Litecoin Price Prediction 2025: Bullish Signals Emerge as Adoption Grows

- Litecoin Technical Analysis: Why Traders Are Turning Bullish

- Growing Adoption: Litecoin Gains Ground in Payments and Mining

- Key Factors Influencing Litecoin's Price Action

- Is Litecoin a Good Investment in August 2025?

- Litecoin Price Prediction FAQs

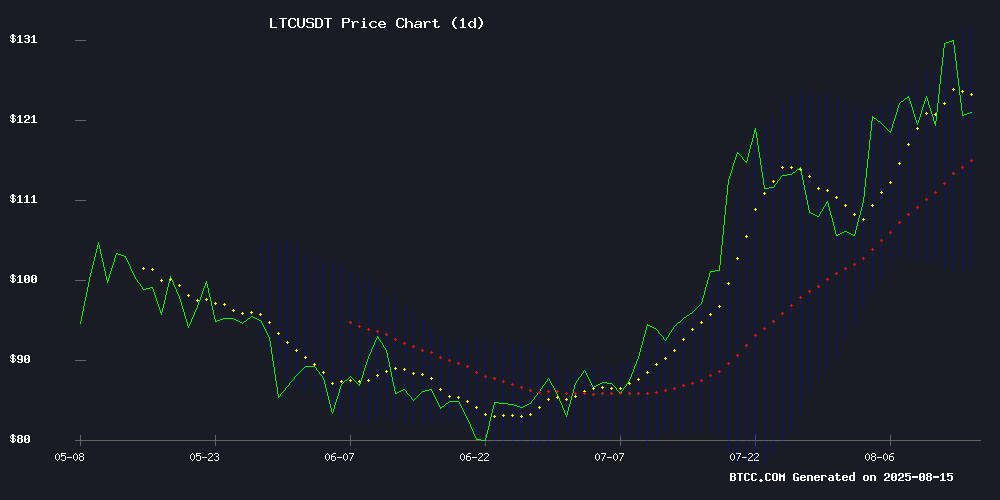

Litecoin (LTC) is showing strong technical indicators coupled with growing real-world adoption, making it one of the most interesting altcoins to watch in August 2025. Currently trading at $121.44, LTC has broken above its 20-day moving average with converging MACD lines suggesting potential trend reversal. Meanwhile, payment processors report increasing LTC usage, while institutional investors are adding it to their crypto treasuries. This comprehensive analysis examines both the technical setup and fundamental drivers that could push LTC toward its next resistance at $132.62.

Litecoin Technical Analysis: Why Traders Are Turning Bullish

As of August 15, 2025, Litecoin presents several compelling technical signals that have caught traders' attention. The price currently sits comfortably above the 20-day MA at $117.37, which has historically served as reliable support during uptrends. The MACD histogram shows decreasing bearish momentum (-2.3205 compared to -7.2759 last week), with the signal line rapidly approaching the MACD line - a classic reversal pattern.

Bollinger Bands tell an interesting story too. With price hovering NEAR the middle band (117.3730), there's clear room to test the upper band at $132.62 if buying pressure continues. The %B indicator sitting around 0.5 suggests we're in neutral territory with upside bias. "What's particularly interesting," notes a BTCC analyst, "is how the bands have been tightening while price holds above the MA - this often precedes significant moves."

Growing Adoption: Litecoin Gains Ground in Payments and Mining

Beyond the charts, Litecoin is making waves in real-world usage. The latest CoinGate report shows LTC now accounts for 13.6% of crypto payments, up from 9.3% in 2023. This growth comes as merchants increasingly value Litecoin's fast 2.5-minute block times and low fees compared to Bitcoin.

The mining sector is taking notice too. Several institutional players including Thumzup Media have added LTC to their crypto treasuries, with the NASDAQ-listed company allocating part of its $50M raise to Litecoin accumulation. Meanwhile, mining operations like QFSCOIN are expanding LTC cloud mining offerings, citing its profitability and stable network.

Key Factors Influencing Litecoin's Price Action

1. Payment Processor Data Shows Steady LTC Growth

CoinGate's 2025 payment trends report reveals fascinating regional differences. While stablecoins dominate Asia (USDT at 24.8% of transactions), Litecoin has become the quiet outperformer in Western markets. Its share grew consistently from 9.3% to 13.6% over two years, suggesting organic adoption rather than speculative hype.

2. Institutional Interest Heats Up

The crypto treasury trend continues gaining steam, with Thumzup Media's recent $50M raise earmarked partly for LTC accumulation. Following Donald TRUMP Jr.'s $3.3M investment, the company plans to hold up to $250M in crypto assets including Litecoin. Such moves lend credibility and could attract more institutional flows.

3. Mining Economics Favor LTC

With operations like QFSCOIN expanding globally, Litecoin mining has become more accessible. Their AI-optimized, renewable-powered data centers make LTC mining profitable even at current prices. As mining difficulty adjusts, this could create positive feedback loops for price.

Is Litecoin a Good Investment in August 2025?

Considering both technical and fundamental factors, Litecoin presents an interesting proposition:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | $121.44 > $117.37 | Bullish confirmation |

| MACD Histogram | -2.3205 (rising) | Momentum shift |

| Bollinger %B | ~0.5 | Neutral with upside |

| Payment Share | 13.6% (up from 9.3%) | Adoption growth |

While the setup looks promising, traders should watch for rejection at the upper Bollinger Band and monitor whether the MACD completes its crossover. The $132 level represents both technical resistance and psychological round number that could trigger profit-taking.

Litecoin Price Prediction FAQs

What is the short-term price target for Litecoin?

The immediate technical target sits at the upper Bollinger Band around $132.62. A clean break above this level could open the path toward $150, though traders should watch volume on any breakout attempts.

How does Litecoin compare to Bitcoin for payments?

While bitcoin remains dominant (23.3% of payments), Litecoin offers faster 2.5-minute block times versus Bitcoin's 10 minutes, with significantly lower fees. This makes LTC more practical for everyday transactions.

Why are institutions adding Litecoin to their treasuries?

Companies like Thumzup Media view Litecoin as a stable altcoin with proven technology and growing adoption. Its lower volatility compared to newer projects makes it attractive for treasury diversification.

What are the risks to Litecoin's price growth?

Potential risks include rejection at current resistance levels, broader crypto market downturns, or shifts in mining economics that could affect network security. Always do your own research before investing.