Cryptocurrency Market Analysis: Bitcoin (BTC), Solana (SOL), and Broader Trends - US Market Recap - April 17, 2025

This report provides an in-depth analysis of the cryptocurrency market as of April 17, 2025, focusing on Bitcoin (BTC) and Solana (SOL) price movements, along with broader market trends. We examine key technical indicators, market sentiment, and macroeconomic factors influencing digital asset valuations. The analysis includes support/resistance levels for major cryptocurrencies, trading volume patterns, and institutional activity. Special attention is given to regulatory developments in the US market and their potential impact on crypto asset performance. The wrap-up also covers emerging altcoin trends and DeFi sector movements that could signal upcoming market shifts.

Crypto Today: Trump criticizes Powell, SOL and ADA lead DeFi gains as Bitcoin price nears $85K

The cryptocurrency sector valuation is hovering around the $2.7 trillion mark on Thursday. While Bitcoin price clings to the $85,000 level, DeFi protocols and layer-1 altcoins appear to be attracting the most traction on the day.

Bitcoin Price Forecast: BTC holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

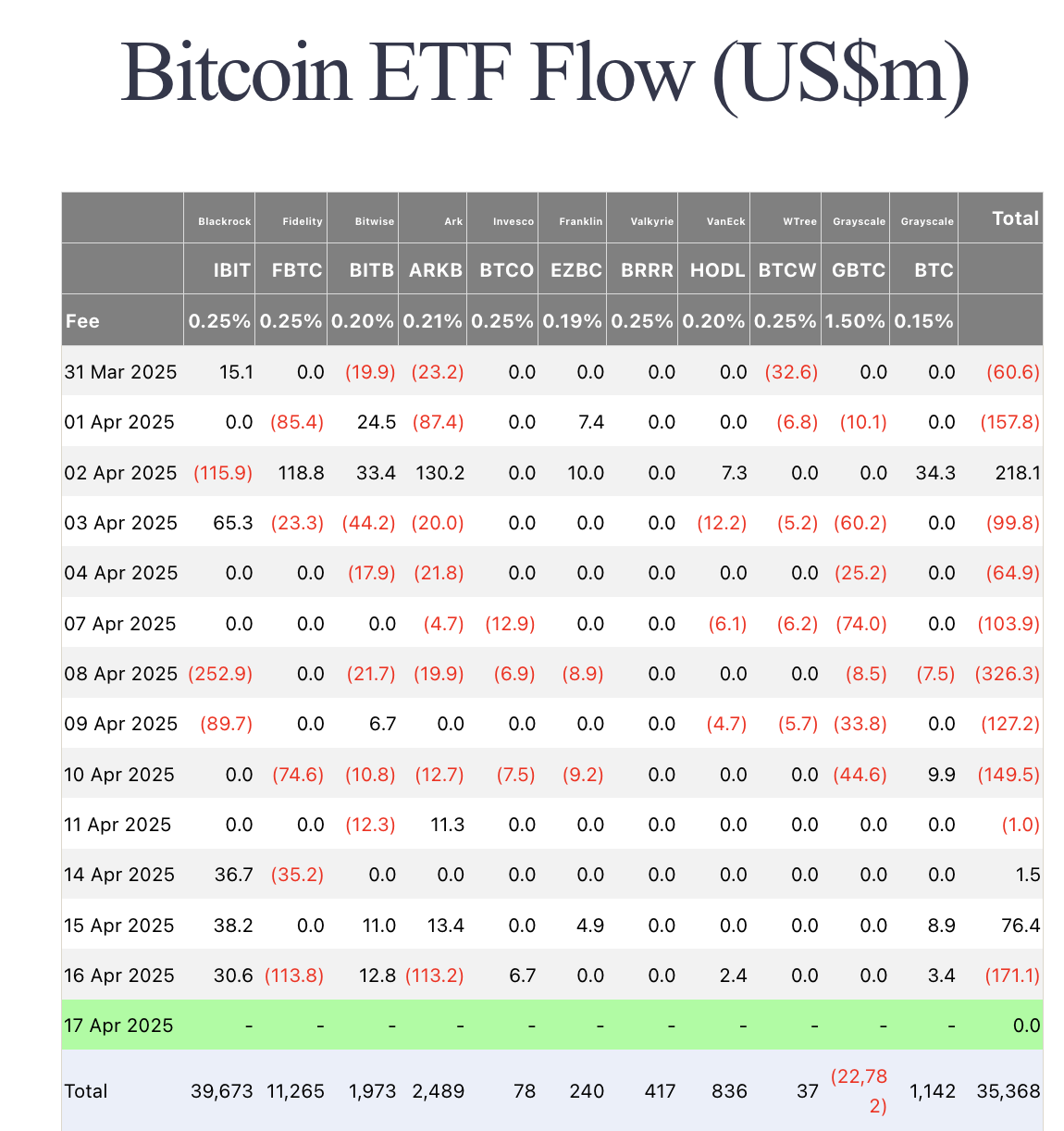

Bitcoin (BTC) is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day Exponential Moving Average (EMA) at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Federal Reserve (Fed) on Wednesday, BTC remains relatively stable. Meanwhile, institutional demand shows weakness, as it recorded nearly $170 million outflow from Bitcoin spot Exchange Traded Funds (ETFs) on Wednesday.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration. This decline was accompanied by a drop in investor activity, with average daily trading volumes plunging 27.3% quarter-on-quarter. In the same period, Bitcoin (BTC) fell by 11.8%, but its dominance increased, and it was outperformed by Gold and US Treasuries.