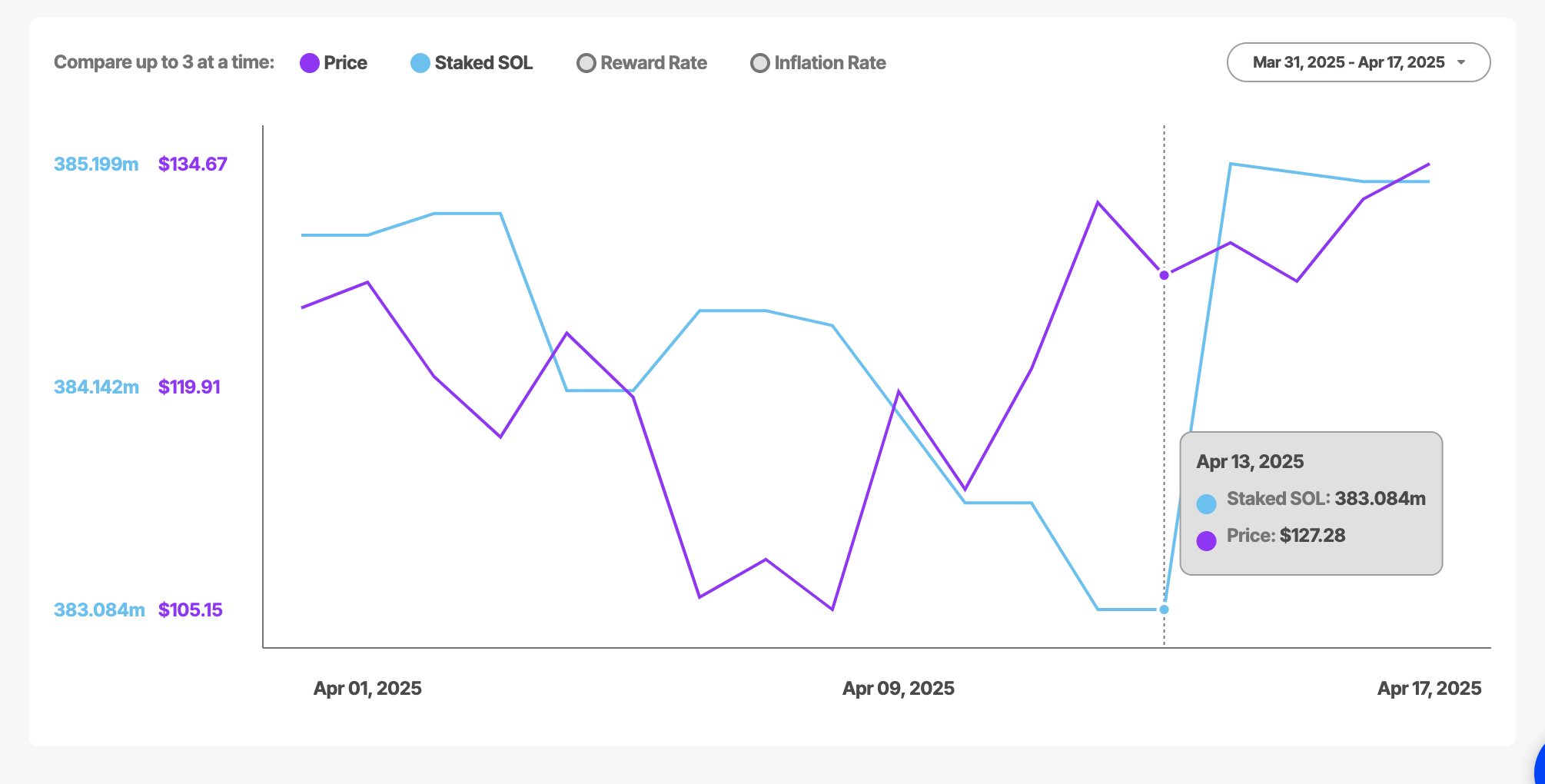

On-chain data paints an equally bullish picture. Since Sunday, staking deposits on the Solana network have surged from 383.1 million SOL to 385.1 million SOL—an increase of 2 million SOL valued at roughly $270 million.

This uptick in staked supply reflects strong investor conviction and removes active float from circulation, effectively tightening supply as demand surges.

The spike in staking also follows last week’s repeal of a restrictive DeFi regulation by US President Donald Trump. That move has invigorated DeFi projects across alternative blockchains, with Solana’s total value locked (TVL) in decentralized finance protocols rising sharply since the policy reversal.

Will Solana encroach Ethereum’s market dominance ?

Previously, Ethereum had enjoyed a unique de facto regulatory status following the approval of ETH ETFs in 2024. However, DeFi trends observed after Trump’s latest move, Solana now appears poised to close that legitimacy gap.

Ethereum, meanwhile, continues to face headwinds, including controversial network upgrades and performance issues. At press time, ETH price remains stagnant at under $1,600, while SOL breaks above the critical resistance at $135 with strong trade volumes and fundamental momentum.

Coupled with institutional inflows from Canada’s ETF and favorable regulatory sentiment, Solana could be on the verge of a sustained breakout, potentially closing the gap on ETH when US-based SOL ETFs get approved.